The breadbasket of the world?

INTRODUCTION

The aim of this study is to provide a comprehensive overview of the Ukrainian agricultural sector in the light of the act on introducing an agricultural land market adopted in March 2020, which partially came into force in mid-2021 and will fully enter into force in 2024. It will allow, for the first time in the history of independent Ukraine, the free and legal trade in agricultural land. This will have far-reaching consequences both for local agriculture and for the country as a whole. The development of the agricultural sector, which has already progressed at an impressive rate in recent years, can be expected to accelerate further still. It should be remembered that Ukraine is the largest country in Europe in terms of area (excluding the Russian Federation) and more than half of its territory is covered by very fertile soils. The vast majority of the country has a climate favourable for agricultural production – the land is characterised by a long growing season for plants, plenty of sunshine and no problems with shortages of water for agriculture. The state thus has excellent conditions for this type of economy.

This text covers the period between 2015 and 2020. This time frame has been chosen deliberately, as in the last five years agricultural production, and in particular its export, developed very dynamically and became the most important item in the foreign trade in goods. The second reason for choosing this over any other framework is Russia's military aggression, which led to the annexation of Crimea and Kyiv’s loss of control over part of the territories in the Luhansk and Donetsk oblasts, making it difficult to compare the performance of the agricultural sector in the pre-2015 period. The paper relies heavily on data from the State Statistics Service of Ukraine (SSSU) in the statistical section, and the SSSU and Eurostat in the section on agri-food production exports.

The text has been divided into two parts. The first part focuses on the description of natural conditions and the characteristics of farming the most important cereals, industrial crops, vegetables and fruits, and of breeding. A separate section has been set aside for the description of agricultural enterprises, including one special type – large agri-holdings – and the political influence of their owners. The second part is an analysis of the exports of products of the agri-food sector, both in terms of goods and geographical distribution, with particular emphasis placed on sales to European Union countries and Poland.

MAIN POINTS

- The natural conditions in Ukraine are favourable for agricultural production. The dominant climates are Atlantic-continental and continental, there is sufficient precipitation on most of the territory and in the southern part of the country, which suffers from a water deficit, an irrigation canal system has been built. The vegetation period of plants in the vast majority of regions lasts over 200 days a year. Fertile chernozem covers half of the territory, and another 14% are very good chestnut soils. This means that most of the country's territory, with the exception of a strip in the north and parts of western Ukraine, is covered by soils ensuring high fertility.

- The act on introducing an agricultural land market in Ukraine, adopted in March 2020, made the previously-prohibited free trade in agricultural land possible from mid-2021. In the long term, this act should lead to greater interest in intensifying production and developing industries that require long-term investment, such as fruit-growing and livestock breeding. Free trade will bring a very large increase in the potential of the Ukrainian economy – according to some estimates, the introduction of market rules could increase GDP by 1 p.p. annually.

- In 2019, there was 28 million ha of cultivated land, which is 46.7% of the country. Cereals were the most popular, occupying 54.7% of the area. Industrial crops made up 32.6% of the cultivated area, vegetables and potatoes made up 6.5%, and animal fodder made up 6.2%. The central, eastern and southern provinces are especially used for agriculture, while the western and northern parts of the country are less developed in this respect due to weaker soils and a less favourable climate.

- The cultivation of cereals and oilseeds is only slightly diversified. Three species – maize, wheat and barley – account for the vast majority of cereals (97% of production in total). The situation is similar in the case of oilseeds – sunflower, rapeseed and soya account for 99%. However, it is difficult to indicate the dominant species among fruit and vegetables.

- In contrast to plant cultivation, animal husbandry has not developed in recent years. The exception is poultry and dairy production (mainly chicken eggs). This is due to the fact that breeding is associated with much higher investment outlays, which local businessmen, focused on boosting income with minimal capital involvement, are barely interested in.

- Ukraine stands out for the high percentage of land cultivated by agricultural companies (agri-companies). In 2019, individual farmers utilised only 27% of the land. The share of companies in production varies depending on the crop type – it is the highest in the case of oilseeds (rapeseed, sunflower and soybean), cereals (maize, wheat and barley) and sugar beets.

- Agri-companies are very fragmented, with the vast majority leasing land of less than 100 ha. The largest players (above 3,000 ha) constitute about 1% of all companies operating in the agri-food sector and produce more than 20% of cereals and oilseeds. The most important position, however, is held by medium-sized companies with an acreage of 200–2000 ha. There are about 6,000 of them and, depending on the species cultivated, they are responsible for cultivating 50–75% of the land tilled by the companies.

- The development of the agricultural sector, based on a system of land renting, has led to the emergence of a new class of big businessmen, who are often called agricultural oligarchs. Although some representatives of this group possess assets estimated at hundreds of millions of dollars, none of them has ever found themselves among the top five of the richest people in Ukraine. In addition to the agricultural oligarchs, most or all of whose assets are concentrated in the agricultural sector, the "traditional" oligarchs are also active in this sector, although on a much smaller scale.

- Although individual agricultural oligarchs have managed to achieve a dominant position in their industry, this is not the level of monopolisation that can be observed among businessmen operating in sectors such as metallurgy or energy. The leading position of Andriy Verevskyi (owner of the agri-holding Kernel) on the vegetable oil market is undisputed, but still the majority of agricultural companies are in the hands of medium and small players who own more than 80% of the cultivated land. This does not give them the prominence among society enjoyed by, for example, Rinat Akhmetov in electricity production or Dmytro Firtash in gas distribution.

- In recent years, it has been possible to observe an increase in the political influence of agricultural entrepreneurs. In the current Verkhovna Rada only the Trust faction, with 20 deputies, is controlled by representatives of agribusiness. However, they are present in all its groupings and form the largest group (next to developers), although their interests differ strongly, making it difficult, if not impossible, to reach a common position. Producers of vegetable oils, cereals and poultry meat compete for state subsidies and tax breaks for themselves rather than joining forces.

- Ukrainian agri-holdings are distinguished by having a large share of foreign capital (the largest portion comes from the USA and Saudi Arabia); entities from outside the country own around 10% of agricultural land. This is a significant difference in comparison to the energy sector, where, apart from electricity distribution (which has Russian businessmen as the shareholders) and a French investment in metallurgy, the whole industry remains under the control of a few local oligarchs.

- The export of agri-food goods is playing an increasingly important role in the domestic economy. In 2020, it accounted for 45% of total exports, which is equivalent to ca. 14.4% of GDP. This sector is the only one with higher revenues in 2020 than in 2013.

- Production of wheat, maize, barley and oilseed crops (sunflower, rapeseed and soya) is mostly (and sometimes almost entirely) export-oriented. For the rest of agricultural crops – particularly vegetables, fruit and other industrial crops – this is of marginal importance.

- Ukraine is among the world's top exporters of cereals and oilseeds, and is the unquestionable leader in sunflower oil sales. Most often it can offer prices for these which are significantly lower than its competitors, even within the region. Given that the production of cereals and oilseeds is increasing every year, it may be assumed that the country's position in this respect will continue to strengthen.

- In terms of the types of goods sold, Ukrainian agricultural exports are not highly diversified. Unprocessed products of plant origin clearly dominate, and nearly three quarters of goods sent abroad fall into just three categories: cereals, oils and oilseeds. Prepared foodstuffs make up only 14% of exports and it seems unlikely that there will be a significant change in this respect in the near future.

- Three main regions can be distinguished among the recipients of local agri-food production: the European Union, Middle Eastern countries and Southeast Asian countries, which account for more than 80% of exports. The EU market plays the most crucial role, importing 33% of Ukraine’s exported food goods, and its importance growing steadily – between 2015 and 2019 food exports to the EU increased by 84%. Other areas, including post-Soviet countries, play a marginal role in this respect.

- In 2019, Poland was the largest recipient of Ukrainian goods among the EU countries, but only the fourth largest importer of Ukrainian food. The structure of products sent to Poland differs significantly from the EU average. First of all, the very low export of cereals, which are the main commodity sold to member states, is noteworthy. In total, Poland receives just 1% of the cereals shipped to the EU market. However, in some categories (e.g. processed fruit and vegetables), Poland is very important or crucial for its neighbour's exporters. Overall, compared to the rest of the EU countries, Poland receives more processed goods than raw materials.

I. AGRICULTURAL PRODUCTION

- Natural conditions

1.1 Climatic conditions

The vast majority of the territory of Ukraine lies in the moderate continental climate zone, with four clearly distinguishable seasons. This applies to the western (except the Carpathian mountain range), central and northern parts of the country. The southern and eastern regions have a continental climate with hot summers and less precipitation (especially in the south). From the northwest to the southeast, the climate gradually takes on a continental character, the temperature difference between winter and summer increases and the amount of precipitation decreases. Only a narrow strip of the southern coast of Crimea occupied by Russians lies in the subtropical Mediterranean zone.

The climatic conditions of Ukraine determine its division into vegetation zones. In the area with a moderate continental climate there are zones of mixed forests and wooded steppe. The continental zone is dominated by the steppe. In the south-western region of the country and in the southern part of Crimea there are mountain areas.

Map 1. Vegetation zones of Ukraine

Source: Всеосвіта, vseosvita.ua.

The average annual temperature in Ukraine varies from 6°C in the north to 12°C in the south. The average temperature in the coldest month (January) ranges from -8 to 0°C, depending on the region, and in July from 18 to 23°C. The growing season, defined as the number of days per year with an average daily air temperature above 5°С, is related to the temperature.

The amount of precipitation depends on the season and the region. The most occurs in June and July. The least, which is about 2–3 times less, is in January. The highest amount of precipitation occurs in the Carpathians (1000 mm per year). In the moderate continental climate zone it is 550 mm, and in the south it is 440 mm per year.

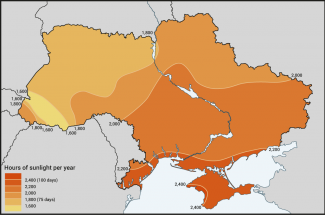

The solar irradiation is geographically distributed in a similar way. In the northwest it is less than 1,600 hours per year, while on the coasts of the Black Sea and the Sea of Azov it exceeds 2,200 hours.

Map 2. Solar irradiation in Ukraine

Source: Карта солнечной активности Украины, solarservice.pro.

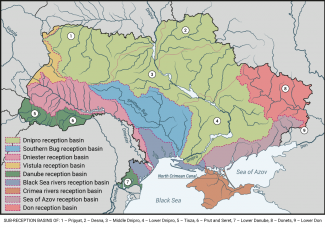

Ukraine has a very well developed river network. The Dnipro plays the largest role, as well as the Dniester, Pripyat, Southern Bug, Desna and Donets. The vast majority (90%) of the country's area belongs to the basins of the Black Sea and the Sea of Azov. There are more than 3,000 lakes, but they are mainly very small lakes, and only 30 are larger than 10 km2. The country is covered by a large number of artificial water reservoirs. In total, there are more than 1,100 of them and they cover an area of almost 7,500 km2. A system of six hydroelectric power stations on the Dnipro River and the reservoirs they create are the most important of these, with an area of almost 7,000 km2. Nevertheless, in the south and southeast, due to the dry climate and high temperatures, there had been a water deficit for agriculture until the 1980s. The problem was largely solved by the construction of two canals. The first one, the Dnipro–Donbas canal, connects the Kamianske Reservoir to the Donets and increases the water supply to parts of Dnipropetrovsk, Poltava and Kharkiv oblasts. An even greater role is played by the second reservoir, the Kakhovka, which irrigates 780,000 ha of land in the Kherson and Zaporizhzhia oblasts. Nevertheless, due to global warming, droughts occur in the south of the country. The Odessa Oblast, with its underdeveloped drainage system, is particularly vulnerable. In order to improve the situation, the government has announced a national irrigation programme. The project will receive $2 billion of support from the World Bank and the European Bank for Reconstruction and Development.

Map 3. River network of Ukraine

Source: Wikipedia.

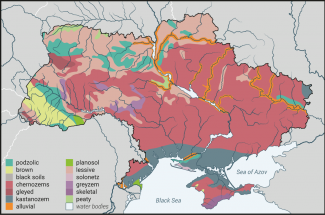

1.2 Soils

The vast majority of land in Ukraine is fertile or very fertile. Approximately 50% of the territory is covered by chernozem, with humus content up to 9% and layer thickness ranging from 40 cm to 1 m, which is considered one of the most fertile soils in the world. 14% is covered by kastanozem soils, with 3–4% humus and layer thickness of about 0.5 m. These two types of highly fertile soils cover approximately 370,000 km2, which is 61% of the country's area. Due to a well-developed network of large rivers in their valleys, alluvial soils have formed (approx. 4.5% of the area), which are also usually characterised by high fertility. The cambisols are less fertile (approx. 19% of the country's area, with humus content of 1–2.5%). The podzolic soils (approx. 6% of the area), formed mainly from sands, are barren soils. Other soil types occur on approximately 7% of the country's area.

Chart 1. Surface area of different soil types

Source: Harvard World Map.

There are significant differences between regions in terms of the types of soil present. In the northern part of the country, the mixed forest zone is dominated by the less fertile cambisols and podzolic soils. The wooded steppe zone has the greatest amount of chernozem. The steppe zone can be divided into two parts – in the north-east chernozem is the most frequently-occurring, while in the south, along the coast of the Black Sea and the Sea of Azov – the chestnut soils. The Carpathian area in the southwest has podzolic soils and poorer quality brown soils.

One of the challenges facing Ukrainian agriculture is the gradual degradation of soils. According to the State Agency for Land Protection, between 1990 and 2015, the average percentage of humus (one of the basic factors determining fertility) in the soils there decreased from 3.36 to 3.16%. This process is fastest in the steppe areas (a decrease from 3.72 to 3.45%). The degradation phenomenon is partly due to climate change, but it is accelerated by the mode of cultivation – above all, the domination of monocultures with a large share of oil plants that sterilise the soil.

Map 4. Soils of Ukraine

Source: Harvard World Map.

Summing up, more than half of Ukraine's area is covered by very fertile soils. The vast majority of its territory has a favourable climate for agricultural production – a long growing season for plants and lots of sunshine, and does not suffer from shortages of water for agricultural purposes. In short, the country has excellent conditions for this type of economy.

- Land ownership

2.1. The closure of kolkhozes and the introduction of a moratorium on land trade

Ukraine has been unable to regulate the issues of agricultural land ownership for an exceptionally long time. In Soviet times land belonged exclusively to the state, and kolkhozes (production cooperatives) and sovkhozes (state enterprises) reaped the benefits of using it free of charge. In 1990 there were about 8,000 kolkhozes and about 3.8 million kolkhoz workers. In 1992, a reform law was passed which did not abolish this form of activity, but granted each of the employees the right to a proportionate share of the kolkhoz's land (a so-called "pai"). The process of determining the size of the pais (1–8 ha, depending on the district) lasted ten years and, according to various data, 6–8 million people received certificates confirming their right to them. Although during this time the entire kolkhoz land was "allocated", only the area of land which fell to a given person was determined, without marking out plots on maps, let alone in the field (this was to be done only if the owner of the pai wanted to leave the kolkhoz and farm independently). The vast majority of land ownership certificates were leased to the heads of agri-companies, and only about 6% were converted into the right to use a specific, physically separate plot of land.

In 2001, the Land Code of Ukraine was enacted, establishing ownership of agricultural land. However, it was believed that the country was not prepared for the introduction of free trade in land (in part due to the lack of a land cadastre) and therefore the implementation of the legislation was suspended until the necessary conditions were met. This moratorium was extended every year until 2019 due to a lack of political will for change, which resulted from strong public opposition to abolishing the act. During this time, there has been a concentration of acreage and the creation of large agricultural enterprises (called agri-holdings in Ukraine), farming on tens or, in some cases, hundreds of thousands of hectares leased from the owners of pais. At the same time, the former kolkhoz workers, some of whom had no heirs, were dying out. The area of such no-man's-land is steadily increasing, and is currently estimated at 1.6 million ha. The possibility of the free use of this land motivated both entrepreneurs and officials, who corruptly profited from this procedure, to counteract the ordering of the ownership situation in agriculture.

2.2. Introduction of a land market

The lack of land tenure hampered the development of the agricultural sector due to a reluctance to make long-term investments on leased land. In addition, the fact that land was leased, rather than owned, meant that companies operating on it tended not to be concerned with its proper use, such as using the right crop rotation or limiting crops which impoverish the soil. Despite this, agriculture grew steadily and became a major source of commodity exports.

The main reason for maintaining the ban on agricultural land trade for such a long period was, as already mentioned, very low social support for lifting the ban. The secret lobbying by the owners of the largest agri-holdings was probably also important. The moratorium remaining in place provided a number of advantages for them – predominantly the access to financing through selling shares on the stock exchange or issuing bonds, which smaller entities were not entitled to. As recently as May 2021, in a survey by the Rating centre, only 36% of Ukrainians were in favour of introducing free trade in agricultural land. This was mainly due to the fear of a repeat of the situation in the 1990s regarding the privatisation of state assets, when the most profitable enterprises and factories were taken over for a small fraction of their market value by a group of oligarchs. This sentiment was fuelled by the representatives of populist and nationalist parties, who were preaching against the threat of selling off national assets. The strong opposition of citizens meant that market liberalisation did not become a priority for any party.

The situation changed with the victories of Volodymyr Zelensky in the presidential election in May 2019 and that of his party (which secured a result that allowed it to rule alone) in the parliamentary election in July that year. Lifting the moratorium was one of the points of Zelensky's electoral programme. It seems that the president's main motivation was to remove a relic of the past in the form of a ban on land sales. The first reading of the bill introducing free trade in agricultural land took place in November 2019. The tabled document was highly controversial, mainly due to the very high threshold for restricting land concentration (200,000 ha) and the possibility of it being bought out by entities holding foreign capital. After numerous amendments and despite opposition attempts to block it, the legislation was adopted on 31 March 2020.

The act concerns 41.5 million ha of land, the trade of which was covered by the moratorium, and provides for the possibility to trade in agricultural land as of 1 July 2021. For the next two and a half years, there will be a transitional period during which land of up to 100 ha can only be purchased by natural persons. From 1 January 2024, this right will also be extended to legal entities and the maximum acreage will increase to 10,000 ha. The legislation does not allow foreigners (including legal entities registered in Ukraine, whose final beneficiaries are foreigners or foreign companies) to buy plots of land. Land cannot be sold at a cheaper price than the set normative price ($700–1,100 per hectare depending on the oblast).

The adopted document is vague on several issues, while in the case of others it announces specific regulations in future legislation. One of these issues concerns the limitation of acreage concentration to 10,000 ha, as it remains unknown how this ban will be enforced in practice. The act provides that detailed rules for control in this respect are to be adopted by a separate government regulation. According to this, the obligation to check in the register whether a person or entity has the right to acquire land rests with the notary drawing up the agreement, which generates significant risks of corruption.

|

Where did five million ha of state land go? According to the State Statistics Committee, there were 10.4 million ha of state agricultural land in Ukraine in 2019. The Act on the Land Market prohibits its sale. This restriction does not apply to tenants who lease the land in accordance with the agreements concluded before 2010. They have the possibility to buy it with a payment scheme spread over ten years and at a normative valuation. In October 2020, Roman Leshchenko, then head of the State Service of Ukraine for Geodesy, Cartography and Cadastre (SSUGCC), which maintains a register of agricultural land plots, sparked turmoil in the media by reporting that only 750,000 ha of land were actually in state hands, most of which belonged to the National Academy of Agrarian Sciences. Another 4 million ha have been transferred to regional authorities. As many as 5 million ha are therefore missing from the register (an area comparable to the territory of Slovakia). It is not known to whom they currently belong, but a detailed inspection should determine this. According to Leshchenko, these lands were illegally taken over by persons planted by local cliques with SSUGCC officials complicit. The mechanism of free privatisation was used for this, according to which every Ukrainian citizen is entitled to 2 ha of state land (in 2013–2020, 690,000 ha of land were distributed in this way). |

The introduction of the free market in 2024 is unlikely to spell an immediate change in land ownership – most likely the process will stretch over several years. According to surveys, only 7% of pai owners intend to sell their plots. Even the purchase of only 10% of all agricultural land at a standard price set by the state would cost around $4 billion, which is a staggering sum for Ukrainian conditions. Smaller entrepreneurs have very limited access to loans, while large agri-holdings, although theoretically more able to obtain funds this way, are usually heavily indebted and will not be able to find the money to buy land of large acreage in a short period of time.

- Crop farming

3.1. General characteristics

In 2019, 28 million ha of land was cultivated in Ukraine, which is 46.4% of the country's area. This area has increased slightly (by 1.8 p.p.) since 2015. This is a relatively large area – by comparison, in Belarus cultivated land covers 27.5% of the territory, in Poland it is 35.2%, and in Germany it is 32.8%.

The percentage of land on which agricultural activities are carried out differs significantly from one oblast to another. It is highest in the Kirovohrad Oblast (69.3%) and lowest in the Zakarpattia Oblast (14.5%), which is due to the fact that a significant part of the latter is located in mountainous and forested terrain. In general, the amount of cultivated land depends on the quality of soils and climate. The least agricultural land is found in the western and northern parts of the country, where soils are relatively poor, and in oblasts that lie in the Carpathian Mountains. The most agricultural land is in the chernozem belt, stretching from Ternopil Oblast, through the central part of Ukraine, to the eastern border.

Dashboard 1. Percentage of cultivated land in each oblast in 2019

Source: State Statistics Service of Ukraine.

Cereals are grown on more than half (54.7%) of agricultural land. Further places are occupied by industrial crops – mainly oil crops and sugar beets (32.6%), vegetables and tubers (6.5%) and plants for animal fodder (6.2%). These proportions have not changed significantly between 2015 and 2019, although a slight increase in the share of industrial crops and a decrease in the area planted with fodder species for forage may be noted.

The considerable regional differences result mainly from soil quality and climate. In mountainous areas relatively more fodder crops and vegetables (mainly potatoes) are grown. The situation is similar in the west and in the Ukrainian part of Polesia up to the Dnipro. The rest of the country is dominated by cereals and industrial crops.

Dashboard 2. Crop structure in individual oblasts in 2019

Source: State Statistics Service of Ukraine.

In terms of production, wheat crops predominate in southeastern Ukraine, maize in the centre, and potatoes in the west. Ternopil Oblast stands out in the west, where sugar beet is produced the most.

Dashboard 3. Dominant crops in terms of yield in 2019

Source: State Statistics Service of Ukraine.

3.2. Cereals

Cereals and Fabaceae crops (primarily peas) occupy 15.3 million ha. While the cultivation area increased only slightly between 2015 and 2019, the amount produced increased by 25% during this period – from 60 million tonnes in 2015 to 75 million in 2019. There are different types of cereals in Ukraine, but three dominate: maize, wheat and barley, which make up 97% of production. Maize is the most important, grown on 5 million ha, with 35.9 million tonnes produced in 2019. Wheat was second (6.8 million ha, 28.3 million tonnes) and barley third (2.6 million ha, 8.9 million tonnes). Only 1.1 million tonnes of the remaining cereals – oats, rye, millet and sorghum – were produced in 2019. Among broad beans, only peas are produced in considerable quotas (573,000 tonnes in 2019).

Chart 2. Production of individual cereals in 2015–2019

Source: State Statistics Service of Ukraine.

The dynamics of change in 2015–2019 shows that wheat production increased by 6.8%, barley production by 7.2%, and maize production by 54.1%. This was mainly due to an increase in yields rather than of cultivated area (which grew by 8.7% over the period, from 4.6 to 5 million ha). This applies to all three species – during these five years, maize yields increased from 5.7 to 7.2 tonnes per ha (by 26.3%), wheat from 3.9 to 4.2 tonnes per ha (by 7.7%) and barley from 3 to 3.4 tonnes per ha (by 13.3%).

The cultivation of different types of cereals often correlates with regional distribution. Maize grows mainly in the centre of the country – more than half of its yield is in Poltava, Chernihiv, Vinnytsia, Sumy and Cherkasy oblasts. Wheat is grown more evenly, although the oblasts of southern and eastern Ukraine – Zaporizhzhia, Kharkiv, Odessa, Dnipropetrovsk and Vinnytsia – stand out in this respect (a total of 36.7% of production). Barley prevails in the southern part of the country – Odessa, Mykolaiv, Dnipropetrovsk and Kherson oblasts (37.1% in total).

Dashboard 4. Cereals yield in 2019

Source: State Statistics Service of Ukraine.

3.3. Industrial crops

Among industrial crops, which occupied 9.1 million ha in 2019, two groups can be distinguished: oilseeds and sugar beets. In the case of the former, a similar situation can be observed as with cereals – although many species are grown in Ukraine, three of them make up more than 99% of production: sunflower, rapeseed and soybean. These occupy an area of 8.9 million ha. Sunflower is the most important and was grown on 6 million ha in 2019, with a yield of 15.3 million tonnes. Soya was grown on 1.6 million ha (3.7 million tonnes produced) and rapeseed on 1.3 million ha (3.3 million tonnes).

Between 2015 and 2019, sunflower production increased by 36.6%, the area of sunflower cultivation increased by 15.4% and the average yield per ha in 2019 was 2.6 tonnes. In the same period, soybean yields decreased by 5.1%, the cultivated area decreased by 10.1%, the average yield per ha was 2.3 tonnes. In turn, rape production increased significantly – by as much as 94.1%. The area of its cultivation increased by 47.1% and the average yield per ha was 2.6 tonnes.

Chart 3. Production of industrial crops in 2015–2019

Source: State Statistics Service of Ukraine

Here too, as in the case of cereals, significant regional differences may be observed. The largest amount of sunflower is grown in Kirovohrad, Kharkiv, Dnipropetrovsk and Mykolaiv oblasts (in total 36.3% of total production). Soya is most popular in central and western Ukraine – Khmelnytskyi, Zhytomyr, Poltava and Kherson oblasts provide 37.8% of its total production. In turn, the leaders in rapeseed are Odessa, Dnipropetrovsk, Vinnytsia and Khmelnytskyi oblasts (33.3%).

Dashboard 5. Industrial crops yield in 2019

Source: State Statistics Service of Ukraine.

In contrast to oilseed fields, the sown area of sugar beet declined over the five years in question – from 330,000 to 222,000 ha (a 33.3% decline). Its production also contracted, though only slightly (by 1%), to 10.2 million tonnes. Vinnytsia (19.3% of total production), Khmelnytskyi (13.8%) and Ternopil (11.6%) oblasts are the leaders.

It seems that the main reason for changes in the acreage and production of particular crops is the economic situation on external markets. Most of the production is intended for export, which is constantly growing (see part II for more details). As a result, the share of those species for which there is the greatest global demand (in particular maize, rapeseed and sunflower) is increasing.

3.4. Vegetables

Vegetable production occupies 513,000 ha of Ukrainian territory. In 2015–2019, their cultivation area decreased slightly (by 1.4%), while production increased by 7.3% and amounted to 10.3 million tonnes in 2019. Unlike cereals and industrial crops, it is difficult to identify the dominant species. The most popular are: tomatoes (2.2 million tonnes), cabbage (1.8 million tonnes), cucumbers (1 million tonnes), onions (998,000 tonnes), carrots (870,000 tonnes), beets (857,000 tonnes), pumpkins (713,000 tonnes), squash (633,000 tonnes) and watermelons (442,000 tonnes). These nine species account for 92% of domestic vegetable production. The most vegetables are grown in Kherson (13.6% of total production), Dnipropetrovsk, Lviv, Kharkiv and Kyiv oblasts.

Chart 4. Yield and acreage of selected vegetables in 2019

Source: State Statistics Service of Ukraine.

Among vegetables, potatoes are of particular importance and their cultivation in 2019 occupied 1.3 million ha of the country's area. Ukraine produced 20.3 million tonnes of them then (down 2.4% compared to 2015). Potatoes are mainly grown in the western and central oblasts.

Dashboard 6. Vegetable and potato yield in 2019

Source: State Statistics Service of Ukraine.

3.5. Fruit

Orchards occupy 522,000 ha; this area decreased by 8.2% in 2015–2019. The contraction of cultivated areas affects all types of fruit except nuts, which may indicate a lack of interest in developing this industry. Despite the reduction in area, fruit production in 2019 increased by 2.5% compared to 2015 to reach 5 million tonnes. The largest crops are apples (98,000 ha and 1.2 million tonnes produced), grapes (42,000 ha and 366,000 tonnes) and plums, cherries and pears (54,000 ha and 504,000 tonnes in total).

Chart 5. Comparison of the size of orchards and vineyards in 2015 and 2019

Source: State Statistics Service of Ukraine.

Chart 6. Comparison of production of main fruit species in 2015 and 2019

Source: State Statistics Service of Ukraine.

Individual fruit species are most often found in specific regions of the country. As much as 43.8% of apples are produced in the territory of three oblasts of central Ukraine (Vinnytsia, Khmelnytskyi and Chernivtsi). Grapes, on the other hand, due to climatic conditions are grown on a larger scale only in a few southern oblasts – Odessa (25,000 ha), Mykolaiv (6,200 ha) and Kherson (4,700 ha) – and in Zakarpattia (3,500 ha). Other species of fruit trees and bushes are found on a rather limited scale throughout the country.

Dashboard 7. Fruit yield in 2019

Source: State Statistics Service of Ukraine.

- Agricultural enterprises

4.1. Regional differentiation and characteristics of crops

Ukraine is distinguished by having a high percentage of land used by agricultural enterprises. In 2019, individual farmers utilised only 27% of the land (for comparison, in Poland it is 92%). These proportions vary quite significantly depending on the region and the crop grown. Only in some oblasts of western Ukraine (less developed in terms of agriculture) do individual farmers cultivate more, and only in two (Zakarpattya and Chernivtsi) are they the majority. This is most likely due to the fact that in these areas collectivisation was not carried out until after the Second World War, so a higher proportion of people were able to farm independently after the kolkhozes collapsed. Enterprises are particularly dominant in the central and northern parts of the country (Khmelnytskyi, Chernihiv and Sumy oblasts).

Dashboard 8. Proportions of area cultivated by enterprises and individual farmers in each oblast in 2019

Source: State Statistics Service of Ukraine.

The share of enterprises in production also differs depending on the species grown. It is highest for oilseeds – rapeseed (99%), sunflower (86%) and soybean (90%) – and for sugar beets (94.6%). With regard to cereals, the position of individual farmers is slightly better – companies produce 86% of maize, 80% of wheat and 60.2% of barley.

The situation is different in the case of vegetables and potatoes, where individual farmers dominate (97% of plantings and 94% of harvests). Companies grow vegetables on a larger scale in only three oblasts (Kherson, Cherkasy and Mykolaiv regions – about 25%), and in none of them for potatoes. Companies also account for only 24% of fruit production. Among the more important species, this percentage is higher only for apples (29.2%) and grapes (46.6%).

4.2. Breakdown by size and productivity

Ukraine is usually seen as a country of huge farms. In reality this view is only partly true. Although there is a group of enterprises there which lease areas of more than 100,000 ha (see the subsection on agri-holdings below), there are nevertheless a huge number of companies which cultivate an area smaller than 100 ha. In total, various species of cereals are cultivated by 70,000 registered entities, the majority of which on less than 100 ha. There are 466 of the largest kind of enterprise, leasing more than 3,000 ha, which is slightly more than 1% of the total. The smallest ones are of little significance; despite their large number (over 21,000) they account for only 4% of cereal production, whereas the largest ones make up 28%. The most important role is played by 8,600 companies cultivating a medium-sized acreage (200–2,000 ha), which together produce over 50% of cereals.

Dashboard 9. Enterprises – leased land and yield

Source: State Statistics Service of Ukraine.

The size of the cultivated area has a large impact on the efficiency. The difference in the size of average yields between the smallest and largest enterprises is almost 100% for barley and maize and slightly less for wheat, whose yields in farms with an area of 200–3,000 ha are almost as high as in those operating on an area of more than 3,000 ha.

In the case of oilseed crops, the smallest players are in a slightly better position, accounting for 8% of sunflower production, 10% of rapeseed and 12.3% of soya. Also in this field, medium-sized farms (less than 1,000 ha) are leading. In contrast to cereals, there is no major difference in efficiency depending on the area cultivated – medium and large-sized farms have similar yields. The domination of large enterprises concerns only the cultivation of sugar beets – 55 largest entities in charge of an area over 1,000 ha are responsible for half of the production.

- Agri-holdings – a special case

5.1. Characteristics of agri-holdings

After the adoption of the Land Code in 2001, the process of the concentration of the agricultural economy began through the creation of so-called agri-holdings, namely the companies farming on tens and sometimes hundreds of thousands of hectares of leased land. This led to the emergence in the first decade of the 21st century of a new class of businessmen, often called agri-oligarchs.

In the second half of this decade some companies decided to float on foreign stock exchanges. In Warsaw, a separate index was even created targeting mainly local agri-companies (WIG Ukraine). However, due to the global financial crisis in 2008 and the economic collapse in Ukraine a year later, the way to the trading floor was closed for the companies operating there as they were not able to meet the IPO conditions. However, Ukrainian agri-holdings coped well with another crisis surprisingly well. The crisis was caused by Russian aggression in 2014–2015 and the need to quickly find new markets for a significant part of their produce due to the restrictions introduced by the Russian Federation (food exports to this country fell from $1.9 billion in 2013 to $64.2 million in 2019). Of the largest companies, only the Huta family-owned Mrija, which was sold to a Saudi Arabian investor (SALIC) in 2018, did not survive the collapse.

Currently, there are twenty-two entities in Ukraine leasing an area of more than 50,000 ha, ten of which are in charge of more than 100,000 hectares of land. In total, they cultivate 3.4 million ha of land. This may seem like a very large number, but if we consider that in 2019 the national cultivated area was 28 million ha, it means that 12% of agricultural land is in their hands. Therefore, unlike other sectors of the economy (such as metallurgy, energy, telecommunications and the chemical industry), one cannot speak of a monopolisation or even oligopolisation of agriculture. Individual agri-oligarchs play a crucial role in the production of certain crops, but it is incomparable to the influence wielded by Rinat Akhmetov (in metallurgy and electricity production) or Dmytro Firtash (in gas distribution).

|

Types of agricultural enterprises From the perspective of Ukrainian law, the term "agri-holdings" does not exist. The term is commonly used to describe the largest companies operating in the agri-food market, which adopt a holding structure to optimise their management. Other types of enterprises also operate in the country. Farms are the most popular (about 72% of all entities, they till about 22% of agricultural land). They are in charge of very diversified land – the average cultivated area is 132 ha per entity, but more than 80% of smallholders lease more than 500 ha. Another form of management is the so-called private agricultural enterprises (about 8% of them) and companies (17%). Companies can take different legal forms (limited liability, joint stock) and some of them are listed on stock exchanges. |

Ukrainian agri-holdings can be divided into those owned by agri-oligarchs, "old" oligarchs and foreign investors. In the first case, these are people for whom this business is the basis of their activity. Among them one should mention Andriy Verevskyi, Yuriy Kosiuk and Oleg Bakhmatyuk. The "old" oligarchs – Akhmetov and Serhiy Tihipko – are businessmen who achieved their position in the second half of the 1990s, usually through the privatisation of industrial assets for a fraction of their market value due to political connections. Activity in the agricultural sector is of lesser importance to them, although they are significant players in this market. Oleksandr Hereha can also be included in this group – he primarily manages the all-Ukrainian chain of Epicentr construction supermarkets, but also owns the Epicentr K agri-company, which ranks seventh in the country in terms of land.

Compared to other sectors of the economy, agriculture is distinguished by having a fairly large share of foreign capital. This applies to both large agri-holdings (the American-owned Agroprosperis or Continental Farmers Group, owned by the Saudi fund SALIC) and small and medium-sized enterprises. Overall, between 2015 and 2019, the cumulative share of foreign direct investment in the domestic agricultural sector increased by 8%, from $502 million to $541 million. The largest amount of money ($211.4 million, accounting for 39% of all FDI into the sector) flowed from Cyprus and it can be predominantly understood as returning Ukrainian capital. Countries investing larger sums in agriculture in Ukraine include: Denmark ($51.3 million), Poland ($44.6 million), the Netherlands ($33.5 million) and Germany ($31.2 million).

5.2. Political influence of major players

The emergence of a new class of agri-oligarchs does not mean that they can compete in terms of wealth with the tycoons who began amassing their assets in the 1990s. The top ten richest Ukrainians, according to the list drawn by Forbes, has only one representative of the agricultural sector – Yuriy Kosiuk (sixth place, wealth estimated at $1.1 billion), and another – Oleksiy Vadatursky – is only the fifteenth.

Agri-oligarchs do not constitute a coherent and consolidated interest group guided by a common goal. However, this does not mean that the agricultural lobby is absent from Ukrainian politics. Its representatives are – next to developers – one of the most numerous groups of deputies in the Verkhovna Rada. This applies to both its current composition and the 2014–2019 term. However, these deputies are scattered across different groupings. Moreover, they represent different industries within the agricultural sector, and most of them manage medium-sized agri-companies and are often driven by different interests than the owners of the largest agri-holdings. There is one grouping in the Verkhovna Rada that can be considered to represent the agri-holdings – the 20-seat Trust party which, according to media reports, is controlled by Verevskyi and usually supports the ruling Servant of the People party in votes. One of the more important factors limiting the political influence of the agri-oligarchs is the lack of their own media outlets, especially national television channels, which are the main power of businessmen such as Akhmetov and Kolomoyskyi.

The cohesion of the agricultural lobby is weakened by its competition for state subsidies. Compared to developed countries, government support for agriculture looks very modest. Between 2017 and 2019, there were five budget subsidy programmes totalling ₴7.25 billion (about $290 million), the largest of which (₴4 billion) provided subsidies to major exporters dependent on the VAT they paid. The vast majority of the funds (₴2.6 billion) went to Kosiuk, who was in close alliance with then president Petro Poroshenko. After his victory in the 2019 election, Zelensky announced that Kosiuk's agri-holding should not receive such high subsidies, as it is profitable enough without them. To make the distribution of subsidies more equitable, in November 2020. The Verkhovna Rada adopted a law on the state agricultural register. It envisages the creation of an electronic platform to distribute the money, with the largest entities to be excluded from applying. It remains an open question how this system will work in practice and whether it will actually increase support for small and medium-sized farms at the expense of the largest holdings.

|

The five largest Ukrainian agri-holdings

Specialises in sunflower and cereal crops. It produces 8% of world sunflower oil and accounts for 15% of its global exports. It has two oil export terminals with a combined capacity of 8.8 million tonnes per year. It is also the largest (13%) exporter of cereal from Ukraine. In the Verkhovna Rada, Verevskyi controls the Trust grouping of 20 MPs, which is a de facto coalition partner of Servant of the People. Since 2007 the company has been listed on the Warsaw Stock Exchange.

The holding is engaged in cultivation of cereals and animal husbandry. It includes Avangard, the country's largest manufacturer of chicken eggs (according to various estimates, it holds between 29 and 56% of market share). Bakhmatyuk is suspected by the National Anti-Corruption Bureau of Ukraine of moving ₴1.2 billion out of his own bank VAB in 2014. He is currently in Austria and efforts to extradite him are underway.

Specialises in wheat, maize, rapeseed, sunflower and soybean. Its own production in Ukraine amounts to over 2 million tonnes, and it is also an important trader, buying agricultural produce from small and medium-sized enterprises. As much as 80% of its production is exported.

Ukraine's largest poultry meat producer. Responsible for 35% of internal consumption and 55% of industrial poultry processing market demand, with about a third of production destined for export. Kosiuk was initially the deputy head of the Presidential Administration and later an advisor to Poroshenko from 2014 to 2019, making him one of the most influential agri-oligarchs and a major beneficiary of state subsidies for agricultural development.

The country's largest sugar producer, it also specialises in milk production and soybean processing. The company has been listed on the Warsaw Stock Exchange since 2006. |

II. AGRICULTURAL PRODUCTION EXPORT

- Importance of agricultural products and the food industry for export

Exports of agri-food production have always played an important role in Ukraine's foreign trade, and over the past few years they have achieved a dominant position in this sphere. While in 2013, food products accounted for 27% of total goods exports, in 2019 this figure has risen to 44.2%, with the agricultural sector overtaking the previously dominant metallurgical production and becoming the most important source of hard currency inflows into the country.

Chart 7. Structure of exports in 2013 and 2019 (in US$ billion)

Source: State Statistics Service of Ukraine.

2013 was the last year before the economic crisis triggered by the annexation of Crimea and the armed conflict with Russia in eastern Ukraine. The slump, worsened by a trade war (including Moscow's embargo on Ukrainian food products), lasted two years. During this period, agricultural exports declined, but the declines were much smaller than in other sectors of the economy, and in 2016 Ukraine managed to find new markets for agricultural produce. As a result, the agri-food sector proved to be the only one whose total value of goods shipped abroad in 2019 exceeded the 2013 level, with an increase of 30.8% in relation to 2013 and as much as 52.1% in relation to 2015. By comparison, between 2013 and 2019, domestic exports of metallurgical production fell by 41.5%, engineering by 47.1% and chemicals by 44.7%.

Chart 8. Value of exports in 2013 and 2019

Source: State Statistics Service of Ukraine.

|

Impact of the trade war with Russia Until 2013 Russia was the most crucial recipient of Ukrainian agri-food production. The Russian Federation's armed aggression against Ukraine in 2014 was accompanied by a trade war. These actions targeted various sectors of the economy, including agriculture. Initially, sanitary restrictions were applied, and in 2016 the Russian government introduced an embargo on the import of agricultural and food products from Ukraine. As a result, the value of their exports to Russia fell from $1.9 billion in 2013 to $64.2 million in 2019. The restrictions were a severe blow to agriculture, but hit the machinery industry even harder (exports fell from $5.2 billion to $838 million between 2013 and 2019). In addition, Ukraine has been quick to find new markets for its food, while it has been only marginally successful in machinery manufacturing. |

For the engineering and chemical industries, the loss of the market in Russia and the other post-Soviet states was a disaster, and the government has been unable to cope with its consequences to the present day. The Deep and Comprehensive Free Trade Area (DCFTA) agreement with the European Union, which unilaterally (the EU opened up to exports from Ukraine) started to take effect in April 2014 and came into full force in September 2017, did not improve the situation of most non-food commodities – domestic industrial production turned out to be non-competitive on the EU market. In contrast, food exports – both to the EU and to other markets – steadily increased (although tariffs and quotas on a number of goods entering the EU, including cereals, were maintained under the DCFTA) .

|

Agri-food commodities – categorisation In this text agri-food goods are defined as items in Sections I to IV and Chapters 01 to 24 of the EU Combined Nomenclature (CN) – the system for the classification of goods in international trade. Section no. Section Chapter no. Division I Live animals; animal products 01 Live animals 02 Meat and edible meat offal 03 Fish and crustaceans, molluscs and other aquatic invertebrates 04 Dairy produce; birds' eggs; natural honey; edible products of animal origin, not elsewhere specified or included 05 Products of animal origin, not elsewhere specified or included II Vegetable products 06 Live trees and other plants; bulbs, roots and the like; cut flowers and ornamental foliage 07 Edible vegetables and certain roots and tubers 08 Edible fruit and nuts; peel of citrus fruit or melons 09 Coffee, tea, maté and spices 10 Cereals 11 Products of the milling industry; malt; starches; inulin; wheat gluten 12 Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodder 13 Lac; gums, resins and other vegetable saps and extracts 14 Vegetable plaiting materials; vegetable products not elsewhere specified or included III Animal or vegetable fats and oils 15 Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes IV Prepared foodstuffs; beverages, spirits and vinegar; tobacco and manufactured tobacco substitutes 16 Preparations of meat, of fish or of crustaceans, molluscs or other aquatic invertebrates 17 Sugars and sugar confectionery 18 Cocoa and cocoa preparations 19 Preparations of cereals, flour, starch or milk; pastrycooks' products 20 Preparations of vegetables, fruit, nuts or other parts of plants 21 Miscellaneous edible preparations 22 Beverages, spirits and vinegar 23 residues and offal from the food industries; prepared animal fodder 24 Tobacco and manufactured tobacco substitutes

|

- Comparison of the production and exports of unprocessed goods in 2019

When we compare Ukraine's agricultural production with the goods it exports, we can clearly see that only a few cultivated species play an important role in foreign trade. These include the three main cereals that are mostly sold externally. This applies to 90.2% of maize and 70.6% of wheat, with only barley showing a lower figure (46.4%). The production and export of other cereals are negligible.

Chart 9. Comparison of the production and export of cereals in 2019

Source: State Statistics Service of Ukraine.

The situation is different in the fruit, potato and vegetable markets. Their export is of absolutely marginal significance in relation to the volume of domestic production, which is basically all consumed internally. The exceptions are legumes and, to a much lesser extent, apples (4.1% of their production is exported).

Chart 10 Comparison of the production and export of fruit in 2019

Source: State Statistics Service of Ukraine.

Chart 11. Comparison of the production and export of vegetables in 2019

Source: State Statistics Service of Ukraine.

Chart 12. Comparison of the export and production of potatoes in 2019

Source: State Statistics Service of Ukraine.

As far as industrial species are concerned, the majority of oilseed crop production is directed towards export, whereas sugar beet production is mainly directed towards internal use. A special example of an oilseed crop is sunflower. Due to the export duty on sunflower seeds introduced in 1999, the seeds are usually processed domestically and only the processed products (oil and oilseed cake) are majority exported. The introduction of similar duties on exports of soya beans and rapeseed is under consideration, but has not yet taken place. This solution exists in other countries (e.g. Russia). It appears that the lobby of producers, who are not interested in investing in processing capacity, is blocking this. As a result, although Ukraine sends soya oil abroad (worth $241 million) and rapeseed oil ($119 million), it sells much less of them in relation to unprocessed soybeans ($1.2 billion) and rapeseed ($1.3 billion).

Chart 13. Comparison of the production and export of industrial crops in 2019

Source: State Statistics Service of Ukraine.

Chart 14. Comparison of the production and export of sunflower in 2019

Source: State Statistics Service of Ukraine.

The extent of the lack of diversification of Ukraine's food exports is demonstrated by the fact that only eight items make up 75% of its value, and all of them are unprocessed or low-processed goods. Nevertheless, it should be noted that between 2015 and 2019 foreign sales of all products in this sector, except barley, increased, in some cases more than doubling (poultry meat by 155.2%, rapeseed by 125%).

Chart 15 Exports of the eight most important agri-food commodities in 2015 and 2019

Source: State Statistics Service of Ukraine.

- The importance of Ukraine in the global food market

Ukraine is the global leader in foreign sales for six of the eight food products it exports listed in the graph above. According to the UN Food and Agriculture Organization (FAO), it was the undisputed leader in sunflower oil trade in 2019, shipping more sunflower oil abroad than the next four countries combined. The situation was similar for oilseed cake (a by-product of the pressing of sunflower seeds). In addition, the country ranked high among the world's largest exporters of cereals: rapeseed (second place), maize (fourth) and wheat and barley (fifth). Considering the fact that in 2019 both agricultural production and exports of its products increased, Ukraine’s position on the global food market is expected to strengthen in the coming years.

Chart 16. The largest exporters of selected agricultural products in 2019

Source: FAO.

When we compare exports from Ukraine and other countries, it is notable that it often ranks lower in terms of income from the sale of goods in relation to their volume. This is due to the fact that the products there are predominantly cheaper than the same items from other major agricultural production exporters, and this is despite there being far lower agricultural subsidies than in the European Union countries and the United States. This also applies to Ukraine's direct competitor in the region – Russia. It seems (although it is difficult to state this unequivocally) that the competitiveness of goods from the Dnipro region results from low labour costs, the relatively large size of farms and the fertile soils, which make it possible to achieve high yields with low expenditure on fertilisation.

- Export characteristics of agricultural and food production

Among the four groups of agricultural and food products, one can notice the clear domination of unprocessed products of plant origin, which accounted for 58.3% of domestic exports in 2018. It is noteworthy that there is a relatively small proportion of prepared foodstuffs (14.5%) and products of animal origin (5.8%). Although there was some growth in these two categories between 2015 and 2019, it is apparent that Ukraine is still unable to become a significant exporter of prepared foods.

Chart 17. Exports of the main groups of agri-food products in 2019

Source: State Statistics Service of Ukraine.

More detailed statistics show that nearly three-quarters of foreign sales are accounted for by just three categories of goods: cereals, oils and oilseeds. In each of these groups, several products play the most important role. In the case of oils this is sunflower oil; among plant products – maize, wheat, rapeseed, soybean and barley; in the group of animal products – poultry meat; and among ready-made foodstuffs – food industry by-products (sunflower and soybean cake).

Although Ukrainian agri-food exports are not very diversified, high growth was observed between 2015 and 2019 for a number of processed goods, e.g. processed tomato products (by 130%), sugar (by 82.4%) and cereals (by 64.4%). However, sales of most goods increased only slightly or even decreased during this period. It should be remembered that these are relatively small values – for instance, trade in processed tomato products brings the country just $50 million a year.

It seems unlikely that Ukraine will become a major global exporter of prepared food in the mid-term perspective. It still imports many prepared foodstuffs. Their imports amounted in 2019 to $1.9 billion, while exports were only $1.3 billion. This is mainly due to the underdeveloped processing industry, which in turn is a result of the poor business environment that has persisted for years. As a rule, local businessmen prefer areas requiring relatively low expenditure and which yield quick profits (e.g. growing and selling cereals). Moreover, for unclear reasons, the government do not sufficiently apply programmes to encourage investment in processing (such as the above-mentioned export duties on sunflower seeds). In addition, widespread corruption means that, despite lower labour costs, the final product is not necessarily price competitive with imports. Due to the poor investment climate, foreign entrepreneurs are also barely interested in developing Ukrainian processing. There are no indications that the situation will significantly improve in the coming years.

- Geographical structure of exports

Among the recipients of Ukrainian agri-food production, three main groups can be distinguished: EU countries, Middle East countries and Southeast Asian countries – they account for more than 80% of total export. Other areas, including the post-Soviet republics, play a marginal role in it, which is mainly due to the restrictions introduced by Russia in 2014. (This included an embargo on food from Ukraine and impeded transit to Central Asian countries).

Chart 18. Export directions of agri-food products in 2019 (in US$ billion)

Source: State Statistics Service of Ukraine.

Comparing the dynamics of exports between 2015 and 2019, we can clearly observe the growing importance of the EU, which has strengthened its position as the most crucial importer of Ukrainian food (growth by 80.3%). Such a significant leap is primarily the result of the Deep and Comprehensive Free Trade Area (DCFTA) agreement, which unilaterally took effect in April 2014. Despite the restrictions still in place – e.g. customs duties were not lifted on all goods, and exporters from Ukraine had to meet strict EU phytosanitary standards – it was the DCFTA that allowed such strong growth in the first place.

Chart 19. Value of Ukrainian exports in 2015 and 2019

Source: State Statistics Service of Ukraine.

Food sales to Middle Eastern countries in 2015–2019 increased by 46%, and to Southeast Asian countries by 46.8%. Although both the volume of exports to these areas and their dynamics are smaller than in the case of the EU, the first four largest importers of Ukrainian food – China, Egypt, India and Turkey – are located there. They import almost exclusively cereals, oil and oilseeds from Ukraine. The Netherlands, the largest recipient of its agri-food production among the Member States, ranks only fifth.

Dashboard 10. Geographical structure of exports in 2019.

Source: State Statistics Service of Ukraine.

Analysing the geographical distribution of sales of the eight most important items of Ukrainian food exports, it is difficult to find any general regularities. None of the importing countries occupies a dominant position. China, which is the largest recipient of the sector's production, receives 8.8% of exports, and another five countries receive more than 5% each. Sales to China are more diversified and include, besides sunflower oil, also maize, oilseed cake, barley and rapeseed oil. India basically buys only sunflower oil (33.2% of total exports). Some goods (e.g. maize) are mainly imported by EU countries, e.g. 60% of rapeseed exports are sent to Germany and Belgium. On the other hand, 50% of barley sold abroad goes to Saudi Arabia and China, and 36.4% of soya goes to Turkey. Wheat is sold mainly to Southeast Asian countries and North Africa. The above overview shows that Ukrainian agricultural exports are quite well diversified and resistant to possible customs restrictions introduced by certain countries.

5.1. Food exports to European Union countries

In terms of the structure of Ukraine's agri-food production exports, the EU area is not fundamentally different from other countries – the most important category of goods sold is cereals, and oilseeds and vegetable oils, which in total account for more than 75% of the country's exports, and the share of processed products is insignificant.

Chart 20. Structure of agri-food products exports to the EU in 2019 (in millions of euro)

Source: Eurostat.

The following EU states are the main buyers of Ukrainian food: the Netherlands, Spain, Italy, Poland and Germany, which in total import agri-food products worth €5 billion, accounting for 70% of the sector's production sold by the country to the EU.

None of the member states plays a dominant role among the recipients of Ukraine's main export categories. The Netherlands can be considered an exception, as it receives more than half of the poultry meat exported.

Between 2015 and 2019, exports to the EU increased by 84%, but this growth was not evenly distributed among its members. The largest was recorded by Germany (281%) and the Netherlands (182%), and the smallest by Italy (21%) and Spain (41%).

Chart 21. Main EU recipients of Ukrainian goods by commodity groups

Source: Eurostat.

Dashboard 11. Food exports from Ukraine to European Union countries in 2019.

Source: Eurostat.

It should be noted that Ukraine has so far hardly increased its exports of prepared food to the EU, the value of which (excluding oilseed cake, which also belongs to this category) amounted to €436 million; this represents only 6% of the products of the agri-food sector sold there. It seems that this situation mostly results from the aforementioned weakness of the domestic processing industry, as well as the fact that the EU market is extremely competitive and it is difficult to gain market share without costly marketing campaigns, which Ukrainian companies do not usually have the resources for. Furthermore, prepared foodstuffs from Ukraine can rarely compete with EU products in terms of both quality and price.

While the DCFTA has proven to be an effective tool in assisting exports, Ukraine is seeking to revise it to further reduce customs duties and increase tariff quotas. Formally, an opportunity of this kind arose in 2021, since the agreement has been in force for five years. Brussels and Kyiv agreed to start talks on the issue at the EU–Ukraine Association Council meeting in February 2021. It is difficult to say unequivocally how long the negotiations will last, but it may be assumed that they will not be concluded quickly. Given the resistance of the agricultural lobbies in some member states to the introduction of further facilitations for production from Ukraine, it does not seem likely that the talks will bring anything more than cosmetic changes to the agri-food goods section of the DCFTA.

5.2. Export of agricultural products to Poland

Poland is the largest recipient of Ukrainian goods among the EU countries, but this is not the case for agri-food products – in 2019 it ranked only fourth in this respect. It accounts for 9.7% of Ukrainian food exports to the EU market with a value of €699 million.

Chart 22. Structure of agri-food products exports to Poland in 2019 (in millions of euros)

Source: Eurostat.

The structure of goods sent to Poland differs significantly from the EU average. Most striking is the very low share of cereals – the basic commodity sold by Ukraine to the EU. This is probably due to the saturation of the market with domestic production and a reluctance to buy cereals from a country considered to be a competitor. In total, Poland receives only 1% of cereals headed to the EU market. Whereas the Polish market is very important or even crucial for Ukrainian exporters of processed fruit and vegetable products (44.8%) and other products of plant origin (mainly sugar-production waste), where its share exceeds 89.1%. Overall, more processed goods (vegetable oils, vegetable industry by-products, dairy products, confectionery, etc.) than raw materials (cereals, oil plants) are exported to Poland when compared to the rest of the member states. This may be related to the growing number of Ukrainian migrant workers in Poland. The presence of a large group of people recognising a given brand is a factor encouraging such companies as Roshen (chocolate products), Veres (vegetable preserves) or producers of strong alcohol to enter the Polish market and it facilitates their expansion.

Analysing the dynamics of Ukrainian agricultural and food production exports to Poland compared to the EU, since 2016 systematic growth can be noticed, not exceeding, however, the average for all member states. In total, between 2015 and 2019, sales of the sector's products to Poland increased by 84% – by the same amount as in the case of the entire EU. At the same time, the shipment of some categories of goods to Poland was significantly above the average (this was the case, for example, for fats and oils – 258%). Poland also began to import articles which it had not imported on a larger scale before. This primarily concerns poultry meat (a leap from €70,000 in 2015 to €36 million in 2019).

Chart 23. Exports of agricultural and food products from Ukraine to Poland in 2015 and 2019

Source: Eurostat.

The increase in the import of agricultural products from Ukraine to Poland, although not exceeding the EU average, alongside small business owners moving from Ukraine to Poland (who do not currently seriously compete with domestic producers) causes understandable concern about the increasing share of Ukrainian goods in the EU internal market. This concerns in particular poultry meat or fruit – areas where the strong position of Polish producers and attractive prices offered by Ukrainian companies collide.

Furthermore, it should be remembered that the DCFTA, apart from increasing competition, has also brought tangible benefits to Polish food producers. Poland is the largest exporter of agri-food products to Ukraine among the EU countries, with sales increasing from €298 million in 2015 to €600 million in 2019 (a 101% increase), accounting for 24% of total EU food exports to the country. At the same time, Poland sends mainly goods with high added value there, such as cereal and vegetables or cocoa products.

OUTLOOK

The agricultural sector has always played a crucial role in the Ukrainian economy, but in recent years it has grown to become one of its most important branches, generating the highest export income (remaining ahead of metallurgy). If this rate of growth continues, forecasts that Ukraine could produce 100 million tonnes of cereal in the mid-term perspective spanning up to ten years, instead of the current 75 million tonnes, are likely to be correct.

The full-blown implementation of the market reform in 2024 will make it possible, for the first time in Ukraine's history, to trade in agricultural land, which over time should lead to greater intensification of production and the development of industries requiring long-term investments – primarily fruit farming and animal husbandry. However, this will be a long-term process and will require the creation of new infrastructure, e.g. for storing agricultural products. However, it does not seem that there will be a radical revision of the present model of agriculture in the immediate future; cereal and oilseed crops, which need relatively smaller inputs, will continue to be dominant.

It is difficult to state unequivocally whether the agricultural reform will result in an inflow of foreign capital into the country. It seems, however, that if this is the case, it will only happen to a minor extent. Foreigners cannot purchase arable land and, because of intense social resistance, this situation is extremely unlikely to change in the immediate future. Foreign investors are present in the agricultural sector, but their share is not increasing, which is mainly due to the invariably unfavourable investment circumstances. For the same reason, increasing investments in the processing industry should be considered doubtful. This also concerns domestic capital, oriented towards profit maximisation with minimal financial input. Theoretically, the state could pursue a policy to stimulate investment of this kind but for various reasons it is not doing so. Besides, Ukraine is too poor to be able to support such enterprises on a larger scale through subsidies or other similar instruments.

With a growing world population and rising living standards in developing countries – which are the main importers of goods from Ukraine – the country is expected to increase agricultural production and food exports in the coming years. Significantly, even the economic slump of 2014–2015 and the trade war with Russia did not exert a negative impact on foreign sales of Ukrainian agricultural products – during this period they increased in all geographical areas except in post-Soviet countries. The greatest increase was recorded in exports to the EU, which was a result of concluding the Deep and Comprehensive Free Trade Area agreement. Ukraine, which was already an important food exporter, has strengthened its position among global leaders. However, it seems that foreign sales of agri-food commodities will continue to be diversified to a small extent and will still mainly include unprocessed or low-processed products. It is likely that in the near future we will see a further increase in prepared food export, but it will still play a secondary role due to the weakness of local processing. It is also doubtful that there will be a rapid expansion of Ukrainian agricultural products to EU markets due to the revision of the DCFTA – the pressure of a strong agricultural lobby in many member states will probably make Brussels reluctant to agree to the introduction of greater facilitations for Ukrainian exporters. This means that unprocessed goods with low added value will remain the basis of Ukraine's foreign sales in the coming years.

In the longer term, climate change could become a challenge for the development of domestic agriculture. Although Ukraine still has excellent natural conditions, further warming will exacerbate the existing water deficit in the southern part of the country. The government can at least partially counteract it through land melioration and the irrigation of agricultural areas, but investments of this kind are very expensive and it is difficult to evaluate whether the government will be able to provide sufficient scope for their financing, even when supported by Western lenders. An additional problem is that similar projects necessitate long-term planning, which has never been a strength of Ukrainian entities. The process of soil degradation, which has been observed for decades, should slow down in the mid-term perspective, as farming practices are likely to change as agricultural land ownership is transferred. Unlike tenants, landowners should be interested in a less extensive use of the land, in particular in proper fertilisation and limiting the dominance of monocultures of oilseed crops, which make the soil barren.