On the eve of a heating season: Russia targets weak links in Ukraine’s energy system

Around the turn of September and October, Russia launched another wave of attacks against Ukraine’s energy infrastructure. The aggressor has modified its tactics – instead of attempting to trigger a nationwide blackout, as it did in previous years, it now seeks to cause the greatest possible disruption in specific regions or urban centres and to reduce gas extraction. Ukraine is considerably better prepared for the forthcoming heating season than it was a year ago, as it has larger gas reserves and greater electricity generation capacity. Nevertheless, if the invaders maintain the current intensity and effectiveness of their strikes on infrastructure, the risk of emergency situations arising in individual cities – particularly those located near the front line – will increase.

Russia changes its tactics

Since the onset of the full-scale invasion, Ukrainian energy facilities have remained a constant target of hostile attacks, particularly in localities situated near the front line. Periodically, the aggressor has intensified its strikes against such infrastructure – the first major instance occurred in October 2022, when assaults were directed mainly at facilities connected with electricity transmission, and the second in the spring of 2024, when the aggressor succeeded in destroying more than 9 GW of local generation capacity (see ‘Ukraine: the energy infrastructure crisis and the potential for a new wave of refugees’). There are numerous indications that another period of intensified attacks on energy infrastructure is currently under way. However, the Russians have modified their strike tactics – instead of targeting dispersed sites across the entire country, they now carry out concentrated assaults on specific cities or even individual facilities, thereby reducing the effectiveness of Ukraine’s air defence systems.

In place of the relatively well-protected substations belonging to Ukrenerho (the transmission system operator), attacks are now being directed against regional facilities of this kind, as well as infrastructure connected with gas extraction. The particularly intense shelling in early October was concentrated mainly on the border oblasts (see ‘Mutual attacks on border energy infrastructure. Day 1322 of the war’). For example, two substations supplying electricity to Kharkiv were hit. The city’s mayor stated that the coming winter would be the most difficult since the outbreak of the full-scale war.

The situation in the electricity generation sector

Despite recent attacks, including on the Prydniprovska TETs and four hydroelectric power plants (see ‘Blackout in Kyiv. Day 1329 of the war’), the situation nationwide remains under control. The power outages lasted for several hours at most and were confined to specific regions. This was due to the fact that Ukraine had succeeded in constructing numerous fortifications to protect critical electricity transmission infrastructure. Moreover, over the past year, new generation facilities have been built and existing ones repaired. On 11 September, Minister of Energy Svitlana Hrynchuk announced that, ahead of the heating season, the country would possess 17.6 GW of capacity, representing a return to a level close to that recorded at the beginning of 2024. It appears that the regional electricity distribution companies (the so-called oblenerho) are the weakest link in the system, as they oversee facilities that have likely not implemented physical protection systems against drone attacks, or have done so only to a minimal extent, thereby rendering them vulnerable targets.

Since October 2022, Ukraine has not published detailed information regarding the operation of its power system. Nevertheless, certain conclusions can be drawn from the available data on electricity trade. In the summer of 2024, when the situation was particularly difficult, Kyiv relied exclusively on imports. However, beginning in the spring of 2025, as repair works were completed and new (usually small and decentralised) generation facilities were commissioned, electricity exports began to expand steadily.

Electricity exports continued even during the summer months, when consumption typically peaks, indicating a production surplus. Since the beginning of October, exports have been significantly reduced and imports increased, most likely as a result of damage caused by Russian strikes. Nonetheless, the current volume of imports remains less than half of that recorded during the most difficult months of the summer of 2024.

Challenges to the gas sector

Since the end of September, infrastructure related to gas extraction has been among the primary targets of the aggressor’s attacks, with the largest assault since the beginning of the invasion occurring on 3 October. The enemy primarily struck compressor and gas treatment stations, particularly in Poltava Oblast – a major gas extraction region – and in the following days also targeted similar facilities in the western part of the country. It appears that, as in the case of the oblenerho, adequate protective measures had not been implemented at these sites. Naftogaz has not disclosed the extent of the damage; however, according to Bloomberg, citing anonymous sources, the country is believed to have lost 60% of its gas production capacity.

Before the recent shelling, the situation in the sector did not appear problematic. Although Ukraine concluded the 2024/2025 heating season with extremely low gas reserves – on 15 April, storage facilities were filled to a record low of just 2.2% – since then, particularly over the summer, it has succeeded in accumulating a significantly larger volume of gas. As on 14 October, storage facilities contained 89.4 TWh of gas – 3.6 TWh more than a year earlier. Under normal conditions, this amount should suffice for the entire heating season; however, if domestic production cannot be restored to pre-attack levels, Ukraine will need to import gas during the winter as well. From a technical perspective (in terms of available pipeline capacity), this should not pose difficulties. The principal challenge will be to secure substantial additional funds to finance the imports, particularly as gas prices tend to rise considerably during the winter months.

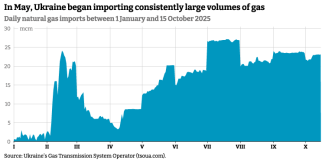

Between 2022 and 2024, Ukraine had virtually ceased importing gas – relying instead on its own production and existing reserves, as reduced consumption caused by Russian aggression made this possible. However, by the spring of 2025, following yet another series of strikes on energy infrastructure, it had become clear that the country would need to import at least 4 bcm of gas (see ‘Ukraine: A difficult situation on the gas front’). Naftogaz lacked the necessary financial resources; however, the issue was resolved primarily through the support of international financial institutions such as the EBRD and the EIB.

By early October, the company had secured €500 million in loans from the former institution and €300 million from the latter, together with a €140 million grant from Norway. Moreover, in July 2025, Naftogaz signed a loan agreement with the state-owned Privat bank for 4.7 billion hryvnias, and on 9 October it received an additional 3 billion hryvnias from the state-owned Oschadbank. Using these funds, Ukraine has imported approximately 4.5 bcm of gas since the beginning of the year and continues to do so.

All indications suggest that the recent strikes on infrastructure will necessitate the continuation of gas imports throughout the winter period. On 7 October, Hrynchuk announced that gas purchases would need to increase by 30% compared with the original projections (without specifying the exact volumes). According to Bloomberg estimates, by March 2026 Ukraine will need to import an additional 4.4 bcm of gas, valued at approximately €2 billion. In this case, too, support will most likely come from the EBRD. According to statements from Ukraine’s Ministry of Finance, negotiations on a new credit line have already begun. Naftogaz, for its part, is also holding talks on the matter with representatives of the G7 and the IMF.

A potential gas deficit could lead to heating problems, as this type of fuel is the principal energy source used for heat production in larger cities. In Ukraine, the decision to begin the heating season is taken by regional authorities once the average daily temperature falls below 8°C for three consecutive days. Under the current circumstances, however, there have been calls to delay the activation of residential heating systems – among those making such an appeal was Borys Filatov, the mayor of Dnipro. The authorities in Kyiv, meanwhile, decided to initiate the heating season but limited the supply of heat to hospitals, schools, and kindergartens.

It appears that the primary threat will not be a shortage of gas, but rather the likelihood of Russian attacks on heating plants. Such incidents have already occurred – most recently on 10 October in Kyiv, where two facilities of this type were damaged. In the event of a massive missile and drone strike targeting a single heating plant, the facility’s defences would likely prove ineffective.

Outlook

Today, Ukraine is far better prepared for the heating season than it was last year, both in terms of available electricity generation capacity and gas reserves. However, the country managed to get through the previous winter with relatively few difficulties, largely owing to two factors – the absence of large-scale attacks on energy infrastructure during that period and the relatively mild temperatures. At present, despite improved preparedness, the outlook is less optimistic, particularly if Russia continues to strike energy facilities with the same intensity observed in recent weeks.

It is unclear whether the aggressor will be able to sustain such a high concentration of strikes. Since the outbreak of the full-scale war, there have been several instances when, following periods of intensified attacks that nearly caused the energy system to collapse, the invaders subsequently shifted their priorities.

It appears that the risk of a nationwide blackout, or even of daily prolonged power outages across all oblasts – as occurred at the turn of 2023 and in the summer of 2024 – remains relatively low. However, if intense shelling of critical infrastructure continues, periodic shortages of electricity and heat may become a common occurrence in certain cities located near the front line, including major urban centres such as Kharkiv, Dnipro, and Zaporizhzhia.