Ukraine–EU: finalisation of the DCFTA revision

On 13 October, the EU Council decided to reduce or completely remove tariffs on a range of agri-food products imported from Ukraine, including dairy products, fruit, vegetables, meat, and processed meat products. This follows a preliminary agreement reached on 30 June between the European Commission and the Ukrainian government regarding the revision of the Deep and Comprehensive Free Trade Area (DCFTA) arrangement. On 14 October, Ukraine’s Deputy Prime Minister for European and Euro-Atlantic Integration, Taras Kachka, announced that the final decision on the changes to the agreement had been made during a meeting of the EU–Ukraine Association Committee. The text of the document has not yet been published; however, according to earlier statements (including from Kachka), it increases tariff-rate quotas for certain agri-food imports from Ukraine, beyond which tariffs will apply. According to a press release issued by the EU Council, the revision also includes an unspecified safeguard mechanism that may be activated if any EU member state experiences market disruption. Following Russia’s invasion of Ukraine, the European Commission temporarily introduced so-called Autonomous Trade Measures (ATMs), which suspended tariffs and tariff-rate quotas set out in the DCFTA. However, these measures were withdrawn last June, reinstating the pre-war trade regime.

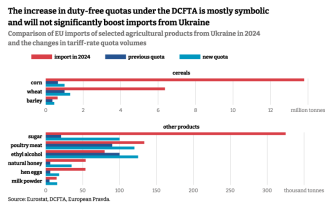

The revision of the Ukraine-EU trade liberalisation agreement aligns with Ukraine’s objective of expanding its exports, particularly of agricultural products. However, based on currently available information, the increased tariff-rate quotas are unlikely to have a major effect. For key commodities entering the EU market, the scale of the increase is relatively modest (for example, quotas for wheat will rise from 1 million to 1.3 million tonnes) and remains well below the level of Ukrainian exports to the EU. At the same time, assessing the potential impact of the revised DCFTA on the markets of individual EU member states is difficult due to a lack of detailed data on tariff-rate reductions, which are crucial for determining export profitability.

Commentary

- The proposed increase in tariff-rate quotas is unlikely to result in a significant rise in Ukrainian exports to the EU. For cereals, the new quotas remain well below current export volumes, but Ukraine is likely to find alternative markets without difficulty. A similar situation applies to many other products, such as sugar and poultry meat. For some goods, such as spirits, Ukraine has not even exhausted its existing quota. In other instances, where quotas have been increased several-fold (for example, those for milk powder – from 5,000 to 15,000 tonnes annually), the quantities involved remain very small, meaning that the changes are unlikely to have any significant impact on the relevant EU markets.

- In the absence of information on the extent of tariff reductions for individual goods, it is difficult to assess the expected effects of the proposal, as tariff levels have a decisive impact on the profitability of Ukrainian food exports to the EU. For some products, such as honey, exports continued even after quotas were exhausted. For others, such as dairy products, existing tariffs rendered them uncompetitive in the EU market. Unlike cereals, finding alternative markets for these goods outside the EU is far more challenging owing to logistical barriers associated with shipping to more distant countries.

- The proposed changes are unlikely to satisfy Ukraine’s EU neighbours, who have introduced a range of import restrictions in response to the surge of Ukrainian agricultural products triggered by the ATMs. Their measures have primarily targeted cereals, but have also extended to oilseeds and their processed derivatives, such as rapeseed cake, which are not subject to restrictions under the DCFTA. However, the aforementioned safeguard mechanism may allow these countries to maintain the existing restrictions. A precedent for this was set between May and September 2023, when the European Commission upheld agricultural import bans imposed by Ukraine’s neighbouring countries. For Ukraine itself, exports – particularly of cereals – to these neighbouring markets are of limited importance, as the overwhelming majority of its goods are shipped through Black Sea ports.