A fragile future: decarbonisation of Germany’s steel sector

The steel industry in Germany holds significant economic importance for the development of key sectors, such as automotive manufacturing and machinery production. Its strategic role is further increasing in the context of rising defence spending. However, the sector is currently in crisis, owing to high energy costs, weakening domestic demand for steel products, and the influx of non-EU steel sold at dumping prices and not subject to the same environmental regulations.

The situation is further complicated by the ongoing decarbonisation of the steel industry, in which Germany has taken a pioneering role within the EU – a process that is now facing growing uncertainty. Despite the emerging doubts, the current course still enjoys clear support from key stakeholders, including most representatives of the industry itself, authorities of individual federal states, and trade unions. Within the federal government, the Social Democratic Party (SPD) remains the main advocate of this policy direction.

The initial steps taken by the CDU/CSU–SPD coalition indicate that Germany will continue to support the decarbonisation of the steel sector both domestically and at the EU level, while also complementing this policy with new incentive instruments. At the same time, the government may be open to certain adjustments – particularly at the EU level – to introduce more flexibility into the framework. The steel industry itself has high expectations for the planned increase in infrastructure and defence investments, anticipating that they will lead to a rise in demand for steel.

Steel is one of the basic materials used across many branches of modern industry. Various steel products are essential in the construction of buildings, roads, bridges, and railway tracks; in the manufacturing of cars, trains, ships, and aircraft; in the production of machinery and household appliances; in the building of both conventional and renewable power plants (such as wind turbines); and finally, in the production of military equipment, including tanks. Due to the industrial and export-oriented nature of the German economy, the domestic steel industry holds particular importance for the Federal Republic. It sits at the start of the supply chain for many key sectors of the processing industry, such as automotive, machinery, and electrotechnical equipment manufacturing. German steelworks typically operate within industrial clusters, in close proximity to their customers, to whom they supply specialised products with specific technical parameters. The German steel sector directly employs nearly 80,000 workers, while related sectors – such as automotive, machinery, and construction – account for as many as 4 million jobs.[1] It is estimated that two-thirds of German manufacturing consists of industries in which steel constitutes a significant component of the final product (these sectors are commonly referred to in German as stahlintensiv, or steel-intensive).[2]

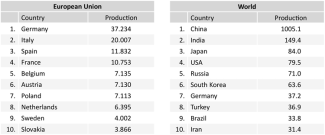

Germany is by far the largest producer of crude steel in the European Union. In 2024, German steelworks produced a total of 37.2 million tonnes, accounting for nearly 30% of the EU’s overall output (see Table). Globally, Germany ranks as the seventh-largest steel producer, with a 2% share of the world market. The country’s largest steel companies are ThyssenKrupp Steel, ArcelorMittal, Salzgitter, and Stahl-Holding-Saar (SHS), which together account for approximately 75% of Germany’s steel production.

Table. Crude steel production in the EU and globally in 2024 (in millions of tonnes)

Source: European Steel Association, World Steel Association.

The steel industry in Germany holds not only significant economic importance but also considerable socio-political weight. It has traditionally been strongly represented in the influential Federation of German Industries (BDI) as well as in the metalworkers’ trade union IG Metall, both of which carry substantial clout in Berlin. The sector enjoys sustained public interest and frequent coverage in mainstream media. It is also one of the few branches of German industry – alongside automotive and chemical – that traditionally maintain privileged access to the highest-ranking officials at both federal and state levels, including the Chancellor. Thus, the steel industry is a key component of Germany’s distinctive business–politics ecosystem.

A deepening crisis

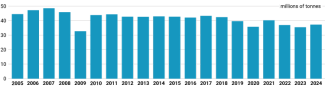

Since the end of the previous decade, Germany’s steel industry has been facing an increasingly serious crisis. In 2024, crude steel production was 13% lower than the average for the previous decade (42.5 million tonnes) and nearly 20% below the level recorded at the beginning of the 21st century (approximately 46 million tonnes; see Chart 1). While between 2000 and 2009 domestic production capacity utilisation regularly exceeded 90%, and remained at a satisfactory level of approximately 85% from 2010 to 2019, in the current decade it has dropped to an average of just 74%. Moreover, in the period from January to July 2025, production fell by another 12% compared with the corresponding period in the previous year.

Chart 1. Crude steel production in Germany, 2005–2024

Source: Wirtschaftsvereinigung Stahl.

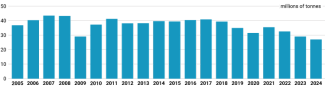

The causes of the crisis in Germany’s steel industry are complex. One key factor is the shrinking domestic market, which is critical for the country’s steel producers. In 2024, domestic consumption of rolled steel fell to 27 million tonnes – the lowest level since the mid-1990s. This decline is largely driven by the broader economic downturn that has affected Germany since 2022, as well as falling output in major steel-consuming sectors – most notably construction (accounting for 33% of demand), automotive (28%), and machinery (13%). Each of these industries is experiencing its own crisis, resulting in reduced manufacturing activity and, consequently, lower demand for steel products.

Secondly, like all energy-intensive industries, the steel sector is suffering from high electricity prices in Germany, which negatively affect production costs and reduce the competitiveness of domestic producers compared with foreign rivals. According to calculations by the industry association Wirtschaftsvereinigung Stahl, electricity expenditures – although lower than at the peak of the energy crisis from 2022 to 2023 – remain twice as high as the average level over the past decade.[3] The situation is further complicated by the EU Emissions Trading System (EU ETS), which applies to steel producers. Although they still benefit from the free allocation of emission allowances, these are no longer sufficient to cover their entire production output.

The third major challenge is the increasing influx into the European Union of cheap steel from third countries – often subsidised and not subject to carbon emissions costs – and frequently sold at dumping prices. In some segments, this imported steel is displacing domestic production from the market, which is particularly damaging during a period of economic downturn. The problem is further exacerbated by the continuously growing global oversupply of steel. This imbalance creates pressure to reduce prices, undermining the profitability of European steelworks, including those in Germany. Adding to these problems are protectionist measures introduced by the United States. The imposition of tariffs on steel imports is expected to divert cheap Asian steel – originally intended for the US market – towards Europe, further worsening an already difficult situation in the domestic market. Moreover, additional fees in the US – a key export destination for EU-made steel – will negatively affect European exporters. According to estimates by the Kiel Institute for the World Economy, US tariffs could reduce Germany’s steel exports to the United States by as much as 35%.[4]

Chart 2. Germany’s rolled steel consumption, 2005–2024

Source: Wirtschaftsvereinigung Stahl.

This situation is leading to declining profitability among German steelworks and to their deteriorating financial standing. Many companies are operating on the brink of viability, or already incurring losses, which is forcing them to implement restructuring programmes, reduce production capacity, and cut jobs. The most prominent example is ThyssenKrupp Steel, which has long been a burden on the balance sheet of the ThyssenKrupp Group. The company has announced a cost-saving programme that includes plans to reduce its production capacity from 11.5 to 9 million tonnes per year, and to cut its workforce from 27,000 to 16,000 by the end of the decade.[5]

Decarbonisation

The difficult situation facing the steel industry is further compounded by the energy transition driven by climate policy requirements, which envisages the gradual decarbonisation of steel production. The steel sector is among the most carbon-intensive industries. In 2023, German steelworks emitted a total of 51 million tonnes of CO₂ equivalent, accounting for as much as one-third of emissions from the country’s industrial sector and nearly 8% of Germany’s total emissions.[6]

The decarbonisation of steel production in the coming years is driven by the EU Emissions Trading System (ETS), which obliges facilities to obtain allowances for each tonne of CO₂ emitted. Although, as previously mentioned, the steel industry still receives free allowances covering around 80% of its production, this is set to change. Starting in 2026, the allocation of free certificates will begin to be phased out. From 2034, all steelworks operating in EU member states will be required to cover the full cost of their emissions. Moreover, the ETS provides for an annual reduction in the total number of newly available allowances, which will inevitably lead to a gradual increase in their market price. By 2039, the sale of allowances is scheduled to end entirely, after which only a small number of previously acquired certificates will remain available at very high prices.

Steel production currently relies on two main technologies. The first is the Blast Furnace–Basic Oxygen Furnace (BF-BOF) method, in which pig iron is smelted from iron ore in a blast furnace using coking coal as a reducing agent. The molten iron is then further processed in a basic oxygen converter to produce primary steel. BF–BOF is the dominant technology globally, accounting for nearly 75% of worldwide steel production; in Germany, it made up 71% in 2024. However, it is also highly carbon-intensive, responsible for approximately 90% of the sector’s total emissions. The second, much more environmentally friendly, method is the production of so-called secondary steel, which involves melting scrap metal in electric arc furnaces (EAF).

There are three main technological pathways currently available for decarbonising the steel industry. The first involves an increasing shift towards the production of secondary steel using the low-emission EAF method. This approach requires access to scrap metal, which serves as the primary raw material, as well as to affordable electricity. The second option is replacing the conventional blast furnace process with Direct Reduced Iron (DRI) technology. In this method, iron is purified not with coking coal but with an alternative reducing agent – either natural gas or hydrogen. The resulting iron can then be melted in electric arc furnaces to produce steel with the desired material properties. This technology allows for a reduction in emissions of approximately 60% when using natural gas and up to 95% when using low-emission hydrogen, compared with the conventional method. The third approach under consideration involves retrofitting existing integrated BF–BOF steelworks with carbon capture installations, enabling subsequent transport of CO₂ either to storage sites or for reuse in other industrial processes.

Because of the structure of Germany’s steel industry – in which BF–BOF steelworks dominate – and the specific requirements of key customers such as the automotive sector, Berlin quickly focused its decarbonisation efforts on integrated plants. According to industry estimates, the share of secondary steel in Germany cannot exceed 50%. The chosen pathway has been the DRI–EAF method, which aligns with other components of Germany’s broader energy transition strategy (Energiewende), including the phase-out of coal and the development of a hydrogen-based economy. Carbon capture, utilisation, and storage (CCUS), by contrast, was deemed impractical and socially controversial. This decarbonisation trajectory was formalised in 2020, when Angela Merkel’s government (a CDU/CSU–SPD coalition) adopted a sector-specific strategy for the steel industry,[7] which was developed jointly with representatives of the steel industry, trade unions, and the authorities of the affected federal states. At the clear request of the sector itself, the strategy was implemented by the government of Olaf Scholz (a coalition of the SPD, Greens, and the FDP). The transformation of the steel sector quickly became one of the government's top priorities in the field of climate policy.

This commitment was especially evident in four pioneering decarbonisation projects launched by Germany’s largest steel producers: ThyssenKrupp Steel, Salzgitter, SHS, and ArcelorMittal. The federal government decided to co-finance these projects with a total of €6.9 billion, against total costs amounting to nearly €12.5 billion.[8] Since such financial support constitutes state aid, the subsidies required approval from the European Commission – an outcome actively pursued in Brussels, particularly by Vice-Chancellor Robert Habeck (Greens). He regarded the aforementioned initiatives, carried out under the banner of transitioning to ‘green steel’, as politically prestigious (Germany received 75% of the funds allocated by the European Commission for steel decarbonisation). These projects involve the construction of DRI–EAF installations and the replacement of coal-based steel production with a process initially using natural gas and ultimately hydrogen. The specific terms of the public aid agreed with the European Commission remain confidential. However, it is known that the switch from natural gas to hydrogen is mandatory and should occur in the 2030s. Together, these investments are expected to enable the production of 11.5 million tonnes of low-emission steel annually, replacing one-third of blast-furnace capacity in Germany.

Problems facing transformation

From the outset, Germany’s steel-sector decarbonisation policy has been burdened by serious concerns that have become even more pressing in recent years. The first issue is the availability of low-emission hydrogen in sufficiently large quantities and at competitive prices. While Germany has achieved some progress in building transmission infrastructure, very few projects related to hydrogen production or import are currently being implemented. The main challenge lies in the cost of production, as it is significantly higher than initially assumed, casting doubt on the viability of hydrogen-based projects.

The second challenge concerns the availability of electricity at competitive prices. As previously mentioned, high electricity costs are already placing a significant burden on the German steel industry. As the sector transitions to low-emission yet energy-intensive production methods, the impact of electricity costs on profitability will become even more pronounced.

Another issue is the market for low-emission steel. It is clear that, especially in the initial period, steel products manufactured using innovative, environmentally-friendly processes will be significantly more expensive than those produced conventionally. For example, according to estimates by BCG, by 2030 steel produced using natural gas instead of coal will be nearly 20% more expensive, and in the case of a transition to hydrogen as much as 95% more expensive.[9] Without state support instruments – whether financial or regulatory – such production would not find buyers on the market.

Growing concerns – particularly regarding hydrogen and electricity prices – led ArcelorMittal in June this year to withdraw from the so-called green-steel project at its German plants, and thereby to forgo state subsidies.[10] According to the company’s executives, the investment does not offer viable business prospects even with the subsidy covering 50% of the costs. The decision by this global steel giant resonated widely and fuelled the debate on decarbonisation and, more broadly, on the future of Germany’s steel sector. In contrast to ArcelorMittal, the remaining three beneficiaries – Salzgitter, ThyssenKrupp Steel, and SHS – have already launched their investments and declared their intention to complete and commission them between 2027 and 2029.

The uproar surrounding ArcelorMittal’s decision, together with the poor performance of the steel industry in the first half of the year, provided the sector with a convenient opportunity to reiterate its demands,[11] and call on the Friedrich Merz government to meet them urgently. The most important of these demands include:

- a reduction in electricity prices (by lowering both wholesale rates and government-imposed charges, especially grid fees);

- guaranteeing demand for low-emission steel in Germany (and more broadly in the EU) – preferably by introducing an obligation to use it in public procurement, for instance in road or railway infrastructure construction (this concept has been debated in Germany for many years under the banner of so-called ‘green lead markets’ and in the EU as ‘pioneer markets’);

- increasing protection against the import of steel from third countries with lower environmental standards into the EU market – mainly by tightening and expanding the scope of the EU’s so-called Carbon Border Adjustment Mechanism (CBAM);

- increasing the availability of steel scrap for German steelworks – primarily by restricting its export outside the EU;

- ensuring the availability of low-emission hydrogen at affordable prices for the steel industry – for example, by relaxing legal regulations that increase production costs or by granting equal status to different low-emission hydrogen production methods in both national and EU regulations;

- enabling the extended use of natural gas in DRI installations until a full switch to hydrogen becomes technically feasible and economically viable.

In light of the above-mentioned problems, some experts – primarily economists – point out that the German steel industry, due to its unfavourable structural conditions, will not be able to remain competitive after switching to low-emission production processes and will be permanently reliant on state support (which is costly). They consider a more effective approach to be abandoning attempts to defend the status quo at all costs and accepting structural changes in the sector – namely, giving up part of the domestic, more expensive, low-emission production of crude steel in favour of imports, while focusing instead on the next stage of processing: the manufacture of finished steel products. However, for now, such a proposal is highly controversial – both for political and social reasons (deindustrialisation) and for strategic ones (owing to the sector’s economic importance, including for the defence industry).

Internal forecasts and prospects

The new CDU/CSU–SPD government led by Merz has identified reviving the stagnating economy and halting the gradual deindustrialisation of the country as among its priorities.[12] The coalition agreement already indicates that the governing parties assign a special role to traditionally strong industrial sectors: automotive, chemical, and steel. Of these, steel has even been accorded ‘central, strategic importance’ for the German economy, with pledged support for the decarbonisation process. Planned measures include the implementation of so-called green-lead markets, improved access to steel scrap, and the authorisation of CCS technology in the steel sector. In the short term, measures to reduce electricity and gas prices will be crucial for improving the competitiveness of the industry. These are to be introduced this autumn. They involve, in particular, the reduction of the grid fee through state budget subsidies amounting to €6.5 billion (for 2026) for the expansion and maintenance of electricity transmission networks (although all electricity consumers will benefit, energy-intensive sectors will benefit the most). The elimination of the so-called storage fee (€3.4 billion for 2026) will, in turn, result in the reduction of natural gas prices. However, the German steel industry is hoping for further relief – especially the special energy-cost subsidies for energy-intensive industries promised in the coalition agreement.

Both the content of the coalition agreement and the first months in office show that the new government intends, in principle, to continue the policy of decarbonising the sector. The main advocate of the current course – particularly regarding the transition to using hydrogen in steel production – is the SPD. Its representatives in the cabinet, led by Vice-Chancellor and Finance Minister Lars Klingbeil, as well as in the federal states (e.g. the Minister-Presidents of Lower Saxony and Saarland), along with the party’s base (notably the main trade unions closely linked to the Social Democrats), are clearly demanding the continuation and state support of this transformation path. The changes negotiated by the Christian Democrats involve the introduction of an additional decarbonisation option for the industry in the form of carbon capture – a legislative package enabling investments in CCUS installations and infrastructure is due to be adopted this autumn.

Meeting the sector’s expectations also requires a more pragmatic approach to hydrogen sourcing (abandoning the exclusive focus on so-called green hydrogen). Apart from AfD, no party questions the need to decarbonise the industry – the debate among Germany’s political, business, and expert elites concerns only which technologies and support instruments should be applied, and at what pace the transformation should be implemented. Despite its negative economic consequences, the transformation resulting from climate policy is still regarded as a necessary meta-process which, with the right stimulus policies, could ultimately bring benefits to the economy, including industry – for example, in the form of innovative, eco-friendly ‘technologies of the future’.

The German steel industry is also placing great hopes in the relaxation of the so-called debt brake to allow for increased investment in broadly defined infrastructure and defence. In particular, the allocation of an additional €500 billion for the construction or modernisation of roads, railway lines, and bridges is expected to significantly boost domestic demand for steel. The industry also hopes that the government will introduce a requirement for the use of low-emission steel of domestic origin in public procurement.[13] The German steel industry also regards the growing expenditures on military equipment in Germany (and more broadly in Europe) as an important area of growth, partially offsetting declines in other market segments. This is prompting individual steelworks (e.g. Salzgitter and SHS) to invest in expanding their offerings for the defence sector.[14]

External prospects

The actions of the new government indicate that, at the EU level, Germany will continue to support the policy of decarbonising the steel sector and complement it with new incentive instruments. However, it may also be open to certain adjustments to make this policy more flexible. Berlin’s priorities within the EU will include implementing regulatory mechanisms to guarantee demand for low-emission steel produced in Europe, as well as strengthening protection of the domestic market against imports of cheap steel from third countries and against the effects of carbon leakage (through tightening and expanding CBAM).

Another important task for the Merz government will be to persuade the European Commission to ease the conditions of the subsidies granted for ongoing decarbonisation projects (allowing prolonged use of natural gas and introducing more flexible conditions for the transition to hydrogen), in order to avert the risk of having to repay the funds. At this stage, Berlin’s position on the reform of the ETS remains unclear – government representatives have signalled the possibility of supporting an extension of free allowances for energy-intensive industries. However, the German steel industry is divided on this issue: ThyssenKrupp Steel has called for a relaxation of current regulations, while Salzgitter and SHS have supported maintaining them so as not to weaken the incentives for decarbonisation.

From the perspective of Poland and many other EU member states, Berlin’s push to relax the rules for granting state aid to domestic industry is regarded as unfavourable. Because of Germany’s financial strength, this could pose a threat to competing companies from other member states.

[1] ‘Stahlproduktion in Deutschland’, Wirtschaftsvereinigung Stahl, wvstahl.de.

[2] ‘Wertschöpfungskette Stahl: Nachhaltigkeit im internationalen Vergleich’, German Economic Institute, August 2022, iwkoeln.de.

[3] Daten und Fakten zur Stahlindustrie in Deutschland, Wirtschaftsvereinigung Stahl e.V., November 2024, wvstahl.de.

[4] M. Sauga, ‘US-Exporte der deutschen Stahlindustrie könnten um 35 Prozent einbrechen’, Spiegel, 7 June 2025, spiegel.de.

[5] ‘Thyssenkrupp-Stahl will 11.000 Stellen abbauen’, Die Zeit, 25 November 2024, zeit.de.

[7] ‘Für eine starke Stahlindustrie in Deutschland und Europa. Handlungskonzept Stahl’, Federal Ministry for Economic Affairs and Energy, 15 July 2020, bundeswirtschaftsministerium.de.

[8] In 2020–2021, the total cost of decarbonising the German steel sector was estimated at €30–35 billion. More recent estimates are not available, but they are certainly much higher, owing in part to inflation.

[9] M. Hesse, B. Müller-Arnold, ‘Wie viel Stahl kann sich Deutschland noch leisten?’, Spiegel, 7 February 2025, spiegel.de.

[10] ‘ArcelorMittal Europe drängt auf schnellere Umsetzung des Aktionsplans für Stahl und Metalle’, ArcelorMittal Europe, 19 June 2025, germany.arcelormittal.com.

[11] Since the sector’s main problems have remained unchanged for many years, the aforementioned demands have long been raised by the German steel industry, albeit with varying emphasis. For example, see the list of demands prepared by the Wirtschaftsvereinigung Stahl association for the new German government following the 2021 elections: ‘Ein Transformationsprogramm für die Stahlindustrie in Deutschland. 10 Forderungen an eine neue Bundesregierung für die ersten 100 Tage’, Wirtschaftsvereinigung Stahl, October 2021, wvstahl.de or the national action plan for the steel sector adopted in September 2024 at the National Steel Summit: ‘Nationaler Aktionsplan Stahl’, September 2024, wirtschaft.nrw.

[12] OSW’s Department for Germany and Northern Europe, ‘Course adjustment: the CDU/CSU–SPD coalition agreement’, OSW Commentary, no. 660, 17 April 2025, osw.waw.pl.

[13] ‘Gemeinsames Positionspapier: Sondervermögen Infrastruktur und Klimaneutralität – Heimische Grundstoffe für nachhaltiges Wachstum!’, Wirtschaftsvereinigung Stahl, 8 July 2025, wvstahl.de.

[14] F. Güßgen, ‘Plötzlich Rüstungskonzern: Ist das Salzgitters Ausweg aus der Krise?’, WirtschaftsWoche, 4 August 2025, wiwo.de.