Game of drones: the production and use of Ukrainian battlefield unmanned aerial vehicles

The Russian–Ukrainian war has been marked by the unprecedented use of unmanned aerial vehicles. The effectiveness of drones on the battlefield has led to their widespread deployment by the Armed Forces of Ukraine (AFU), enabled by their low cost and ease of production. Kyiv sees the development of unmanned systems as a potential way to offset the enemy’s superiority in conventional firepower, particularly artillery. Russia’s continued dominance in this domain means that the number of drones on the front line and their importance to Ukrainian defenders will continue to grow. This trend is further reinforced by Ukraine’s military and political leadership, which views drones as a possible solution to the army’s manpower shortages.

The full-scale invasion has triggered a boom in drone production in Ukraine, elevating this sector to one of the most promising segments of the economy, with considerable future export potential. At the same time, attaining lasting quantitative and qualitative superiority in the use of these systems at the front will significantly influence the future course of the conflict.

The widespread use of drones within the Ukrainian Armed Forces

Unmanned aerial vehicles have been used in military operations in Ukraine since 2014. Initially, they were employed for reconnaissance, observation, and artillery fire correction. By 2015, they had begun to be used for carrying and releasing explosives. With the onset of full-scale war, Kyiv prioritised the development of these systems as an effective asymmetric response to the aggressor’s superiority, particularly in armoured vehicles and aviation. Over time, drones became the primary strike asset of the Armed Forces of Ukraine at the front, often compensating for shortages in artillery shells and air-defence systems.

As drones were used more frequently, they came to dominate the battlefield almost entirely. They carried out a wide range of tasks: from reconnaissance operations providing precise data on enemy positions, to delivering ammunition, equipment, and supplies to soldiers in combat, to being used as weapons in direct engagements and for striking distant targets. At present, drones are responsible for destroying nearly 85% of enemy military targets on the front line,[1] and for 70–80% of Russian casualties (including killed and wounded personnel).[2] The mass deployment of drones has also forced both sides of the conflict to withdraw heavy weaponry, such as tanks and artillery systems, several kilometres back from the front line. This has been made possible by the drastic shortening of the command chain, enabled by the use of drones by units operating directly in the combat zone.

The growing scale of drone use on the front line, at sea and for striking targets deep inside enemy territory has led to significant changes in the structure of Ukraine’s armed forces. At the beginning of 2023, the AFU brigades formed the world’s first unmanned-systems assault companies, along with independent drone units; more than 60 formations in total, including regiments and stand-alone subunits. This was followed by an organisational and doctrinal overhaul of the army to adapt it to new battlefield conditions. As a result, in June 2024, Ukraine established a pioneering, independent branch of drone forces – the Unmanned Systems Forces (USF). In February 2025, a new initiative known as the Drone Line was launched, bringing together the five most effective drone assault units. These included the Magyar’s Birds regiment, commanded by Robert Brovdi.[3] The mission of the Drone Line is to develop and implement a new concept for the deployment of drones across various sectors of the front by creating a so-called ‘kill zone’ – a 10–15-kilometre-deep stretch of territory in which drones would eliminate all enemy activity.

Drones and the national defence industry

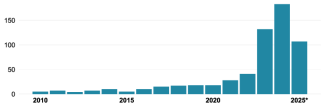

As early as 2015, Ukraine saw a rise in the number of companies involved in the production of aircraft.[4] While this category formally includes conventional aeroplanes and helicopters, in practice, the recent surge in activity and output in this segment – particularly since 2022 – has been driven almost entirely by the growth of the drone sector.

Following the outbreak of full-scale war, the number of new companies in the industry rose from 41 in 2022 to 132 in 2023 and 183 in 2024. In just the first four months of 2025, a further 107 new entities were registered. Prior to the invasion, the country’s leading drone manufacturers included PIK Deviro, Screentech, Tekhavtofart Pivden, and Ukrspecsystems. The most notable producers to emerge subsequently include Flash Tech, Smart Machinery Solutions, Robotics Distribution, and UMO Ukraine.

Chart 1. Number of registered aerospace enterprises in Ukraine, 2010–2025*

*Covering the period up to 25 April.

Source: YouControl.

It is estimated that a single brigade uses several hundred FPV drones per month, while actual needs are assessed at around 2,500. In 2024, approximately 2.2 million unmanned aerial vehicles of various types were produced in Ukraine. In 2025, that number is expected to exceed 4.5 million, over 2 million of which are projected to be FPV drones. This surge is driven by a record allocation of 775 billion hryvnias (approximately $18.5 billion) from the state budget for the purchase of domestically produced drones, alongside an additional 216 billion hryvnias (around $5 billion) provided under a budget amendment passed in late July 2025.

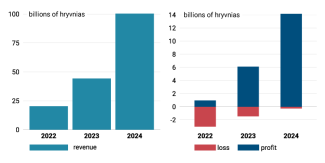

The development of Ukraine’s drone sector is reflected in the rapid improvement of its financial performance. In the first year of the invasion, due to heavy initial investment, the urgent need to reorganise production under wartime conditions, and the lack of experience in large-scale drone manufacturing, the sector suffered net losses exceeding 2 billion hryvnias. By 2023, however, a turnaround had occurred: the total net profit of the industry reached over 4.6 billion hryvnias, with revenues surpassing 44 billion. This was the result of rapid production scaling, the growth of local engineering expertise, active state support through grant programmes and Ministry of Defence procurement, and partnerships with volunteer organisations. In 2024, growth momentum proved even more striking. Companies in the sector achieved record revenues of up to 100 billion hryvnias, with net profits exceeding 13.8 billion.

Chart 2. Financial performance of Ukraine’s drone manufacturing sector, 2022–2024

Source: YouControl.

As a result of organisational shortcomings in the early phase of the full-scale war, Ukraine’s drone units experienced significant underfunding, particularly in terms of equipping front-line formations. This gap was largely filled through public fundraising campaigns led by volunteer networks. Consequently, the number of private drone assembly initiatives surged, many of them operating from makeshift home workshops. This decentralised model of production offers certain advantages, such as reducing the risk of factory destruction by Russian airstrikes and enabling the tailored delivery of drones to meet the specific needs of individual units. However, it also has notable drawbacks. These include a vast diversity of drone types and assembly methods, inconsistent operating protocols, and a wide variation in technical and quality standards. The drone units of the Unmanned Systems Forces (USF) currently operate with over 250 different UAV models.

In December 2024, new regulations were introduced to address the challenges posed by this high degree of variation. These required suppliers to obtain certification confirming compliance with defined technical standards, as well as expert assessments authorising specific drone models for military use. However, the new rules also extended procurement timelines and exposed the process to corruption, as purchases became conditional on possession of the required documentation.[5] This particularly hampered the delivery of urgently needed drones to the front line, where large quantities are used and rapid replacement of lost or damaged units can be critical to repelling enemy attacks. In June 2025, the Ministry of Defence launched DOT-Chain Defence – a dedicated digital platform that enables brigades operating in key sectors to place direct orders for FPV drones from selected suppliers.[6] This system is intended to significantly streamline and accelerate the ordering and delivery process for drone operators within the armed forces.

The centralisation of drone production in Ukraine remains, for now, a matter of planning and public declarations. Such a move carries the risk of corruption, which is already facilitated by the current opaque system of funding for drone procurement. As with other categories of armaments and military equipment, the acquisition process is largely classified under wartime regulations.[7] This secrecy has led to abuses, as evidenced by scandals reportedly involving senior officials and individuals within President Volodymyr Zelensky’s inner circle.[8] An additional challenge is the complexity and sluggishness of bureaucratic procedures related to procurement. These have resulted in delays both in contracting and delivering drones to military units, and in certifying new models and adding their manufacturers to the list of approved military suppliers.

Ukrainian–Russian technological race

The demand for mass drone production is, first and foremost, a result of their high attrition rate on the front line. Although the accuracy of Ukrainian drones increased from 30% in 2022 to 70% two years later,[9] it is estimated that around 60–80% of FPV drone strikes still fail to destroy their targets. This is largely due to the enemy’s use of armour protection,[10] and its ability to jam drones using electronic warfare (EW) systems. Russia has deployed thousands of such systems along the front line, capable of operating across multiple radio-frequency bands used for communication between the operator and the drone.[11] Estimates suggest that, in 2024, up to 75% of all drones used by both sides in the conflict were neutralised by jamming equipment.[12] As a result, both Ukrainian and Russian forces have begun seeking technological solutions to this problem.

Ukrainian designers have focused on developing an AI-based control system, enabling drones to autonomously track and approach a target using image recognition algorithms. This allows the drone to operate independently over the final few hundred metres of its flight, rendering it immune to EW interference. In parallel, work is underway on swarm attacks involving drones that communicate with one another and make decisions without human input.

Real-time image analysis and object recognition remain complex tasks requiring the integration of high-quality components, a precisely engineered data-processing system and extensive testing. One of the key barriers is the insufficient quality of the video feed transmitted from the onboard camera, which prevents accurate identification and tracking of targets. In addition, the algorithm has not yet been developed to the point where it can reliably guide the drone to a specific weak point on a target – such as a vulnerable spot on a tank – to ensure its destruction. For this reason, the technology still requires further development before it can be widely deployed. Nonetheless, it was likely used in part during the high-profile Spider Web operation – a drone attack on Russian strategic aircraft on 31 May 2025.

Meanwhile, the invading army has made widespread use of unmanned aerial vehicles guided by fibre-optic cables. The first models of this type appeared in the Ukrainian Armed Forces as early as 2023, but the concept was later abandoned in favour of developing AI-equipped systems. Despite being more expensive, requiring larger batteries, offering less manoeuvrability, and carrying smaller explosive payloads compared to conventional drones, fibre-optic drones are entirely immune to electronic warfare measures. A fibre cable unwinding from a spool attached to the airframe transmits high-quality video to the operator with virtually no delay.

A key advantage of such systems lies in their immunity to radio-horizon loss – that is, the loss of signal range caused by terrain features – and in their ability to penetrate freely the interiors of buildings or bunkers. The operator can also remain safely concealed underground or within a fortified structure. Notably, the use of fibre-optic guidance represents a form of technological regression – a return to solutions from the mid-20th century. Fibre-optic cables were, for example, used in the first Soviet anti-tank guided missile, the 9M14 Malyutka. The revival of this technology has been driven by the development of electronic warfare systems, which have severely reduced the effectiveness of remotely guided munitions.

Russia introduced its first fibre-optic drones to the battlefield in the summer of 2024. Their mass deployment from early 2025 proved to be one of the key advantages in pushing Ukrainian forces out of the Kursk region. Elite units equipped with these systems – such as Rubikon and Sudny Den (Judgement Day) – were subsequently deployed to critical sectors of the front, including around Pokrovsk and Toretsk. These formations played a significant role in Russia’s gains in Donetsk oblast and became a serious challenge for Ukrainian defences.

Kyiv is attempting to close the gap: in March 2025, Ukrainian forces successfully tested fibre-optic-guided drones, and in April the first units were delivered to the military. In June, President Zelensky signed amendments to the tax code exempting cable exporters from customs duties, with the aim of significantly reducing production costs for such systems. However, a major challenge remains the industry’s dependence on Chinese fibre-optic threads – around 90% of those available on the market originate from China. Ukrainian manufacturers also rely on Chinese suppliers for other essential components used in drone production.

Dependence on China

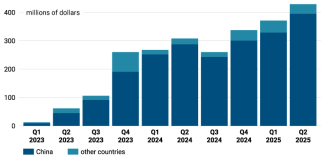

Ukraine’s drone industry remains heavily reliant on foreign suppliers. Unmanned aerial vehicles were only classified as a separate customs category in national statistics in 2023. Data from 2023, 2024, and the first two quarters of 2025 indicate a sharp increase in imports of drones and related components, from China as well as from other countries. However, China remains the dominant supplier.

Chart 3. Value of Ukraine’s imports of unmanned aerial vehicles, Q1 2023 – Q2 2025

Source: State Customs Service of Ukraine.

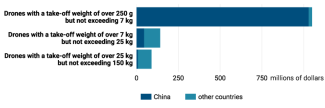

An analysis of 2024 data reveals a clear differentiation in imported drones based on their weight class and country of origin. Ukraine’s greatest dependence on Chinese suppliers concerns the lightest category of drones – those with a take-off weight of up to 7 kg. As much as 98% of drones in this class were manufactured in China. This refers primarily to multi-rotor drones equipped with permanently integrated systems for video recording and transmission. Nearly 600,000 such units were imported from China. These drones are most commonly used on the front line for reconnaissance or for carrying light explosive payloads. For heavier drones, weighing between 7 and 25 kg, China’s share drops to around 32%. In the most advanced category – those over 25 kg – it accounts for just 9.5%. Overall, Ukraine’s import structure indicates that it relies on China primarily for low-cost, lightweight systems that can be easily adapted and deployed in wartime conditions.

Chart 4. Value of Ukraine’s imports of main types of unmanned aerial vehicles in 2024

Source: State Customs Service of Ukraine.

China also plays a critical role as a supplier of components for drone manufacturing. This includes structural materials (such as carbon fibre), propulsion elements (various types of electric motors), power systems (primarily lithium-ion batteries), and energy converters. Drones also require complex electronics: integrated circuits, resistors, and control devices. In addition, key communication components are essential, including antennas, remote-control systems, radio-navigation devices, cameras, and rangefinders, as well as propellers, electrical wiring, and specialised measuring and control instruments.

Such heavy dependence on China for both finished drones and the parts needed to assemble them has raised concerns that Beijing could impose restrictions that would paralyse the industry. However, such a move appears rather unlikely. Although President Zelensky stated in late May 2025 that China had halted drone deliveries to Ukraine and the EU, this claim is not supported by data from the State Customs Service of Ukraine (see chart 3) or from Eurostat. Domestic statistics record goods by their country of origin, but in practice, most are imported via third countries. In the drone sector, Poland plays a particularly important role. In 2023, Polish drone exports to Ukraine were worth €139 million; in 2024, this figure rose to €482 million, and in the first seven months of 2025 alone, reached €422 million. This suggests that any potential restrictions imposed solely on Ukraine by Beijing would have limited impact, and a blanket embargo on exports to all countries appears unlikely.

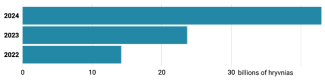

The value of sold industrial output in the drone segment confirms the rapid growth of domestic production. In 2022, it stood at approximately 14.1 billion hryvnias, rising to over 23.6 billion the following year, and reaching 42.9 billion in 2024 – representing a threefold increase over two years.

Chart 5. Value of sold aircraft production (excluding VAT and excise duty)

Source: State Customs Service of Ukraine.

Prospects

The growing number of new companies and their rising revenues clearly point to the continued development of Ukraine’s drone market since 2022 and to a technological revolution in this field. The sector is emerging as one of the most promising segments of the economy, combining a vital role in the country’s defence system with strong export potential once hostilities end.

This trend will be reinforced by efforts to replace soldiers on the battlefield with unmanned systems capable of carrying out combat operations. In doing so, Kyiv aims to address the problem of personnel shortages in the armed forces. According to Ukrainian military sources, a group of around a dozen operators equipped with a sufficient number of drones can effectively hold defensive positions along several kilometres of the front – positions previously manned by trench crews numbering in the dozens. This is particularly significant in light of the ongoing mobilisation crisis.

Ukraine hopes to achieve a military breakthrough in the war through the effective use of artificial intelligence in drones. This could significantly shorten the decision-making process aimed at eliminating enemy units, including the potential use of ground-based systems. The Armed Forces of Ukraine have already begun initial tests of drones capable of autonomously detecting and attacking vehicles. At present, the decision to strike remains in the hands of a human operator at a command post, but delegating this authority to drones appears to be only a matter of time. Progress in removing human involvement from the decision-making loop for combat tasks already raises ethical concerns. However, given the existential nature of the war and Ukraine's uncompromising pursuit of battlefield advantage, such developments appear inevitable.

The continued rise in drone use and their evolution as a combat tool are also driven by the unique conditions of the Ukrainian battlefield. The more than 1,200 km-long front line, criss-crossed with fortifications and minefields, severely limits manoeuvrability for Russian troops and compels them to operate in dispersed combat groups – against which drones are highly effective. At the same time, the use of advanced anti-tank guided missiles and artillery plays a critical role in preventing Russian breakthroughs, particularly through strikes on enemy logistical infrastructure. For this reason, drone use will continue to grow; however, drones will remain a complementary capability and are unlikely ever to fully replace conventional weapons systems.

[1] T. Ланчуковська, ‘Французький генерал: 80% цілей в Україні знищують FPV-дрони, але ситуація може змінитися’, Інтерфакс-Україна, 6 October 2025, interfax.com.ua.

[2] M. Santora et al., ‘A Thousand Snipers in the Sky: The New War in Ukraine’, The New York Times, 3 March 2025, nytimes.com.

[3] In July 2025, Brovdi was appointed commander of the Unmanned Systems Forces (USF), tasked with integrating and establishing a unified electronic system for planning, analysis, coordination, command, and reporting across all drone systems in the country. His appointment was accompanied by the incorporation of the Drone Line into the USF and was preceded by the dismissal of his predecessor, Colonel Vadym Sukharevskyi. The change was most likely driven by the reluctance of the Commander-in-Chief of the Armed Forces of Ukraine, General Oleksandr Syrskyi, to work with Sukharevskyi – a young and ambitious officer who enjoyed considerable authority within the military. It was in fact Sukharevskyi who initiated both the USF and the Drone Line back in the summer of 2024. However, Syrskyi, who at the time underestimated the role of drones on the battlefield, blocked the initiative. The nomination of Brovdi – a media-savvy figure with no military background (prior to 2022 he was a businessman with a questionable reputation) and no support within the defence establishment – signalled a move towards placing someone entirely dependent on the Commander-in-Chief at the helm.

[4] This refers to enterprises classified under code 30.3 of the Ukrainian Classification of Types of Economic Activity (KVED): ‘Manufacture of aircraft, spacecraft, and related machinery.’ This category includes both manned and unmanned aerial vehicles.

[5] Т. Ніколаєнко, ‘Як Міноборони ускладнило закупівлю військовими частинами дронів і РЕБів, Українська правда’, 19 February 2025, pravda.com.ua.

[6] To date, only a dozen or so manufacturers have been authorised to participate in the programme. These include Escadrone, General Cherry, Gryph Dron, TAF Drones, GRIM, Vyriy Drone, Gurzuf Defence, Quantum-Systems, SkyRIPer, Warbirds, DeViRo, and Reactive Drone.

[7] In 2024, the Ukrainian government signed contracts for the purchase of 1.6 million drones at a total cost of 114 billion hryvnias. Through public tenders conducted via the Prozorro system – a mechanism introduced in February 2024 to significantly reduce procurement costs – orders worth 15.4 billion hryvnias were placed. The remaining tenders were conducted under classified procedures. Я. Пилипенко, ‘Україна збільшила закупівлі безпілотників у шість разів. Хто їх закуповує найбільше’, ZN.ua, 20 February 2025.

[8] ‘Корупція при закупівлі дронів та РЕБ: ВАКС заарештував нардепа Кузнєцова’, Центр журналістських розслідувань, 4 August 2025, investigator.org.ua.

[9] J. Ling, ‘Inside Ukraine’s Killer-Drone Startup Industry’, Wired, 2 May 2024, wired.com.

[10] J. Watling, N. Reynolds, Tactical Developments During the Third Year of the Russo–Ukrainian War, Royal United Services Institute, February 2025, rusi.org.

[11] Б. Мірошниченко, ‘Рій дронів та божевільні покупці. Як інженери перетворюють виробництво FPV на велику індустрію, Економічна правда, 25 July 2024, epravda.com.ua.

[12] ‘Генерал однієї з країн НАТО заявив, що дрони вже через пару років можуть втратити домінування’, Defense Express, 20 June 2024, defence-ua.com.