At the monopolist’s mercy: Germany’s dependence on Chinese rare earth elements

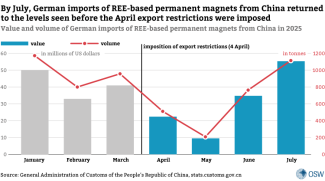

The trade war between the United States and China has triggered serious economic repercussions for the EU, including Germany. In response to Washington’s tariff increases in April 2025, Beijing not only raised duties on US goods but also introduced global export restrictions on rare earth elements (REEs) and products made from them, including permanent magnets. The temporary lack of access to these critical materials caused production delays across many German companies, as 92% of the magnets they import originate from China. Due to this heavy dependency, Berlin took no retaliatory measures. By July, imports of permanent magnets had returned to levels seen at the beginning of the year. However, the risk of supply bottlenecks within industry remains.

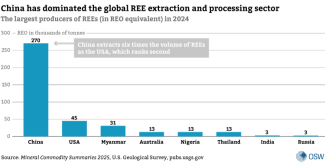

In the absence of viable alternative sources of REEs, Beijing is likely to use export restrictions as a tool to exert pressure on the EU, demanding concessions in other areas of policy and economic relations. China accounts for nearly 70% of global REE extraction and 90% of their processing. Due to long-standing technological neglect, strict environmental regulations, and extensive bureaucratic requirements, launching mining and processing operations within the EU will remain virtually impossible in the coming years.

Numerous shortcomings in Germany’s raw materials policy have led to an excessive dependence of its industry on imports of permanent magnets. The continued development of the German industry, including its energy and automotive sectors, now hinges on maintaining REE trade with China, while companies lack the technology needed to enhance their autonomy in processing these elements. Despite experts’ warnings about the growing risk of supply disruptions, government efforts to diversify sources have so far been largely superficial. Mounting challenges in trade relations with China are pushing the German authorities to reorient their foreign policy and seek alternative partnerships, for example, with Canada.

Extraction and industrial significance of rare earth elements

REEs are a group of 17 elements, divided into light, medium-heavy, and heavy categories. Despite the name, some of them are more abundant than lead or copper, but they do not occur in isolation, and their concentration in ores is rarely high enough to make extraction economically viable. They are characterised by very strong magnetic properties and high thermal stability, which makes them useful across numerous industrial sectors.

The largest reserves[1] of REEs are located in China (approximately 44 million tonnes of REOs, accounting for 48% of the world’s exploitable resources) and Brazil (21 million tonnes) – see the chart above. The United States ranks seventh in this comparison (1.9 million tonnes), yet it is the second-largest producer of these elements after China, which accounts for 69.2% of global output (see the chart below). Heavy REEs are found almost exclusively in China, are less commonly available than light REEs, and are more difficult to extract – which makes them highly valuable and subject to export restrictions.

The extraction, separation and refining of REEs are complex and costly processes that generate radioactive waste. Since the 1980s, China has heavily invested in developing the necessary technologies and expertise, while other countries have outsourced extraction and processing to external providers to minimise costs and protect the natural environment. As a result, China currently accounts for 90% of global REE processing, which in practice amounts to a monopoly. In addition, state subsidies make Chinese permanent magnets relatively inexpensive, rendering it impossible for companies from other countries to compete on price.

REEs are primarily used in the production of permanent magnets, which are of strategic importance to global industry. Beijing’s export controls target these magnets rather than the REEs themselves, making the restrictions particularly burdensome for foreign companies. Permanent magnets play a vital role in the defence sector, in the automotive industry – particularly in the production of electric motors and sensors – and in wind energy, where they are used in turbine generators. They are also used in consumer electronics, medical devices, robotics and more. According to forecasts, REE consumption for magnet production is set to grow, and by 2030 is expected to account for over 35% of total demand for these elements.[2] Other areas of application include catalytic and glass production, as well as metallurgy.

The German industry’s dependence on rare earth elements

Delays in REE exports from China have raised concerns within German industry due to the critical importance of permanent magnets for the country’s economy as a whole. Sectors particularly vulnerable to supply chain disruptions include the automotive and mechanical engineering industries, as well as energy and defence technologies. In 2022, 1.3 million people – 17% of the entire processing industry workforce – were employed in the production of goods containing these elements.[3] Shortages of magnets cast doubt over the progress and success of the green transition: without stable supplies of these components, companies may struggle to sustain their development, particularly in the field of electromobility.

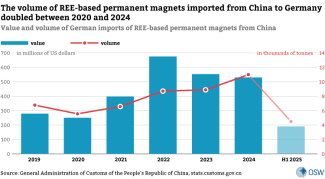

The challenges posed by REE and magnet shortages risk triggering a crisis in Germany that could prove far more serious than the energy crisis of 2022, due to the lack of alternative sources. In 2024, 92% of REE-based magnets imported to Germany originated from China.[4] At the same time, Germany was the largest importer of this product from China, accounting for 18.8% of its total exports,[5] (see chart below). The country also imports large volumes of raw REEs – 5,200 tonnes in 2024, worth €64.7 million. However, domestic extraction has little future: although deposits have been discovered in Saxony, estimated at 20,000 tonnes of ore, the REE content is assessed at only 0.5%, making extraction economically unviable.

Germany and the EU’s efforts to achieve greater independence are also hindered by strict EU environmental regulations and lengthy administrative procedures. Some of the largest REE deposits in Europe are located near Kiruna in Sweden, where approximately 1 million tonnes of ore have been identified in recent years. According to the Swedish mining company LKAB, due to the prolonged permit-granting process, extraction and commercialisation of the metals may not begin for another 10 to 15 years.[6]

The politicisation of natural resources

The recent disruptions in REE exports from China were triggered by a trade conflict with the United States, initiated in February 2025 by the Donald Trump administration. By April, the total number of US tariffs on Chinese goods had reached 54.[7] In response, Beijing not only raised tariffs on US products to the same level but also reduced global sales of seven heavy REEs, as well as products made from them. The decision was justified on the grounds that these elements have dual-use applications: the magnets produced from them play a significant role in the defence industry, including in missile guidance systems and advanced communication equipment. Under the new regulations, companies wishing to import REEs must obtain a licence issued by China’s Ministry of Commerce, which reports to the State Council. Initially, the waiting time for this document was as long as 45 days. These licences, valid for one to three years, are not granted to firms suspected of stockpiling. By July, imports of permanent magnets had returned to the levels recorded before the imposition of the April restrictions (see chart below).

Officially, the export restrictions were targeted against the US defence industry, but they also adversely affected European entities. The EU’s heavy reliance on REE imports became a tool of leverage in Beijing’s hands, which, in exchange for granting licences, started to demand concessions in other areas. Its demands included the provision of detailed information on how European companies use REEs. In the case of automotive firms, this included data on electric motor designs, production volumes, and descriptions of manufacturing processes. Such demands are unprecedented in both scale and severity, as they carry the risk of disrupting industrial production across the EU.

Response from state-controlled and private entities

When the export restrictions were imposed, the German authorities refrained from issuing any official response. Nor did they announce any repercussions against China – though in any case, excessive economic dependencies would have made such actions unfeasible. Publicly acknowledging the issue could have been interpreted as an admission of helplessness, as well as a recognition that the current difficulties stemmed from failures to build domestic REE supply chains and from an ineffective raw materials policy, which had left national industry in a vulnerable position. The first official to speak on the matter was Foreign Minister Johann Wadephul (CDU), who addressed it during the EU–China summit in July 2025. He stated that China had undermined trust in trade relations. He further threatened to use EU instruments to counter China’s unfair economic practices.

Beijing’s suspension of REE exports caused panic among German business circles. As early as June 2025, the first companies were forced to scale back production, and many sectors feared a collapse in operations.[8] The issue was taken up by industrial associations such as the VDA and VDMA. The latter made a direct appeal to Brussels to exert greater pressure on China to restore REE exports.[9] This was also the main topic raised by German firms during the summit. Wadephul’s statement and the business sector’s reaction may indicate an emerging willingness to build a joint German–EU front against China. This would mark a departure from Berlin’s previous, more individualistic approach, in which relations with China were often guided by national interests.

In more general terms, the import of REEs is part of the wider issue of the German industry’s structural dependence on foreign supplies. The country’s economy also heavily relies on other critical raw materials from China, including lithium, graphite, and magnesium. The risks associated with this dependency have been well known to policymakers and experts for years.[10] This is not the first time Beijing has used trade tools for political leverage – in 2010, it suspended REE exports to Japan for two months due to a dispute over the Senkaku/Diaoyu islands, prompting a global price surge and concern in Berlin over the security of supplies.

Industry associations and analytical centres have long stressed the need to reduce Germany’s dependence on critical raw material imports from China.[11] Their recommendations include expanding and diversifying supply sources through partnerships with other producers, and increasing the participation of German public and private sectors in overseas extraction and processing projects.[12] Other proposals involve developing domestic processing capacity, strengthening recycling capabilities, and establishing strategic reserves. Calls for reform in raw materials policy intensified particularly after 2022, when the risks associated with dependence on Russian oil and gas became apparent. According to the Institute for Market Integration and Economic Policy (MIWI), a supply shock linked to REE imports could reduce Germany’s GDP by up to 4%.[13] The potential collapse of supply chains from China poses not only an industrial risk but also a threat to national security. Chancellor Friedrich Merz aims to make the Bundeswehr the strongest conventional army in Europe, and components made from REEs play a key role in the expansion of the defence sector.

In response to potential risks linked to supply disruptions by China, the German authorities have, for over a decade, been developing agendas outlining possible economic threats and recommended courses of action. The country’s first strategic document aimed at achieving raw material independence – Rohstoffstrategie – was published in 2010. It was updated a decade later, and in 2023 the Federal Ministry for Economic Affairs and Climate Action (BMWK) released a report titled Pathways to Sustainable and Resilient Raw Material Supplies.[14] These documents focus in particular on:

- developing a circular economy and new REE recycling technologies,

- diversifying supply chains,

- undertaking joint international projects in REE extraction and processing,

- increasing raw material storage capacity and establishing strategic reserves,

- developing consistent ESG standards.

Recent examples of the practical implementation of these strategic documents include President Frank-Walter Steinmeier’s visit to Kazakhstan in June 2023 and Chancellor Olaf Scholz’s trip to Central Asia in September 2024. During his visit, Steinmeier signed 23 agreements worth a total of US$1.7 billion, covering cooperation in REE processing and other sectors such as industry and agriculture.[15] Scholz, in turn, concluded an agreement on the extraction and purchase of REEs from Uzbekistan.[16] Since 2011, Germany has also cooperated with Mongolia on raw material trade, including rare earth elements. During a meeting with Mongolia’s prime minister in Berlin in 2022, the Chancellor expressed a desire to enhance the partnership in this area.[17]

The German government’s most recent initiative is the launch of a raw materials fund in autumn 2024 to support projects aimed at diversifying the supply of critical resources, including REEs, for domestic industry. The fund’s budget stands at €1 billion and covers projects related to the extraction, processing, or recycling of raw materials designated by the EU as strategic.[18] So far, no projects have been selected, as initial applications are only now entering the assessment phase.[19] The delays stem from a prolonged administrative process; it was only in July 2025 that the entity responsible for evaluating and approving applications was confirmed. The KfW Bank has received 40 applications from companies interested in joining the initiative.[20]

The measures taken by Berlin have so far yielded no tangible results in reducing Germany’s dependence on REE imports from China. For years, German industry benefited from the low cost of imported permanent magnets, while the risks repeatedly highlighted by experts were largely seen as unlikely. It was only after 2022 that the political will to seek alternatives to lucrative Chinese supplies began to emerge. However, the government did little to develop processing or recycling technologies – either domestically or in cooperation with foreign partners – which are essential for the production of permanent magnets.

At the EU level, the most significant measure in recent years was the introduction of the Critical Raw Materials Act (CRMA) in 2024. According to the directive, by 2030 the EU should import ‘no more than 65% of its annual consumption’ of any given critical raw material from a single third country. In addition, 25% of annual demand should be met through recycled materials rather than new extraction.[21] Currently, in the case of REEs, that figure stands at less than 1% in the EU, and research efforts are largely focused on the recycling of permanent magnets.[22] One of the main reasons behind the underdevelopment of Europe’s REE recycling sector is the high cost of the final product, which cannot compete with the price of Chinese magnets. Another challenge facing the EU is the low rate of collection and recycling of electronic waste, which prompted the European Commission to revise the WEEE (Waste from Electrical and Electronic Equipment) Directive in July 2025.[23]

Germany’s private sector is also taking steps to secure supplies of REEs and permanent magnets. One of the companies applying for funding from the raw materials fund is the Australian firm Arafura Rare Earths, which, in addition to extracting REEs, plans to build one of the first ore-processing facilities in northern Australia. As early as April 2023, the company signed a supply agreement with Siemens Gamesa for neodymium and praseodymium deliveries between 2026 and 2030. It has also opened talks with Chinese permanent magnet producers about relocating production to Europe to ensure supply security for German firms.[24] Another example of private-sector initiative is BMW’s development of EESM (Externally Excited Synchronous Motors), which do not require the use of permanent magnets. This solution eliminates dependency on REE imports, although it comes with certain technological limitations, which is why these motors have yet to achieve widespread adoption in the automotive industry. In May 2024, Heraeus Remloy opened a REE-based magnet recycling facility in Bitterfeld, considered the largest of its kind in Europe. Initial plans envisaged the production of 600 tonnes of magnetic powder annually, with the potential to double that volume. However, the company is currently facing financial difficulties that have prevented it from reaching full production capacity.[25]

Prospects for REEs in German foreign policy

The current CDU/CSU–SPD government has announced a somewhat more confrontational stance towards China than that adopted by the Scholz administration, which had been more open to concessions and the deepening of cooperation.[26] Friedrich Merz (CDU), even prior to the parliamentary elections, stated that he would not support companies that voluntarily remain in China despite deteriorating political conditions.[27] He has repeatedly stressed the urgent need to diversify trade relations. At the Berlin Ambassadors’ Conference in early September 2025, for example, he remarked that Germany must not again allow itself to become overly dependent on raw materials, given the risk of political pressure. At the same time, the coalition intends to maintain the current level of cooperation with China in other areas, such as trade and climate policy.

The government has also taken steps to establish new partnerships for REE imports. During Foreign Minister Wadephul’s visit to Japan in August 2025, both countries expressed readiness to cooperate in reducing their dependence on critical raw material supplies from China.[28] The most significant step taken by the German government to date was the signing of an agreement with Canada in late August 2025 on the import of strategic raw materials and support for cooperation between companies from both countries.[29] While Canada does extract and process REEs on a commercial scale, its infrastructure is not yet sufficiently developed to become a serious alternative to China in the near term.[30] However, it does intend to expand production capacity in response to growing demand, including from the United States.

The United States is the world’s second-largest producer of REEs, yet it is unlikely to replace China in supplying Germany and other EU countries with these materials in the coming years. Since 2023, the EU has been negotiating a Critical Minerals Agreement (CMA) with Washington aimed at securing supplies needed for electric vehicle battery production. Brussels is seeking to include over 50 raw materials listed in the Critical Raw Materials Act (CRMA) – among them REEs – while the US side has proposed limiting the agreement to only five: graphite, lithium, manganese, nickel, and cobalt.[31] President Trump is currently focused on boosting REE production and processing within the United States and ensuring national self-sufficiency in this sector.[32] The topic of exporting REEs to EU countries has not been raised during trade talks between Brussels and Washington.

In the short to medium term, Germany will not achieve independence from Chinese permanent magnet imports. The government is currently focused on boosting economic growth and addressing long-standing underinvestment in outdated infrastructure. In this context, supporting capital-intensive investment in REE processing and recycling technologies is unlikely to be a priority, especially given current budgetary constraints. Political and economic relations with Beijing are likely to remain cautious – for instance, in discussions on limiting the influx of surplus Chinese electric vehicles into the EU – as the government seeks to avoid provoking further export restrictions. This effectively allows China to shape its trade relationship with Germany and influence German industry without fear of retaliation from Berlin. In the longer term, Germany’s hopes rest more on other countries – such as Australia and Canada – independently developing their own rare earth processing industries. This would offer new opportunities for diversifying supply chains and reducing dependency on China.

[1] ‘Reserves’ refer to identified raw material deposits that are considered economically viable to extract. ‘Resources’ is a broader term – in addition to ‘reserves’, it also includes discovered deposits with potential value, as well as those that geological analyses suggest may exist.

[2] 61 Dera Rohstoffinformationen. Seltene Erden, Deutsche Rohstoffagentur, January 2025, deutsche-rohstoffagentur.de.

[3] No up-to-date data available.

[4] Data from the Federal Statistical Office of Germany, destatis.de.

[5] The United States ranked second, followed by South Korea in third place. A. Huld, ‘Rare Earth Elements: Understanding China’s Dominance in Global Supply Chains’, China Briefing, 29 August 2025, china-briefing.com.

[6] ‘Europe’s largest deposit of rare earth metals located in Kiruna area’, LKAB, 12 January 2023, lkab.com.

[7] As the conflict escalated further, Trump threatened to raise it to 145%.

[8] M. Large, ‘Chinesische Exportstopp seltener Erden zeigt bald Wirkung’, all-electronics, 3 June 2025, all-electronics.de.

[9] ‘German engineering group calls on EU to put pressure on China over rare earths’, Reuters, 12 June 2025, reuters.com.

[10] See A. Kwiatkowska ‘The natural resources deficit: the implications for German politics’, OSW Commentary, no. 46, 8 February 2011, osw.waw.pl.

[11] ‘Fünf-Punkte-Forderung zur Versorgung mit kritischen Rohstoffen’, Bundesverband der Deutschen Industrie, 20 October 2022, bdi.eu.

[12] A. Baur, L. Flach, ‘Strategien gegen die Flaschenhals-Rezession: Was hilft bei Lieferengpässen und steigenden Preisen’, ifo Institut, 19 January 2022, ifo.de.

[13] J.C. Kofner, ‘Strategic Supply of Rare Earth Elements for the German Economy: Current Status and Policy Recommendations’, Institute for Market Integration and Economic Policy, 26 December 2024, miwi-institut.de.

[14] ‘Eckpunktepapier: Wege zu einer nachhaltigen und resilienten Rohstoffversorgung’, Federal Ministry for Economic Affairs and Climate Action, 3 January 2023, bundeswirtschaftsministerium.de.

[15] ‘Rare Earth Metals and Energy: Kazakhstan and Germany Sign Documents for $1.7 Billion’, Kazakh Invest, 21 June 2023, invest.gov.kz.

[16] See L. Gibadło, M. Popławski, ‘Acquiring resources and legitimising the partnership: Scholz's visit to Central Asia’, OSW, 20 September 2024, osw.waw.pl.

[17] ‘Ein enger Partner in Krisenzeiten’, the Federal Government, 14 October 2024, bundesregierung.de.

[18] See A. Kozaczyńska, ‘A new tool in Germany's raw material policy’, OSW, 11 October 2024, osw.waw.pl.

[19] M. Becker, ‘Bänder in Deutschland stehen still, wenn China es will’, Spiegel, 3 July 2025, spiegel.de.

[20] ‘Projekte für Rohstofffonds werden geprüft’, Bundestag, 12 August 2025, bundestag.de.

[21] Critical Raw Materials Act, European Commission, single-market-economy.ec.europa.eu.

[23] ‘Circular Economy: New evaluation looks at how to improve WEEE Directive’, European Commission, 2 July 2025, environment.ec.europa.eu.

[24] C. Steitz, ‘Siemens Gamesa, Chinese magnet suppliers discuss European production, COO says’, Reuters, 26 June 2025, reuters.com.

[25] E. Venkina, ‘Warum Deutschland bisher kaum Seltene Erden recycelt’, Deutsche Welle, 20 August 2025, dw.dom.

[26] See L. Gibadło, P. Uznańska, ‘De-risking can wait. Scholz's visit to China’, OSW, 17 April 2024, osw.waw.pl.

[27] A.-S. Chassany, ‘German election frontrunner warns of ‘great risk’ for companies investing in China’, Financial Times, 23 January 2025, ft.com.

[28] ‘Speech by Foreign Minister Johann Wadephul at the Sasakawa Peace Foundation’, Federal Foreign Office, 18 August 2025, auswaertiges-amt.de.

[29] ‘Versorgungssicherheit bei Kritischen Rohstoffen: Deutschland und Kanada vertiefen Zusammenarbeit’, Federal Ministry for Economic Affairs and Energy, 26 August 2025, bundeswirtschaftsministerium.de.

[30] According to Mineral Commodity Summaries 2025, Canada’s reserves stand at 830,000 tonnes of REO. Meanwhile, the SRC Rare Earth Processing Facility report from 2024 noted that, based on 2022 studies, the country possesses 15.2 million tonnes of REO in measured and potential deposits.

[31] ‘EU-US critical minerals agreement. Building stronger supply chains together’, European Parliament, 28 November 2023, europarl.europa.eu.

[32] ‘Did the US just nationalize the rare earth industry?’, Adamas Intelligence, 14 July 2025, adamasintel.com.