The EU in the face of China’s growing role in global and European climate policy

At the COP30 climate summit in the Brazilian city of Belém, the European Union hopes to reaffirm the importance of efforts to reduce emissions, the effectiveness of the multilateral climate regime, and its own leadership within it. At the same time, however, both global climate policy and the EU’s leading role in this sphere are facing mounting challenges. The United States’ withdrawal from the Paris Agreement and the Donald Trump administration’s criticism of the assumptions and rationale underpinning climate policy have contributed to China’s growing importance in this domain. As a result, the EU – committed to achieving emissions reductions both domestically and globally – is becoming increasingly dependent on China. Moreover, to meet its ambitious energy transition goals, the EU will need to continue importing raw materials from China, as well as Chinese-made components and equipment for low-emission technologies, at least for the coming years. These inexpensive supplies not only exacerbate the EU’s dependence on China but also impede the development – and in some cases even threaten the survival – of domestic production within the bloc.

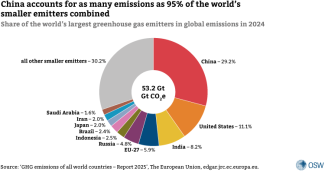

Political challenges may influence both the course and outcomes of COP30. They also raise questions about how best to shape relations between the EU – which has so far pursued the world’s most ambitious climate policy and seeks to retain its leadership in this domain – and China, the single most important country for the success of international efforts to reduce emissions, responsible for nearly 30% of global greenhouse gas emissions last year. Answering this question is complicated by the fact that EU-China cooperation is fraught with tensions arising from an increasingly evident strategic divergence at both the political and economic levels.[1] While there remains scope for cooperation on climate issues, its extent and future remain highly uncertain. This stems from differing motivations and objectives behind the climate policies of the EU and China, the EU’s limited capacity to influence China’s actions in this area, and the unresolved question of whether – and how – it is possible to set aside the fundamental differences between the two partners.

The EU’s climate policy – ambitions and challenges

The European Union as a whole has for decades ranked among the world’s leading emitters of greenhouse gases. In 2024, it was the fourth largest emitter globally, following China, the United States, and India. At the same time, it has long pursued what is arguably the most ambitious climate policy in the world. EU emissions have been steadily falling – in 2024 they were nearly 35% lower than in 1990[2] – and Brussels has set increasingly stringent reduction targets, including the long-term objective of achieving climate neutrality by 2050. The EU aspires to global leadership in this process, aiming to set the benchmark for achieving the largest emissions reductions, adopting the most ambitious targets, and developing and implementing comprehensive legal frameworks for climate policy and related regulatory mechanisms, including the world’s first emissions trading system.

The EU has also been actively engaged in international climate initiatives and diplomacy. Together with its individual member states, it aims to provide the highest level of climate financing in the world. On 16 October, the European Commission published its new vision for the EU’s international climate and energy strategy,[3] partly to highlight the achievements of global climate policy to date and the EU’s role within it. The document also reaffirmed the EU’s commitment to linking climate action with efforts to enhance European industrial competitiveness.

At the same time, the ambitions outlined in the EU’s strategic documents and climate targets have recently encountered a range of challenges; as a result, the bloc’s influence in global climate policy is likely to decline. Its decreasing share of global emissions (just around 6% in 2024[4]) is inevitably slowing the pace and increasing the cost of each further reduction. The consequences are at least two-fold. First, the impact of the EU member states’ actions on global emission levels will continue to diminish. Second, as the cost of reducing emissions steadily increases, support for climate policy within the EU is weakening, further undermining internal consensus on this issue.

This trend has become increasingly evident in recent years. Ongoing political instability in the EU’s immediate vicinity, stemming largely from Russia’s invasion of Ukraine, together with uncertainty in the evolving energy markets and high prices – attributable both to the consequences of the war and to the costs of measures to reduce emissions – have contributed to a markedly sharper decline in the competitiveness of European industry and a deteriorating situation for at least some households. All of this has clearly eroded public support for subsequent stages of the energy transition – support which was already fragile in many EU countries – and has deepened divisions among the member states.

There has also been a noticeable rise in scepticism, particularly evident in Central Europe, towards extending the Emissions Trading System to additional sectors (the so-called ETS 2), alongside growing concern that climate action will lead to further price increases. Negotiations over the next emissions reduction target for 2040 stretched into the days immediately preceding the COP30 climate summit, raising the prospect of an embarrassing failure to reach an agreement in time. A last-minute compromise, reached on 5 November following overnight talks at the EU Environment Council, is not yet final, as it still requires approval through the so-called trilogue process involving the European Parliament. It formally maintains the target proposed by the European Commission in February 2024 – a 90% reduction in emissions by 2040 compared with 1990 levels – but includes a number of concessions (including on ETS 2), more flexible language, and a revision clause.[5] The agreement has paved the way for setting a commitment to reduce emissions by 2035 – within the range of 66.25-72.50% – ahead of the upcoming COP30 summit.[6] However, this has neither reduced the controversy surrounding the objectives and instruments of the EU’s climate policy nor healed the deepening fractures within the bloc in this field.

Moreover, despite its undeniable success in reducing its own emissions, the EU is also grappling with other challenges that may hinder its ability to lead by example in multilateral climate negotiations. Notably, there is a significant risk that it will fail to meet its 2030 target to reduce emissions by 55% from 1990 levels. In addition, economic challenges are becoming increasingly pressing, particularly regarding the competitiveness of the EU economy relative to China and the United States. Contrary to its initial assumptions, Europe has so far failed to turn the green transition into a driver of economic growth, and there is no indication that this is likely to happen in the near future. Economic difficulties and other strategically important priorities, such as enhancing competitiveness and expanding the defence industry, may further limit the capacity of EU member states to fund climate action globally. President Donald Trump has asserted that the EU’s climate policy has been counterproductive. He has overseen a shift in US policy that presents yet another challenge for Brussels, which risks losing a key ally in this field.

The goals and role of China’s climate policy

From the perspective of the Chinese leadership, the goal of reducing emissions is secondary to the country’s core economic priorities; consequently, climate policy remains subordinated to its industrial strategy. In their view, China’s structural conflict with the United States is both permanent and unavoidable, which makes it necessary to strengthen the domestic economy. The Chinese government’s priority is therefore to reduce the country’s dependence on foreign partners while deepening those partners’ dependence on China, and to support technological progress that drives the country’s development.[7] Modernising and expanding the country’s industrial base is central to the government’s agenda.

China’s ongoing energy transition serves as a means of achieving these objectives; any reduction in its carbon footprint will be regarded merely as a side effect. In 2020, the Chinese government pledged to reach peak emissions before 2030 and achieve carbon neutrality by 2060. Last September, Chairman Xi Jinping announced at the UN that, as part of the current round of updating Nationally Determined Contributions, China would commit to reducing its net greenhouse gas emissions by 7–10% from peak levels by 2035, increasing the share of non-fossil sources in total energy consumption to over 30% and expanding its wind and solar capacity six-fold from 2020 levels to around 3.6 TW.

The Chinese government has so far made only cautious pledges that are insufficient to place the country on a trajectory consistent with the goals of the Paris Agreement. Nevertheless, against the backdrop of Trump’s vocal criticism of climate policy, they have contributed to portraying China as a responsible and constructive partner. These commitments represent a safe minimum for Beijing, rather than the peak of its decarbonisation ambitions. Simply maintaining the current pace of China’s ‘clean’[8] energy boom would be sufficient to exceed significantly the stated targets for reducing emissions and increasing the share of renewables. The absence of a defined baseline year and peak emissions level also leaves room for further growth in emissions before that peak is reached. Furthermore, the lack of independent audit mechanisms makes it difficult to verify China’s claims of progress.

China continues to prioritise the electrification of its economy on the basis of domestic energy sources. Abundant, low-cost electricity is intended to further enhance the competitiveness of Chinese industry, including energy-intensive ‘industries of the future’ such as artificial intelligence, and to reduce the country’s dependence on imports of fossil fuels.[9] The world’s largest investments in renewables are driven by the need to meet the economy’s growing energy demand, rather than by the goal of decarbonisation. Last year, China reportedly accounted for roughly one-third of global investment in green energy,[10] and nearly two-thirds of newly installed renewable capacity. According to official data, it connected 429 GW of new renewable capacity to its grid within a single year – an amount equivalent to the total renewable capacity installed by the United States, the global runner-up in this field, by the end of 2024. Yet even this unprecedented expansion was insufficient to meet the surge in electricity demand, forcing the country to increase output from conventional sources. At the same time, China was building the largest number of coal-fired power plants in at least a decade – more than the rest of the world combined. Its image as a leader in the green transition is further undermined by the fact that the share of renewables in overall electricity generation in China has been rising more slowly than in dozens of other countries.

However, China is undoubtedly the global leader in the production of equipment and components for renewable energy. It dominates the photovoltaic supply chain (including polysilicon, ingots/wafers, cells, and modules) and key segments of the battery supply chain, such as cathode and anode active materials. In many of these areas, China’s share exceeds 80%; in others, such as lithium refining, it stands at over 60%. At the same time, China continues to play a leading role in the production of wind turbines – including nacelles – and electrolysers for hydrogen generation. This position stems from a combination of active industrial policy and the considerable scale of the domestic market. Alongside rising technological efficiency, this has led to a rapid decline in the cost of renewable energy: over the past five years, prices of photovoltaic modules have plummeted by 70%, while those of lithium-ion batteries have fallen by 40%.[11] In the short term, lower costs of the energy transition based on Chinese supplies support efforts to achieve global climate targets, but over the longer term they make these goals more difficult to attain. Indeed, China’s price advantage and immense production scale are hindering the development of the cleantech sector outside the country and deepening global dependence on the Chinese government, which is increasingly willing to use this leverage.

Currently, climate goals set by China and other countries are fuelling economic growth in China and creating favourable conditions for its industry to expand abroad. According to expert estimates, broadly defined low-emission energy[12] accounted for 10% of China’s economy last year and contributed 26% to its GDP growth.[13] Other assessments suggest that, in 2024, exports of Chinese ‘green products’ reached approximately US$177 billion.[14] The so-called ‘new trio’ plays a particularly important role. In 2024, China accounted for around 80% of global production of photovoltaic modules, about 75% of lithium-ion battery cells, and over 70% of electric vehicles. Most of these goods remained on the domestic market, but exports also increased rapidly. Around 1.65 million electric vehicles, nearly 200 GWh of batteries, and more than 230 GW of PV modules were sold abroad; with Europe remaining a key export market. Moreover, in 2023-24, Chinese companies in this sector announced plans to build production facilities overseas worth approximately US$58 billion and signed contracts for green power plants and energy-storage projects valued at around US$24 billion.[15]

The EU’s dilemmas regarding cooperation with China...

The US withdrawal from the Paris Agreement and the current challenges facing the EU have further strengthened China’s role in international climate policy. In recent years, the country’s position has grown visibly owing to the scale of its own emissions and the global impact of potential reductions, as well as its ongoing energy transition, its dominance in the global market for green technologies and intermediate goods, and its expanding influence in a number of countries crucial to the future of the international climate regime, including those in the Global South.

Therefore, the EU faces the question of how it should, and how it can, shape its climate cooperation with China. Until recently, climate issues appeared to be the only viable area of partnership within the EU’s 2019 ‘triad’ framework, which characterised China simultaneously as a partner, competitor, and systemic rival. In practice, however, climate matters are increasingly becoming a field of economic competition owing to diverging industrial and trade agendas between the EU – both its individual member states and Brussels – and Beijing. Although China is broadly aligned on the objective of reducing emissions and has participated in both bilateral initiatives (including the EU-China High Level Environment and Climate Dialogue) and multilateral talks, its priority remains the export of components and the pursuit of its own industrial objectives. It does not treat climate policy as a separate domain but as part of its broader economic and foreign policy strategy.

China currently appears to be an indispensable partner for the EU, both in terms of global efforts to reduce emissions and in the internal dimension of the EU’s own energy transition. However, this partnership presents the EU with strategic dilemmas arising from fundamental systemic differences between the two sides and a range of immediate challenges. The EU and China have clearly conflicting political interests related to the war in Ukraine, relations with Russia, and the wider global order. Moreover, recent years have seen intensifying competition and tension in their economic relations, driven particularly by the growing presence of Chinese products in the EU market – a trend that has directly affected Europe’s economic interests.

Examples include the tariffs imposed by the EU on subsidised Chinese electric vehicles and an even more consequential step taken by China on 9 October, partly targeting the EU: the tightening of export controls on dual-use civilian-military goods and on the technologies used to produce them, including rare-earth metals, advanced lithium-ion batteries, and selected superhard materials – a measure later suspended for one year following an agreement between Trump and Xi.[16] Given the Chinese government’s de facto control over the entire domestic supply chain for rare-earth metals and its efforts to extend that control beyond national borders, these decisions will affect a range of sectors worldwide, as well as Europe’s energy transition. This could increase costs and slow progress, for example by temporarily restricting access to key intermediate goods used in the wind-energy sector, electric vehicles, and energy storage systems. Such restrictions will also impede efforts to build supply chains for renewable-energy installations that are even partially independent of China, and to develop electrified transport.

The fact that China’s latest restrictions were announced on the eve of COP30 also highlights the divergence between China and the EU in the objectives and paradigms of climate policy. Whereas China acts on highly pragmatic grounds, prioritising its overriding economic and industrial objectives, for the EU climate policy serves to advance one of its core goals – as recognised by a number of member states – and in turn influences and indirectly shapes the direction of other EU policies, including energy and industrial policy. The bloc’s approach is largely grounded in values rather than in economic calculations. As a result of these fundamental differences in motivation and in perceptions of climate policy, the EU has only limited scope to influence China’s actions in this area.

Despite these challenges, it appears that, given the current state of technological development and the EU’s continued climate ambitions, the bloc will have little choice but to continue cooperating with China, at least in the short term. Such cooperation will be essential not only for achieving internal and global climate targets, but also for advancing economic, industrial, and security-related objectives. Owing to China’s high – and often dominant – share in the markets for key components used in energy-transition technologies, and in entire production chains for these components, imports from China have become indispensable for developing new renewable capacity. At the same time, access to sufficient quantities of relatively inexpensive energy underpins economic development worldwide, including the growth of emerging sectors such as digital technology and AI, the expansion of infrastructure, and defence manufacturing.

Although the EU aims to increase its self-sufficiency and reduce its dependence on third countries – including China – in the production of green technologies, achieving the manufacturing scale and price levels required to compete with Chinese output remains unrealistic for the time being. The same applies to critical raw materials essential to many green technologies. Efforts to expand their extraction, recovery, and processing have so far produced few tangible results – results that are certainly inadequate given the scale of the challenge – due to limited domestic reserves, environmental regulations, and other barriers. In third countries, including those in Africa, EU companies face strong competition and often have no choice but to enter into joint ventures with Chinese entities that are already well established on the ground.

…and the actions required

The energy transition presents the EU with an opportunity to minimise its dependence on hydrocarbon imports, although it has so far been pursued at the cost of deepening reliance on supplies from China. However, unlike oil and gas – where supply disruptions rapidly halt energy production – the purchase and installation of renewable-energy systems creates generation capacity that operates without the need for continuous delivery of new equipment.[17] The EU’s primary focus should therefore be to accelerate and prioritise measures that enhance economic security and reduce dependence on China across the broadly defined energy and climate sector. Achieving this will require intensified efforts to secure and process critical raw materials both within Europe and in third countries, substantial investment in innovation throughout the cleantech value chain, and the pursuit of new technological solutions. To support progress in this direction, the EU should take further steps towards a more pragmatic energy and climate policy – one that increasingly incorporates security and economic interests and is oriented towards effectiveness defined by tangible outcomes and scalable impact.

Initiatives such as the Net-Zero Industry Act, the Critical Raw Materials Act, the Clean Industrial Deal, the action plan for the automotive sector released last March, and the new EU state-aid framework adopted last June all represent steps in this direction. They link the decarbonisation process with efforts to strengthen the competitiveness of European industry. These initiatives place particular emphasis on increasing production within Europe, reducing energy costs for businesses, enhancing the resilience of supply chains, and accelerating the modernisation of the economy.

It also appears that, similarly to earlier steps taken by Russia,[18] recent Chinese actions and their consequences will compel the EU to define clear priorities for its energy and climate policy, at least in the immediate future. Achieving all three objectives of the so-called energy trilemma in the short, or even medium term, will be extremely difficult, if not impossible. It is therefore essential to establish a hierarchy among them: from security (of supply, economic security, and hard security), through economic development, and finally to climate.

Reconciling imports from China with security concerns already presents a major challenge. Renewable-energy installations based on components sourced from China entail risks not only in terms of strategic dependence on foreign supply, but also in the field of cybersecurity. These risks stem from several factors, including the software used in control systems, default-enabled remote access, automatic updates, and connections to the manufacturer’s servers. In 2025, undocumented communication modules were discovered in Chinese-made inverters and energy-storage units in the United States, prompting the government to warn that they could bypass security protocols and enable remote interference with grid operations.[19] Another issue is that rapidly expanding the EU’s production and processing capacity for certain critical raw materials – and certainly reducing their cost – may require easing some environmental regulations. Moreover, given China’s dominance across the supply chains for critical raw materials and cleantech, as well as its influence over policy goals and instruments, European actors may find it increasingly difficult to develop their capacity on purely commercial principles and the logic of business profitability.

Finally, the EU needs to develop a highly pragmatic and internally coherent framework for bilateral cooperation with China in this area, one that helps advance its own strategic objectives. It is particularly important to consider what forms of short-term Chinese involvement in the EU’s energy transition should be permitted, and how such involvement should be managed. This includes establishing transparent rules for investments by Chinese companies in this sector within the EU (including the proposed requirement for technology transfer), considering possible revisions to the Carbon Border Adjustment Mechanism (CBAM), and assessing potential cooperation with China (or the absence of it) under a proposed international emissions-trading system. A related challenge involves finding an appropriate balance in the scope, purpose, and forms of cooperation between EU and Chinese entities in third countries – whether in supply chains for critical raw materials or in joint initiatives to support adaptation efforts in response to the adverse effects of climate change.

[1] For more details, see: P. Uznańska, ‘Dialogue from a position of strength: China’s EU policy’, OSW Commentary, no. 693, 10 October 2025, osw.waw.pl.

[2] ‘GHG emissions of all world countries’, EDGAR Community GHG Database, a collaboration between the European Commission, Joint Research Centre (JRC), the International Energy Agency (IEA), edgar.jrc.ec.europa.eu.

[3] ‘Joint Communication – EU global climate and energy vision’, The European Commission, Directorate-General for Energy, 16 October 2025, energy.ec.europa.eu.

[5] ‘2040 climate target: Council agrees its position on a 90% emissions reduction’, Council of the EU, 5 November 2025, consilium.europa.eu.

[6] ‘EU aims to advance global clean transition and implementation of the Paris Agreement at UN's COP30’, The European Commission, 5 November 2025, ec.europa.eu.

[7] M. Kalwasiński, ‘The economy according to Xi Jinping: a technological ‘leap forward’’, OSW Commentary, no. 621, 21 August 2024, osw.waw.pl.

[8] This energy is clean at the point of use, but the production of equipment – such as solar panels, batteries, and turbines – and the extraction of the necessary metals and other raw materials causes environmental degradation, together with health and social harms that remain invisible in emissions statistics. See: V. Beiser, Wyścig o najważniejsze metale świata. Brudne oblicze czystej energii i cyfrowych technologii, Wydawnictwo Prześwity, 2025.

[9] M. Kalwasiński, ‘China on the road to ‘green’ energy security’, OSW Commentary, no. 605, 7 June 2024, osw.waw.pl.

[10] World Energy Investment 2025, The International Energy Agency, 5 June 2025, iea.org.

[11] E. Graham, ‘China’s clean technology exports hit record high in August, reaching $20bn’, Ember, 6 October 2025, ember-energy.org.

[12] Encompassing renewables, nuclear energy, power grids, energy storage, e-mobility and rail transport.

[13] L. Myllyvirta, Qi Qin, Chengcheng Qiu, ‘Clean energy contributed a record 10% of China’s GDP in 2024’, Centre for Research on Energy and Clean Air, 19 February 2025, energyandcleanair.org.

[14] L. Myllyvirta, ‘China’s clean-energy exports in 2024 alone will cut overseas CO2 by 1%’, Carbon Brief, 22 July 2025, carbonbrief.org.

[15] Ibid.

[16] M. Kalwasiński, M. Bogusz, ‘A blow dealt to Europe’s defence: China steps up control of strategic exports’, OSW, 14 October 2025, osw.waw.pl.

[17] It is also possible to stockpile components on a larger scale than is the case with fossil fuels. However, the resilience of renewable energy systems to supply disruptions does not eliminate digital and maintenance-related risks. Remote access by the manufacturer creates the potential for interference with system operations.

[18] See: A. Łoskot-Strachota, ‘Energy policy in times of war and transition. Priorities of the Central and Eastern European countries and Germany’, OSW, Warsaw 2025, osw.waw.pl.

[19] S. Mcfarlane, ‘Rogue communication devices found in Chinese solar power inverters’, Reuters, 14 May 2025, reuters.com.