Fuelling defence: expanding NATO’s pipeline system to the eastern flank

NATO is entering a decisive phase in its efforts to strengthen its deterrence and defence. Faced with the war in Ukraine and the long-term threat posed by Russia, the allies agreed at their recent summit in The Hague to increase defence spending through to 2035. The aim is to develop new capabilities and expand the militaries of the member states to support NATO’s regional defence plans. Collective defence will require vast quantities of fuel, along with reliable systems for its delivery and storage along the eastern flank. Underground pipelines are the safest method of transporting fuel, tried and tested across many NATO countries. In peacetime, in addition to supporting armed forces, this infrastructure’s core task is to ensure supplies to civil aviation. In wartime, it switches completely to a military mode, serving primarily the air force, but also providing supplies to land forces.

Poland and Romania have long been the leading advocates of expanding NATO’s fuel pipeline system. Constructing the necessary infrastructure on the eastern flank and connecting it to the existing NATO network will pose a significant organisational and financial challenge. This effort will not only secure fuel supplies during potential military operations, but also provide new options for commercial deliveries. However, in the case of some Central European countries, including Poland, launching them would require the creation of additional civilian demand in the aviation sector to help ensure market-based financing for running pipelines and storage facilities in peacetime. Despite the energy transition, the armed forces of NATO’s member states will continue to rely primarily on conventional liquid fuels, while gradually increasing the use of synthetic alternatives, which can also be transported through NATO’s fuel pipelines.

The eastern flank: military demand for fuel

Ensuring a continuous supply of fuel is essential for maintaining the operational capabilities of armed forces. In NATO’s military doctrine, air superiority is of critical importance. As a result, in a wartime scenario, the air forces are expected to account for as much as 85% of total fuel consumption. Land forces would account for 10%, and naval forces for 5%. At present, fuel deliveries for the armed forces of countries on NATO’s eastern flank are carried out mainly by rail and road tankers, using existing civilian infrastructure. Due to limited and predictable demand in peacetime, primarily related to training activities, current needs are met without any difficulty.

However, in the event of an armed conflict with Russia, existing methods of fuel supply would prove highly inadequate. Two developments would pose the most serious challenges. First, the movement of large land and air formations from Western Europe and the United States to the eastern flank would result in a multifold increase in fuel demand across the entire theatre of operations. Second, the unpredictable intensity of operations across various axes would cause sharp, local spikes and drops in fuel consumption.

In the scenario of NATO joint operation on the eastern flank, fuel consumption would likely exceed the supply capacity of the existing infrastructure even before full-scale hostilities begin – during the concentration of allied forces. This surge in demand would be generated by the movement of land forces, airlift operations, and fighter jet sorties to protect airspace. It is therefore essential not only to connect the eastern flank to NATO’s fuel pipeline network, but also to develop expansive storage facilities that are resilient to enemy action. Supplying the entire Central European theatre of operations solely by rail and road tankers could quickly lead to their shortages. Moreover, it would reduce the capacity of road and rail networks, which will already be under significant strain from other wartime logistical tasks. Furthermore, fuel transported by tankers is far easier to track, creating the risk of revealing the location of troop concentrations.

Tankers play a critical and irreplaceable role at the tactical level, supplying individual vehicles and aircraft with fuel in the immediate rear. However, their use at the operational level – that is, for transporting large volumes of fuel from depots to frontline formations – is suboptimal, and at the strategic level, it is highly inefficient. This is particularly true given that a single armoured brigade conducting manoeuvre warfare may require over 300,000 litres of fuel per day;[1] several dozen such brigades may be operating across a single theatre.

The Central Europe Pipeline System

An underground pipeline network forms the lifeblood of NATO’s fuel logistics. Built during the Cold War, the NATO Pipeline System (NPS) consists of nine main pipelines stretching over 10,000 km and encompassing 12 countries. It comprises two multinational pipeline networks: the Central Europe Pipeline System (CEPS), which links France, Belgium, Luxembourg, the Netherlands, and Germany, and the North European Pipeline System (NEPS), which connects Denmark and Germany. These are complemented by seven national systems: in Iceland (ICPS), Norway (NOPS), Portugal (POPS), Northern Italy (NIPS), Greece (GRPS) and two in Turkey (TUPS) – western and eastern. In addition to the pipeline network itself, which is connected to ports and refineries, the NPS includes fuel and lubricant storage facilities with a combined capacity of over 4 million cubic metres, as well as pumping stations and loading points for onward distribution by road and rail. The NPS is overseen by the NATO Petroleum Committee (known until 2008 as the Pipeline Committee).

Map. NATO’s Central Europe and North European Pipeline Systems (CEPS and NEPS)

Source: Service ist unser Geschäft. Raffiniert transportiert, garantiert, Fernleitungs-Betriebsgesellschaft mbH, 2023, unserebroschuere.de, p. 6.

At the core of the NPS is the Central Europe Pipeline System (CEPS), which spans approximately 5,300 km of pipeline, with diameters ranging from 102 to 305 mm. It supplies both civilian airports and air force bases in France, the Benelux countries, and Germany. Established in 1958 and developed throughout the Cold War, the CEPS was designed for use in the event of a conflict with the Warsaw Pact. Its easternmost points are Neuburg in Bavaria, southern Germany, and Bramsche in Lower Saxony, north-west Germany. The Danish-German NEPS reaches as far as Hohn in Schleswig-Holstein. The CEPS has the capacity to transport 12 million cubic metres of fuel annually – including aviation fuel, diesel, petrol and kerosene – for both military and civilian sectors. The pipeline is a “rigid” structure, meaning that any product pumped into the system can be delivered to only one recipient.[2]

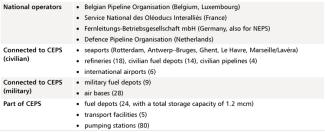

Table. Elements of CEPS

Source: the authors’ own compilation.

Militarily, the largest user of the CEPS is the United States (primarily the US Air Force), which relies on this system to supply aviation fuel to its Ramstein and Spangdahlem bases in Rhineland-Palatinate. For this reason, unlike the United Kingdom and Canada, both of which have withdrawn from the CEPS, the US remains a member of the programme. National sections of the CEPS also handle a significant share of fuel deliveries to the armed forces of host countries; for example, in France, this share stands at 50%. After the Cold War, the CEPS was used to support NATO out-of-area operations, supplying aviation fuel for aircraft involved in Allied Force (Yugoslavia, 1999), Unified Protector (Libya, 2011) and ISAF (Afghanistan, 2001–14). During the ISAF mission, it supported 1,726 flights by C-17 and C-5 aircraft. At the height of expeditionary operations, military fuel shipments via the CEPS exceeded 1.5 million cubic metres annually, equivalent to 12.5% of its capacity. In the years that followed, which saw no large-scale operations, this volume was halved.[3] The CEPS is also used during allied military exercises.

Following the end of the Cold War, the CEPS underwent restructuring prompted by a reduction in the US military presence in Europe and the downsizing of the European militaries, which led to a declining demand for fuel. In an effort to reduce costs, parts of the pipeline network and some fuel storage facilities were decommissioned as greater emphasis was placed on civilian use. Collective defence became less of a priority and NATO began promoting investment in mobile fuel delivery systems tailored to expeditionary operations. As a result, there was little interest in funding permanent pipeline infrastructure for the armed forces. At one point, there were even discussions about phasing out the CEPS programme and transferring the pipeline network to civilian management. This process continued until 2014, culminating in the United Kingdom’s decision to privatise its section of the NPS (the GPSS), which was sold in 2015 to the Spanish operator Exolum.

In recent years, the security of critical elements of the CEPS has been enhanced through investments such as power generators capable of keeping the system operational for 30 days. Buried around 80 cm underground, the pipeline is generally easy to repair: reserves of pipe segments are available and engineering teams can restore its functionality within 72 hours. One drawback, however, is the need to clean storage tanks and fully drain the pipes when switching from aviation fuel to diesel or synthetic fuels. Therefore, reconfiguring the network to handle a different type of fuel can be time-consuming.

All of NATO’s pipeline networks, with the exception of the CEPS, are controlled by host nations. The Central European system is managed by the CEPS Programme Board, which includes representatives from the six member states: France, the Netherlands, Belgium, Luxembourg, Germany, and the United States. The board meets at least three times a year and makes decisions by consensus. Day-to-day administration is handled by the Programme Office in Versailles, which operates under the supervision of the NATO Support and Procurement Agency. The office coordinates with the national organisations listed in the table above, which are responsible for individual sections of the network.[4] The operating costs of the CEPS (c. €180 million annually) are shared among the participants in the programme, but nearly 90% are covered by revenues from charges for fuel shipment and storage paid by commercial clients, namely airlines. Although the CEPS is technically capable of transporting various products, its depots are adapted exclusively for aviation fuel.

…and its East European extension

Russia’s aggression against Ukraine in 2014 gave NATO’s pipeline network a second life. The allies gradually shifted from debating whether to maintain the CEPS to planning the construction of an East European Pipeline System (EEPS), which, once connected to other NPS sections, would secure fuel deliveries to NATO’s eastern flank. In recent years, NATO has conducted an internal assessment of its fuel delivery capabilities across various operational directions, as the end of the Cold War prompted its members to scale down their logistics capacity in this area – both in rail and road transport (resulting in a lack of tankers and depots) and in maritime cargo – and to outsource a large portion of logistical support to the private sector. It is therefore not surprising that the analysis revealed significant gaps in fuel supply to the eastern flank in a conflict scenario with Russia and highlighted the need for remedial action. In light of these findings, NATO’s Supreme Allied Commander Europe formally requested the necessary pipeline investments. By 2021, a feasibility study on the development of the East European Pipeline System had been completed. The project was then consulted at both the military level (with allied joint force commands which defined their fuel needs) and the political level (with national governments, which proposed ways to increase supply).

Although the planning of the EEPS is focused primarily on the wartime needs of collective defence, the military – particularly the air and land components – will also benefit from the network in peacetime. Fuel demand will rise as the armed forces of the eastern flank countries continue to expand;[5] NATO and US training activity and exercise intensity in the region are also likely to increase.[6] In addition, Poland plays a key role in delivering military assistance to Ukraine, including fuel supplies for its armed forces. In peacetime, a pipeline network ensures lower transport costs; in wartime, it provides greater security, as pipes and storage facilities are located underground.

NATO has been considering two options for integrating Poland into the NPS: a direct connection from northern Germany linking to the Danish-German NEPS, and a route through the Czech Republic linking to the CEPS. In fact, the possibility of implementing both routes was not ruled outbuilding one kilometre of pipeline at €1 million. The entire project to build the EEPS, along with supporting infrastructure, would total around €21 billion, with a projected timeline of 20 to 25 years for completion.[7]

It is important to note that fuel supply is a complex, interconnected system that involves more than just pipelines. For this reason, NATO’s planning for the EEPS also includes other modes of fuel transport – namely rail and road – for instance in the Baltic states, which lack their own combat aircraft and where civilian aviation does not generate sufficient demand to justify a pipeline-based solution. The EEPS is intended to cover all the eastern flank states, with fuel depots and supporting infrastructure to be built (even in the absence of a direct pipeline connection in some countries). Romania and Bulgaria are set to be connected to the Greek system (a trilateral letter of intent to this effect was signed in 2023)[8] while Poland, the Czech Republic, and Slovakia to the CEPS. The EEPS programme has moved into an advanced stage of detailed Project Data Sheets analysis. It now appears likely that the construction of this network will be approved by the end of this year.

Civilian use and economic rationale

In peacetime, the armed forces are a minor fuel consumer compared to the private sector. On a daily basis, the CEPS is used primarily for the commercial delivery of aviation fuel (Jet A-1) to civilian aviation. For example, in the French section, 85% of the total volume of fuel transported is allocated for civilian needs.[9] This model helps to maintain the system in good condition and, thanks to the fees collected, covers the vast majority of the cost of operation and maintenance. In Germany, market-based contracts cover up to 70% of the CEPS’s annual operating costs.[10] The CEPS directly supplies airports in Brussels, Liège, Amsterdam, Luxembourg, Cologne/Bonn, and Frankfurt.[11] The Dutch section transports over 4.5 million cubic metres of fuel (kerosene) annually, with Amsterdam Schiphol Airport receiving around 40% of that volume.[12] For airlines, the CEPS offers a long-term logistical solution, as it can also transport Sustainable Aviation Fuel (SAF), which has strong potential to become the future fuel of decarbonised civil aviation. The first SAF deliveries via the CEPS took place in 2023, supplying Brussels Zaventem Airport. In host countries, the CEPS accounts for approximately 30% of total fuel distribution. It is worth noting that in the event of a crisis or war, military supply takes precedence over deliveries to the civilian sector.

In Poland, the state-owned company PERN is the dominant player in the transport and storage of crude oil and petroleum products. It has the most extensive experience in developing oil infrastructure in the country and is involved in discussions on expanding NATO’s pipeline system to serve Polish needs. PERN has declared its readiness to participate in the project as both operator and investment coordinator, once NATO makes the relevant decisions. The company estimates that building fuel pipeline infrastructure in Poland as part of the NPS would take six years, although some elements could be completed sooner.[13] Depending on the financing model adopted and the extent of public funding, PERN could contribute to part of the construction and operating costs. Nonetheless, securing external financing would undoubtedly be essential to delivering the project.

Poland and the other countries in the region, from Estonia to Bulgaria, are seeking NATO’s approval for the project to be funded in part from the alliance’s common budget, which is set at €4.6 billion in 2025, including over €1.7 billion allocated to the NATO Security Investment Programme (NSIP). It also appears feasible to obtain EU funding for some elements of the EEPS as an investment in critical energy infrastructure supporting military mobility, particularly given that the pipeline would be capable of transporting low-emission synthetic fuels. Efforts are also underway to find ways for civilian entities to cover at least part of the system’s peacetime operating costs, as is the case with the CEPS.

In Poland, aviation fuel for both civilian airports and the air force is supplied primarily by the Orlen Group. In 2024, Jet fuel consumption reached 1.45 million cubic metres, a 9% increase compared with the previous year.[14] Domestic production, which totalled 1.67 million cubic metres (12% more than in 2023), covered 97% of this demand.[15] This high level of self-sufficiency and the capacity to further increase domestic output suggest that generating additional demand, for example by building new airports, would be necessary to justify the commercial use of NATO’s fuel pipelines in Poland. In addition to investment decisions of this kind, such as the development of the Central Transportation Hub (CPK), ensuring closer coordination between military planning and the civilian sector would be another key requirement.

In the current situation, assuming that demand for aviation fuel in Poland does not increase, at least two scenarios may materialise. First, the state could absorb the full cost of operating the new fuel pipeline system, which would entail an additional permanent financial burden. Alternatively, NATO’s pipelines could begin supplying fuel to the Polish market, thereby competing with Orlen, the current dominant supplier. In parallel, the use of low- and zero-emission fuels in aviation will increase as a result of the EU’s decarbonisation process, driven by regulations under the Fit for 55 package. According to the targets set in the ReFuelEU Aviation regulation, SAF should account for 2% of fuel at EU airports by 2025 and 6% by 2030.[16] In Poland, Orlen is supposed to be the sole producer of SAF, with plans to launch a hydrogenation line for vegetable oils in Płock later this year to supply sustainable fuel to LOT Polish Airlines.[17] Orlen has been working with domestic and foreign partners to improve its production process. SAF is already produced in Western Europe and transported via the NPS. According to available data, in 2024 it accounted for 5% of all fuel transported through these pipelines – a share that continues to grow. It is therefore possible that, particularly in the event of delays and/or limited production of synthetic fuels in Poland, NATO’s pipeline system could be used, at least in part, for civilian deliveries of SAF to the Polish market, helping to accelerate the decarbonisation of the aviation sector. The prospects of alternative deliveries and increased market competition could also mitigate the risk of excessive price increases for end users.

Finally, one of the entry points to the EEPS could be located on Polish territory and connected to Orlen’s refineries. In this option, in addition to covering domestic demand, the construction and peacetime operation of pipelines would enable fuel exports to countries participating in the system, thereby generating additional revenue.

Challenges related to the construction and maintenance of EEPS

1. Co-financing from NATO. Large-scale infrastructural projects of NATO-wide importance, funded through its common budget, require unanimous approval from the North Atlantic Council. Some allies remain wary of contributing to such investments, arguing that they should be incorporated into national capability targets under NATO’s Defence Planning Process (NDPP) and therefore financed entirely from domestic budgets. Moreover, co-financing of the NPS on the eastern flank is not a priority for the southern European allies. The administration of Donald Trump, for its part, is generally reluctant to support increases in the budgets of international organisations. The United States is the largest net contributor to the NSIP: in 2023, it received less than €60 million from the programme while contributing €206 million.[18] Plans to expand the NPS could be further hindered by the prospect of a reduced US military presence in Europe.

2. Polish-Czech-German cooperation. In the scenario of the absence of co-financing from NATO, constructing a fuel pipeline system on the eastern flank could become a strategic project at the centre of trilateral cooperation between Warsaw, Berlin, and Prague. The Czech Republic has a well-developed fuel pipeline infrastructure, so its integration with the networks in Germany and Poland should not pose a major challenge. For Germany, expanding its pipeline system eastward offers twofold benefits: it would improve the efficiency of fuel deliveries to the eastern federal states and, in the longer term, to Lithuania, where a German brigade is due to be stationed from 2027. One potential risk for Germany is that opponents may argue that the development of such infrastructure is incompatible with restrictions stemming from the 1990 Two Plus Four Treaty between West Germany, East Germany, the United States, the United Kingdom, France, and the Soviet Union, which notably paved the way for Germany’s reunification.[19]

3. Implementation. The EEPS project will require sustained commitment and determination from individual countries, close civil-military cooperation and international coordination. Its implementation will take much more than a decade. As with the CEPS, it will also be necessary to establish a supranational management and administrative mechanism, such as a board and coordinating office, to oversee the network. As with all projects of this kind, environmental approvals and land acquisition will present additional challenges.

4. Energy transition. In the altered security environment following Russia’s invasion of Ukraine, the lobby within NATO advocating for reduced military emissions appears to be less of an obstacle to the EEPS project. This is especially true given that the NPS can be framed as a step towards the adoption of sustainable fuels and a more environmentally friendly alternative to road transport. Currently, the transition towards low-emission energy sources has little impact on the military sphere. Armed forces are expected to undergo decarbonisation more slowly and in a different way than the civilian sector. Although NATO militaries are investing in renewable energy sources for military infrastructure and in electric vehicles, liquid fuels will remain essential for operations in the air, land, and maritime domains, at least for the foreseeable future. However, the use of synthetic fuels, such as methanol derivatives, is set to gradually increase at the expense of conventional fuels; indeed, the air forces of some NATO member states already use semi-synthetic blends for refuelling. Nevertheless, a major shift towards synthetic fuels will face several challenges, including their still high cost, lower energy efficiency and the need to adapt equipment (particularly engines and fuel tanks), infrastructure, and supply chains.

At the same time, the EU’s ongoing implementation of the European Green Deal will affect the operations of allied armed forces. In particular, the accelerating electrification of civilian transport will reduce demand for traditional fuels, which may lower the profitability of at least some refineries in Europe and lead to closures. As a result, maintaining a level of fuel production sufficient to meet military needs will become an increasingly important task, one that falls outside NATO’s remit. This will also require increasing the production of non-conventional fuels, partly by adapting refineries for that purpose.

[1] ATP 4-90 Brigade Support Battalion, The US Department of the Army, June 2020, armypubs.army.mil, p. 139.

[2] J. Woźniak, ‘Znaczenie rurociągów NATO w łańcuchu dostaw paliw do wojsk’, Wojskowa Akademia Techniczna, Systemy Logistyczne Wojsk, no. 52/2020, slw.wat.edu.pl.

[3] D. Jankowski, ‘The NATO Pipeline System: a forgotten defence asset’, NATO Defense College, April 2020, ndc.nato.int.

[4] ‘Central Europe Pipeline System (CEPS)’, NATO, 30 August 2021, nato.int.

[5] For example, the Abrams tanks entering service with the Polish Land Forces can be powered by aviation fuel or other types of fuel that can be transported through NATO’s pipelines.

[6] Under the 2020 Polish–US Enhanced Defence Cooperation Agreement, Poland committed to providing logistical and fuel support to US forces, including through the Poland Provided Infrastructure (PPI) and Poland Provided Logistical Support (PPLS) programmes.

[7] Germany estimates its own contribution at €3.5 billion. M. Gebauer, Ch. Schult, ‘Sprit für die Ostflanke’, Der Spiegel, 21 February 2025, spiegel.de.

[8] ‘Greece, Bulgaria, Romania sign letter of intent to extend NATO pipelines network’, Kathimerini, 12 October 2023, ekathimerini.com.

[9] ‘Réseaux oléoducs’, The French Ministry of the Armed Forces, defense.gouv.fr.

[10] Service ist unser Geschäft. Raffiniert transportiert, garantiert, Fernleitungs-Betriebsgesellschaft mbH, 2023, unserebroschuere.de.

[11] In addition, aviation fuel from CEPS is delivered by land transport to German airports in Munich, Berlin, Leipzig, and Stuttgart, as well as to Zurich Airport in Switzerland.

[12] The main pipeline is capable of transferring 550 cubic metres of fuel per hour. ‘Pipeline network’, Ministry of Defence of the Netherlands, defensie.nl.

[13] W. Jakóbik, ‘PERN apeluje o ropociągi NATO i jest gotów na drugą nitkę Ropociągu Pomorskiego. W tle Niemcy’, Biznes Alert, 12 February 2024, biznesalert.pl; W. Jakóbik, Farbowana ropa z Kazachstanu, paliwociąg NATO, bezpieczeństwo. Opowiada prezes PERN, Energy Drink, 9 June 2025, youtube.com.

[14] Raport roczny 2024, The Polish Organization of Petroleum Industry and Trade, March 2025, popihn.pl.

[15] Poland exported small quantities of JET fuel, mainly to the Czech Republic and Denmark – see ibid.

[16] ‘Commission brings clarity on ReFuelEU Aviation implementation’, European Commission. Directorate-General for Mobility and Transport, 28 February 2025, transport.ec.europa.eu.

[17] Ł. Malinowski, ‘IATA: Powolny wzrost produkcji SAF. W Polsce tylko Orlen’, Rynek Lotniczy, 25 December 2024, rynek-lotniczy.pl.

[18] ‘Transparency and accountability’, NATO, 20 December 2024, nato.int.

[19] Treaty on the final settlement with respect to Germany, United Nations Treaty Collection, treaties.un.org.