Europe compensates for losses in German exports

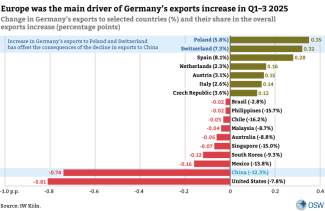

According to a report by the German Economic Institute in Cologne (IW Köln), in the first three quarters of 2025 Germany’s exports of goods and services increased by 0.25% year on year, despite a decline in sales to its two most important trading partners: China (-12.3%) and the United States (-7.8%). Taken together, these two destinations reduced Germany’s total export growth by 1.55 percentage points. In the case of the United States, the key factor behind the deterioration was the protectionist trade policy pursued by President Donald Trump, which particularly affected the German automotive and machinery industries and, to a lesser extent, the chemical sector. The decline in exports to China, by contrast, resulted from several factors: increased competitiveness of Chinese producers on the domestic market, aggressive subsidisation of domestic enterprises by the authorities in Beijing, and the appreciation of the euro against the yuan.

The negative impact of these trends was, however, offset by increased sales to European countries characterised by geographical proximity and strong economic integration, most notably Poland, Switzerland, and Spain. German suppliers were among those who benefited from robust GDP growth in Spain and Poland, as well as from higher infrastructure spending in Poland, including on rail, roads, energy networks, and ports.

The declining attractiveness of the United States and China as export markets has intensified pressure in Berlin to finalise an agreement with the Mercosur countries, which is regarded as a strategic element of Germany’s export diversification. Owing to their geographical proximity and deep economic integration, European countries are set to further consolidate their position as the most important markets for German exports.

Commentary

- The decline in German exports to China results from a permanent shift in competitive conditions and is unlikely to be reversed in the long term. In recent years, many German companies have adopted an ‘in China for China’ strategy, which no longer involves merely establishing production facilities in the PRC but increasingly includes the development of local research and development activities. This model reflects the growing technological maturity of Chinese partners, with German corporations increasingly making use of their solutions. Consequently, the former configuration – under which innovative advantage lay predominantly with companies from Germany – is gradually being reversed. Thus, sales of German-made goods to the Chinese market will increasingly be replaced by the relocation of additional segments of value chains directly to the PRC. Moreover, some German companies are beginning to pursue an ‘in China for the world’ strategy, turning the PRC into a primary production base oriented towards exports to third countries, at the expense of production in Europe.

- Competition between German and Chinese companies is increasingly shifting to third markets. Beyond the United States and China, German companies have also recorded declines in exports to Southeast Asia and the Pacific, as well as to Brazil and Chile (see Chart 1). This has been driven to a large extent by the closure of the US market to Chinese production surpluses as a result of the high tariffs imposed by the Trump administration. Consequently, these goods have been redirected to other markets, where they now represent significant competition for German products. This pressure is set to intensify, particularly in Southeast Asia, as the share of Chinese exports increases with the deepening effects of the Regional Comprehensive Economic Partnership (RCEP), in force since 2022. Under these circumstances, the conclusion of the EU–Mercosur trade agreement has been of particular importance for Berlin, as it could facilitate exports – above all German cars and machinery – to South American countries under more favourable conditions.

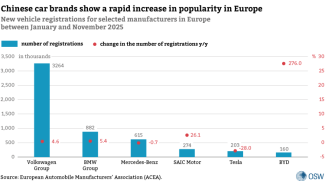

- Europe’s role as the principal market for German goods and services is set to strengthen further. At present, approximately 70% of Germany’s exports are destined for European countries, and this share is expected to increase as sales decline in other parts of the world (see Chart 2). At the same time, an increasingly serious challenge for German companies will be the insufficient protection of the European market against inflows of Chinese production surpluses, particularly in the automotive, chemical, and steel sectors. This pressure is becoming more pronounced: although the Volkswagen Group maintained the largest share of new vehicle registrations in Europe in 2025, Chinese manufacturers (including BYD) have recorded very high growth rates in the European market, gradually strengthening their position (see Chart 3).

- The sale of services is gradually gaining importance in Germany’s export structure. Real exports of services in the first three quarters of 2025 increased by 1.6% year on year, partially offsetting the negative trend affecting goods exports (-1.4%). In the third quarter alone, the nominal share of services in total exports reached 24.7%, compared with 17.2% in 2010. These developments – alongside plant closures and job losses in manufacturing – have become the subject of intense public debate in Germany, reflecting concerns about the deindustrialisation of the economy. Experts tend to view the growing role of services negatively, as it largely involves sectors with lower productivity and wage levels, which are unable to fully replace industry as a source of high productivity and innovation.