Germany: how the gas sector changed in the crisis year of 2022

Due to Russia’s aggression against Ukraine and the mounting energy and gas crisis in Europe, 2022 saw a spell of permanent crisis management in the German energy sector, in particular gas. The structure of Germany’s imports has changed significantly: shipments from Russia, its former principal supplier, have ceased; and Germany has had to launch extremely costly emergency measures to find alternative suppliers on the global market. The war has pushed Berlin to take numerous steps to diversify its supplies, in particular to develop its LNG import infrastructure at a rapid and unprecedented pace. A significant reduction in gas consumption, mild weather and LNG supplies have all enabled Germany to fill its gas storage facilities and avoid the risk of gas shortages this winter. Major changes have also occurred in the management and ownership structure of the German gas sector: Berlin has nationalised the SEFE (Gazprom Germania) and Uniper companies, which has enabled the German state to seize control of the country’s key gas infrastructure and its strategically important gas importers. All these factors have contributed to a major weakening of Germany’s energy ties with Russia.

Primary energy consumption

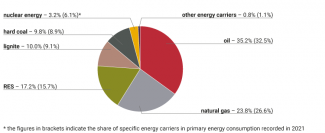

In 2022, Germany’s primary energy consumption stood at 11,829 PJ, down 4.7% compared to 2021. Over the same period, there was a significant decrease not only in natural gas consumption (-14.8%), but also in nuclear energy consumption (-49.8%). Utilisation of other energy sources increased, including lignite (+5.1%), hard coal (+4.8%), oil (+3%) and RES (+4.4%). Despite this, no significant changes in the structure of Germany’s energy mix have been recorded. Oil, natural gas and RES continue to be the most widely-used energy carriers, followed by lignite, hard coal and nuclear energy (see Chart 1).

Chart 1. The structure of Germany’s primary energy consumption in 2022

Source: AG Energiebilanzen e.V.

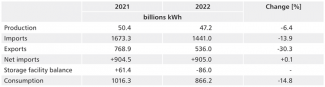

In 2022, Germany’s natural gas consumption stood at 866.2 billion kWh (almost 80 bcm). Domestic production met 5.5% of the country’s demand. The volume of this production decreased by 6.3% versus 2021, down to 47.2 billion kWh. Germany’s gas imports fell significantly (-13.9%). In 2022, Berlin imported 1441 billion kWh of natural gas, compared to 1673.3 billion kWh in 2021. Germany’s gas exports recorded an even bigger decrease (30.3%). Unlike the previous year, in 2022 more gas was pumped into the storage facilities than drawn from them (see Table).

Table. Balance of Germany’s natural gas supplies

Source: German Association of Energy and Water Industries (BDEW).

The politically favourable decrease in gas consumption

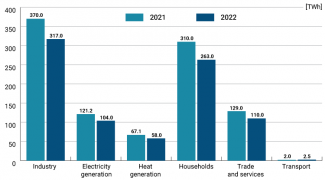

Germany’s drop in gas consumption (down 14.8%) in 2022 was the biggest since the beginning of the 21st century. A gradual decline in gas consumption was recorded in all sectors of the economy excluding transport, where it is insignificant anyway (see Chart 2). In sectors such as industrial production (-14.3%), electricity generation (-14.2%) and heat generation (-13.5%), as well as in the commerce and service sector (-14.7%), it mainly resulted from a major increase in the price of gas. The industrial sector made efforts to reduce its gas consumption, and replaced gas with other energy carriers (mainly coal and oil) whenever possible. In addition, it attempted to increase its manufacturing efficiency and – in selected cases, when no other solution was viable – either to reduce it or to relocate production to another country (this was particularly evident in energy- and gas-intensive sectors such as the chemical sector). In the case of households (-15.2%), in addition to the high price of gas, other factors of major importance included the mild spring and autumn, which contributed to decreased demand for gas for heating purposes, as well as awareness campaigns launched in spring to encourage consumer savings. In the energy sector, reduced gas consumption was facilitated by reactivating coal-fired units with a total capacity of 7 GW. The reduction in gas consumption was favourable in political terms because it had been listed among the necessary conditions which would enable Germany to avoid shortages of gas and the need to ration it. Representatives of the government and the Federal Network Agency, which is responsible for the energy sector, made repeated announcements regarding the need to save gas.

Chart 2. Changes in Germany’s natural gas consumption structure according to sectors

Source: German Association of Energy and Water Industries (BDEW).

Crisis management in the electricity generation sector

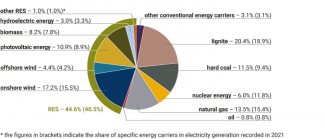

2022 was also marked by crisis management in Germany’s electricity generation sector. In order to reduce gas consumption here, Berlin allowed power plant operators to provisionally reactivate or to extend the operation of coal-fired units with a total capacity of almost 9 GW until spring 2024.[1] So far, operators of power plants with a total capacity of around 7 GW have used this opportunity. As a consequence, electricity generation using hard coal rose by 20.3%, and using lignite by 6%, while the output of gas-fired power plants fell by 13.9% (see Chart 3). It is worth noting that conventional power plants – which supplement the increase in electricity generation from RES (+8.1%) – have in part replaced the three nuclear power plants which were decommissioned at the end of 2021. In autumn 2022, following a long public debate and a sharp dispute within the coalition, Berlin postponed the planned phase-out of the three remaining reactors until mid-April 2023, citing the need to stabilise the electricity generation system in the wintertime.[2]

Chart 3. The structure of Germany’s electricity generation in 2022.

Source: German Association of Energy and Water Industries (BDEW).

Changes to the structure of Germany’s gas imports and exports

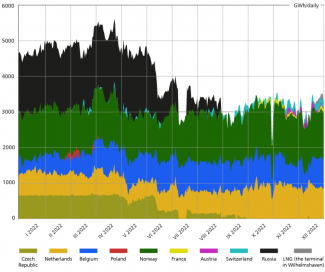

2022 saw major changes affecting the structure of the German gas sector’s imports. Due to Moscow’s political decisions, as of spring 2022 the transmission of Russian gas via pipelines to Germany was gradually reduced, and ultimately completely halted at the end of August 2022 (see Chart 4). The drop in gas imports from the east was mainly offset by increased supplies from Norway, which has become the main source of gas imports, and from the Netherlands and Belgium. In the case of the latter two countries, this mainly involved the supply of liquefied gas via Dutch and Belgian LNG terminals (it is likely that Germany purchased a certain volume of Russian LNG as part of these supplies). Germany’s imports from France have also increased (both using the existing interconnectors via Switzerland and directly via the Obergailbach point, which had previously been used to transmit gas in the opposite direction). Germany has failed to fully replace the missing gas with gas purchased from other sources: its gas imports fell by a total of 13.9%. Alongside this, the cost of these supplies increased significantly: throughout 2021 it stood at €39 billion, while between January and October 2022 the figure rose to €61 billion.

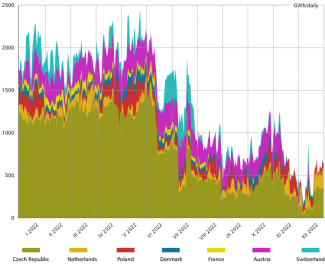

Due to Russia halting its gas supplies which had been bound for Central and Western European countries, a major decrease (down 30.3%) in Germany’s gas exports (that is, gas transit via German territory) to countries such as France, the Netherlands, Austria, Switzerland and the Czech Republic was recorded (see Chart 5). The Czech Republic is a particularly interesting example: the gas which this country imported via the Nord Stream pipeline ended up being sent back to Germany (to Bavaria). The halt in Russian supplies which had been bound for other markets has reduced Germany’s importance as a transit country. However, Berlin continues to play a significant part in supplying LNG to Central European states (particularly the Czech Republic, which is importing LNG via the FSRU Eemshaven unit located in the Netherlands, and is interested in using the German FSRU in Lubmin).

Chart 4. Gas transmission to Germany according to supply sources in 2022

Source: Federal Network Agency

Chart 5. Gas transmission from Germany to neighbouring countries according to supply destinations in 2022

Source: Federal Network Agency.

Filling up gas storage facilities

In addition to reducing gas consumption, another crucial initiative to combat the gas crisis involved filling up the storage facilities ahead of the winter of 2022/2023. The decision was motivated by both the gas crisis itself and the fact that the filling level of German storage facilities at the end of last year’s heating season was unprecedentedly low (a mere 25%), for reasons including Gazprom’s deliberate actions. In April 2022, Berlin stripped the Russian gas giant of control over its gas assets in Germany, including its storage infrastructure; these included Germany’s largest gas storage facility in Rehden which, unlike other such facilities, had been almost empty since autumn 2021. The German public began to monitor the filling level of gas storage facilities just as it had monitored the daily number of new COVID-19 cases during the pandemic. The requirement to fill the storage facilities up to a certain level was introduced in spring 2022 and revised upwards in summer, including up to 85% by 1 October and 95% by 1 November 2022. In addition, the federal government obliged the German gas hub THE to buy up gas on the global market in order to store it, and earmarked a total of €16.5 billion for this purpose. As filling the storage facilities before the heating season was a political priority (it was one of the conditions Germany had to meet to avoid gas shortages), THE purchased gas on the global market, especially during the summer, and frequently at unprecedentedly high prices, without paying heed to the cost. This in turn further raised the price of gas in Europe and elsewhere.

The storage facilities were successfully filled to 100% in mid-November 2022, mainly thanks to the reduction in gas consumption, the emergency purchase of gas by THE, Germany’s financial standing, the availability of gas on the global market (which was facilitated by lower demand for gas in Asia), and to mild weather in spring and autumn. In this context, Germany’s decision to maintain a certain level of Russian gas imports until summer another important factor; in 2022 Russia accounted for 22% of Germany’s gas imports as a whole. Had this not been done, it would have been much more difficult for Germany to fill up its gas storage facilities before the start of the current heating season, if at all.

Germany’s increasing decoupling from Russia and the state’s entry onto the gas market

The crisis caused by the Russian aggression against Ukraine has triggered a change in Berlin’s approach to its former energy alliance with Moscow, and contributed to Germany’s decision to become independent of Russia in this sphere. This process was evolutionary in nature: the sequence of events has pushed Germany to make further adjustments and more far-reaching decisions. At the war’s outset, Chancellor Olaf Scholz presented a plan for the long-term diversification of gas supplies involving the construction of two fixed onshore LNG terminals (at Brunsbüttel and Wilhelmshaven), which are to be put into operation in the mid-2020s. In spring 2022, Berlin decided to accelerate the diversification process and to lease five floating LNG terminals in the short term, using funds from the state budget (the original plan had been to lease four such units). Two of these were to be put into operation at the turn of 2023 (the FSRU in Wilhelmshaven was opened in mid-December 2022 and the FSRU in Brunsbüttel will be inaugurated later in January 2023), and the other three (Wilhelmshaven II, Stade, Lubmin II) will open in winter 2023. In addition, a private FSRU initiative has been launched in Lubmin with political backing from the state government and the federal authorities; it is to be inaugurated on 14 January 2023. The rapid implementation of these projects has been possible thanks to the LNG infrastructure law which Germany adopted in a fast-track legislative procedure; this has radically simplified the procedures for issuing construction permits and environmental impact studies.[3] The planned total regasification capacity of the planned six FSRUs is 32 bcm annually, which is expected to help to stabilise the situation on the gas market by mid-2024, despite the likely permanent halt in gas supplies from Russia. The floating terminals are viewed as a provisional (and complementary) solution which will be used until the three fixed onshore terminals are launched (aside from Brunsbüttel and Wilhelmshaven, preparatory work on the project in Stade is ongoing).

In addition to the emergency construction of infrastructure to enable diversification (that is, to replace the supplies formerly provided by Gazprom), the process of Germany becoming increasingly independent of Russia in the gas sphere has involved certain changes affecting companies which are symbols of the former German-Russian gas alliance. These included nationalising their assets and increasing the role of the state in the German gas sector, which until recently had been dominated by privately-owned companies. The nationalisation of Gazprom’s German and other European gas assets (including the Gazprom Germania company, currently known as SEFE)[4] was an unprecedented move which enabled Berlin to regain control over assets such as strategic gas infrastructure (storage facilities, transmission pipelines) as well as several gas trading companies which are of key importance from the point of view of the gas market. Germany’s efforts to rescue Uniper, its largest gas importer, were another important initiative. This company had largely based its business model on importing Russian gas, and faced insolvency when Russia halted its gas supplies; in the end, the German government nationalised it.[5]

2022 marks an important period in the history of German-Russian cooperation in the gas sector. Until recently, this sector had been one of the foundations of this cooperation. The ties between the two countries in this sphere have been significantly reduced, and a return to cooperation as it was before the war now seems highly unlikely. New LNG contracts and infrastructure will reduce the prospects for the potential resumption of trade relations, while the political risks and losses German companies have incurred will also have a deterrent effect in the future. However, this does not mean that the decoupling in the gas sector is irreversible. Should politically favourable circumstances occur, Berlin will likely follow the suggestions from the industrial sector in particular, and from at least some local politicians, and move to restore imports from Russia, albeit in smaller volumes than those recorded before the war (Germany has ceased entirely to import coal and oil from Russia, in line with EU decisions).

The issue of domestic production re-emerges

At present, Germany only meets around 6% of its demand for gas from domestic production, whereas at the beginning of the 21st century the proportion was around 20%. The gradual exhaustion of local gas fields, the high availability of cheap imported gas (mainly from Russia), public reluctance and the political controversy related to it have all prevented Germany from implementing new projects. The present uncertainly regarding the future of Germany’s gas supplies in the coming years, on condition of a permanent halt to Russian supplies, combined with the likelihood of gas prices remaining high in the long-term, have revived the German debate on domestic gas production. New projects – including in the sphere of hydraulic shale gas fracturing, which is de facto banned in Germany (German shale gas fields are estimated at between 380 to 2300 bcm) – have received open backing from the FDP party (a component of the ruling coalition) and the opposition CDU/CSU parties. However, the FDP’s coalition partners, the SPD and the Greens, whose electorates reject the idea of shale gas production, have expressed their strong opposition to this plan, mainly citing concerns over the possible impact on the environment. Moreover, the authorities of Lower Saxony (where these two parties make up the ruling coalition), which hosts the vast majority of the potential gas fields, are against this plan. However, the crisis has brought about a shift in the attitudes of the federal government and the government of Lower Saxony towards the project to extract gas in the North Sea, near the Dutch-German offshore border, which the Dutch ONE-Dyas company is developing with the support of the Dutch government (the estimated volume of this gas field is up to 60 bcm). Following many months of delay, mainly due to protests by environmental organisations, and after an intervention by the government in the Hague, Germany unblocked the project in spring 2022.

The future of gas and of the energy transition

The 2022 crisis has not undermined the main assumptions of the German electricity sector’s transformation model. In the new situation caused by the war, the new ruling SPD-Green-FDP coalition has even stepped up some of its earlier ambitions regarding the pace of the transition to a system based on renewable energy sources. In summer 2022, Germany adopted a package of reforms – the biggest in its history – in order to accelerate and facilitate the investments in wind farms and photovoltaic installations. The hope is that this will enable Berlin to reach the newly set goal of RES reaching an 80% share of Germany’s electricity consumption by 2030 (in 2022 the proportion was 46%, while the share of RES in the electricity generation mix stood at 44.6%).

Furthermore, Berlin has not changed its plans regarding the use of natural gas as transition fuel: the only modification relates to on what scale and for how long gas will continue to be used in the electricity generation sector. In line with the concept endorsed by the new coalition, gas-fired power plants will be used less frequently and for shorter periods; they will be switched to hydrogen co-firing sooner, and ultimately a complete fuel switch will be achieved. Several important initiatives from the point of view of the Energiewende have been announced for 2023. These include an energy market reform (including elements of capacity market mechanisms as an incentive to make investments in the new H2 Ready-type gas-fired power plants which are expected to replace nuclear and coal-fired units); a revision of the hydrogen strategy; and the implementation of instruments which will be important in the context of decarbonising the industry (in particular ‘carbon contracts for difference’, and the carbon management strategy which will allow Germany to implement the carbon capture and storage technology – CCS).

The difficult situation in the German gas sector will likely continue in 2023. In the context of the expected absence of gas supplies from Russia, it will be more difficult than it was in recent years to refill the storage facilities before the next heating season starts. In this context, the fact that their filling level is presently high (on 9 January it was more than 91%) is good news. Much will depend on the volume of gas consumption in the economy as a whole; the availability of LNG on the global market; the scale to which the new floating terminals will be used, how promptly the other such terminals can be launched; and finally, on the weather, which is important in the context of gas consumption for heating purposes. The size of the current supplies and the volume of gas reserves, for their part, will be important in the context of gas prices, which according to most forecasts will remain high throughout 2023.

[1] M. Kędzierski, ‘Germany: the crisis is driving a renaissance for coal’, OSW, 12 October 2022, osw.waw.pl.

[2] Idem, ‘Germany: nuclear phase-out postponed for three and a half months’, OSW, 17 November 2022, osw.waw.pl.

[3] Idem, ‘An abundance of gas ports. The emergency diversification of gas supplies in Germany’, OSW Commentary, no. 447, 20 May 2022, osw.waw.pl.

[4] For more see M. Kędzierski, S. Kardaś, ‘Germany: nationalisation of Gazprom’s gas assets’, OSW, 24 November 2022, osw.waw.pl.

[5] For more see M. Kędzierski, ‘Germany: nationalisation of Uniper’, OSW, 23 September 2022, osw.waw.pl.

![[Q&A] Skąd taka niechęć Niemców do atomu? Co myślą o cyfrowym zapóźnieniu? Jak oceniają Merkel?](/sites/default/files/styles/media_360_200_s_c/public/oembed_thumbnails/l1EiVo2dQ4LGIQHuvq8dCKB2VnnaFfPsKkKaBBxF6U4.jpg?itok=1o-SKDa7)