Great expectations: LNG on the European gas market

The first shipment from the Sabine Pass terminal on 24 February 2016 marked the beginning of US liquefied natural gas (LNG) exports. Two large Australian terminals also commenced operation in the first quarter of this year. LNG is becoming increasingly available on the global markets. By 2020 the new export infrastructure, located above all in Australia and the United States, is expected to boost the global potential of LNG exports by 40%. The presence of new players and the increased volumes of gas available on the market will most likely lead to an evolution of the rules of LNG trade: contracts will become more flexible, and price formulas will be changed.

Meanwhile, as the pace of growth of demand for LNG in Asia has slowed down, the significance of Europe as an LNG outlet has been growing. This offers the opportunity to improve the diversification of supplies and to reduce gas prices in the EU. This is particularly important for the Baltic states and Poland, where Russian gas supplies predominated until recently. Over the past eighteen months, these countries have put terminals by the Baltic Sea into operation which enable LNG imports: Klaipeda in Lithuania, and Swinoujscie in Poland.

The increasing availability of LNG translates into growing competition for the traditional suppliers of natural gas to the EU market, including Russia’s Gazprom. Another challenge, to new and traditional exporters alike, are the falling gas prices across the EU, on hubs and in long-term contracts; these are making the competition even fiercer. This may contribute, in particular, to Gazprom changing its strategy to defend its market share: by improving the flexibility of its operations, increasing its presence on European hubs, and by it deliberately competing on price. Gazprom’s European strategy and its specific effects will thus be the essential factors influencing the possibility of increasing the LNG share in the EU’s gas supply basket – alongside the price level and the demand for gas in the EU and also the effectiveness of the diversification policy adopted by the EU (including the recently published LNG strategy) and its individual member states.

More LNG: how much, how, and where from

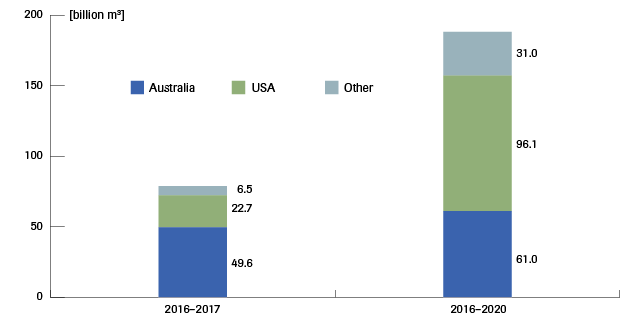

The increasing opportunities for exporting liquefied natural gas observed at present are a manifestation of the second wave of the rapid growth in the availability of LNG worldwide. The previous wave took place in 2009-2010, when new terminals (above all those located in Qatar) enhanced export capacity by around 100 billion m3 (bcm). The first LNG wave contributed to a further liberalisation of the European gas market, and to strengthening the role of hubs and spot prices. The share of LNG in the European gas imports mix had temporarily increased, but no sustainable change in the structure of imports were observed on the EU scale. The present wave began to swell in 2015 and has contributed to an increase in LNG export capacities worldwide by around 33 bcm. These capacities are expected to grow by 40% by 2020 (by around 177 bcm) – see Appendix. Almost half of the new terminals are expect to become operational in 2016-2017, although delays should be expected due to an environment of exceptionally low gas prices. More than 90% of the new export capacities will be located in Australia (two thirds of the total capacity) and the USA[1]. Three large terminals, with a total export capacity of around 55 bcm, were opened in the first quarter of 2016 alone. The first shipment from Australia Pacific LNG was dispatched on 9 January, from Sabine Pass (USA) on 24 February, and from Gorgon LNG (Australia) on 21 March.

The new terminals have added to the diversity of LNG supply sources. They will allow Australia to become the world’s largest exporter of liquefied natural gas by the end of this decade, pushing Qatar into second place. The terminals also enabled the United States to launch exports opening the way for it to become the third largest exporter on the global market.

The actual export volume will depend on a number of factors, including demand and global gas prices. However, only some of the exporters (mainly those from the USA[2]) can withhold exports when market conditions are unfavourable. Most of them will sell LNG to at least partially offset investment expenses. It has also been predicted that the rapidly growing supply will be higher than the demand for gas in the next few years. The consequences of the slowdown in the growth of demand in Asia (LNG imports decreased in China in 2015 for the first time; according to forecasts, Japan will also reduce its imports) and the oversupply will include: strengthening the role of short-term LNG trade, and intensifying the competition between the various sources of LNG and between LNG and pipeline gas[3]. This may, in turn, further reduce gas prices which are already low (in part due to low oil prices) and affect exporters’ strategies. Qatar, which is losing its position as global leader, has already begun adjusting to the changing situation on the market[4]. Examples of this include Qatar’s RasGas reducing the price of its LNG supplies to India’s Petronet by half, and the change of the price formula itself[5] and the favourable conditions of the recently signed long-term contract between Qatar and Pakistan[6].

The increase in Australian and US exports of LNG in the coming years will equate to a strengthening of the global role of ‘Western’ suppliers and trade practices. In particular, exports from the USA will entail the emergence of new rules in LNG trade: US gas, instead of being oil-indexed, is indexed to the Henry Hub gas prices, and contracts have no destination restrictions[7]. This makes it possible to sell gas almost anywhere in the world, depending on the market conditions and the specific needs and possibilities. The US rules of LNG trading, which are different than those commonly used so far, seem to offer more flexibility and the ability to respond to changing market conditions, and this may make these rules more popular. They can thus contribute to an evolution of gas trading rules and to improving the flexibility and the convergence of the global gas markets.

The EU’s great expectations

The changes on the global LNG market, the rapidly increasing export potential, and the currently reduced growth of demand for gas (including LNG) in Asia all add significance to the European market. This offers European consumers the chance for supplies of relatively cheap LNG. This also concerns Central European countries, which are mostly bound by long-term contracts and want them to become more flexible and/or supplemented with short term, hub-priced supplies. This contributes to the implementation of the goals of the European energy policy as defined since 2014 (after the Ukrainian crisis), including the diversification of supply sources, partly through the increase of LNG imports, which was called for in the European Commission’s document on the Energy Union of February 2015 and which is one of the goals of the EU’s LNG strategy of February 2016[8].

The EU’s LNG imports have been falling since breaking records in 2011 – only 41 bcm of the 191 bcm of available regasification capacity was used in 2014; i.e. 21.5%[9]. This was linked above all with the strong competition from Asian markets and relatively high LNG prices, but also with insufficient integration of the terminals with the gas grid across the EU. The present market (oversupply, low and still falling prices) and political conditions (interest in diversification) increase the chances that both the import volume of LNG and its role in the EU will in fact grow. Although the first LNG shipments from the new terminals in the USA and Australia did not go to the European market[10], LNG supplies from other sources have been increasing. In 2015, LNG imports to Europe (including Turkey) rose by 15.8%[11], and the forecasts, for example from the IEA, suggest that they may double to around 90 bcm by 2020, which would satisfy around 18.2% of total demand (8.4% in 2014)[12].

The possibilities for absorption of the increasing LNG quantities by the EU depend, among other factors, on connecting the existing terminals and those under construction to the internal gas grid. The market integration goals, the Projects of Common Interest (PCI) list (which has been revised also for this purpose) and the EU LNG strategy are aimed at improving the possibilities of transmitting gas from regasification terminals not used to capacity (in Spain, France and the United Kingdom) to recepients across the EU, including those that are most interested in alternative supply sources. It is possible to observe, for example, the efforts made to enable LNG from Spain, which has around 30% of the EU’s overall regasification capacity (around 60 bcm in 2015 – see Appendix), to flow to its neighbour, France (the MidCat project) and beyond, for example, to Italy, or the projects aimed at facilitating LNG distribution from the new terminals by the Baltic Sea to other Central and Eastern European countries (the North-South gas corridor).

The Central and Eastern European case

The changes on the LNG market coincide with important changes in the infrastructural landscape of Central and Eastern European countries, which were until recently heavily dependent on Russian gas supplies. Two LNG terminals already operate by the Baltic Sea – the floating terminal near Klaipeda in Lithuania (opened in December 2014) and the Polish terminal in Swinoujscie (opened in December 2015, and expected to commence commercial operations in July 2016). The new infrastructure enables a real diversification of both the sources and the routes of the gas supply. It also makes it possible to supply in aggregate 7 bcm of LNG (5 bcm in Swinoujscie[13] and 2 bcm in Klaipeda) annually and to boost competition on the regional market.

Lithuania forecasts that its LNG terminal will enable it to import at least half of its gas needs in 2016 from Norway, which will put an end to the long-lasting dominance of Russian gas on the Lithuanian market[14]. Furthermore, the construction of the terminal enabled Lithuania to negotiate a price discount from Gazprom in 2014-2015, while previous negotiations to this effect had been unsuccessful[15]. The new market context has also affected other rules of gas supply to Lithuanian recipients: short- or medium-term contracts currently predominate in imports, and Gazprom itself – since no new long-term contract was signed – has decided to sell part of its gas at auction at competitive prices[16]. LNG supplies via the Lithuanian terminal have also made possible the diversification of gas supplies to Estonia (it bought gas from the Lithuanian terminal already in 2015) and have opened up the same option to Latvia. The launch of the terminal in Swinoujscie should have similar results. It coincides with the increased availability of cheap LNG and is changing the situation of Poland and, potentially, also of other Central European countries as regards the gas sector. In addition to providing access to alternative sources of natural gas, the new transport infrastructure may help the Polish side renegotiate the conditions of Russian gas supplies under the long-term contract currently in force (Gazprom-PGNiG). It may also affect the shape of the regional market, by stimulating inter alia the development of infrastructure that will enable gas supplies from Swinoujscie to other countries in the region, for example as part of the North-South corridor. This may also boost the development of gas hubs in the region or see them merge with the large Western hubs (for example, those in Germany).

The Baltic terminals are also important in the context of the continuing conflict in Ukraine, strained relations (also concerning gas) between the EU and Russia and the sustained, increased risk of instability of Russian gas supplies via Ukraine to the EU, including to the countries located on its eastern flank.

Regardless of the multi-level benefits resulting from the launch of the new infrastructure, the use rate of the new terminals in the longer run is not certain. Nor is the future level of demand for gas in the region certain, and LNG will have to compete with gas supplies from both Russia and European countries and companies (including German ones). Finally, given the environment of oversupply, the Baltic terminals are likely to compete with each other for market share – unless a successful co-operation formula, e.g. via demand aggregation, is developed. Therefore, it is not certain that the existing import infrastructure and the availability of LNG on the global market will suffice to ensure a lasting diversification of supplies in the region.

Hope vs. reality: the EU’s gas market

The growing supply of LNG and the increased need of diversification due to the Ukrainian crisis are at contrast with the situation on the EU’s gas market. Demand had been falling for several years to reach the record-low level of 409 bcm in 2014 (a decrease of 11%)[17]. And although demand was higher in 2015, according to early estimates, the forecasts are not overly optimistic. Both the IEA and the EU expect gas demand to stabilise in the coming decades[18]. Its final level will in part depend on the manner and the consequences of the implementation of the EU’s climate policy, including a possible tightening of the adopted targets for the reduction of greenhouse gas emissions, which might entail a reduction in gas consumption. Another important factor will be the price competitiveness of gas as compared to other energy sources, including renewable energy and coal.

At the same time, domestic gas production is falling in the EU. The restrictions on extraction, for example, imposed by the Netherlands in 2015 have contributed to a clear increase in import needs and these are expected to grow in the coming years (a further decrease in the EU’s output; the failed plans of unconventional gas development). According to the IEA’s forecasts, gas imports to Europe and Turkey will increase by around 70 bcm by 2020 [19].

Furthermore, gas import prices have clearly been falling over the past few months – in January 2016 they were on average 12% lower than a month earlier and 46% lower than a year earlier[20]. Since oil prices have remained low (and the time lag in their feeding through to oil-indexed gas prices in long-term contracts), further price falls can be expected in the coming months.

The reduced demand for natural gas in the EU, the low prices along with the uncertainty about future demand and the real shape of the EU’s energy policy have all hindered the implementation of new infrastructural projects (including interconnectors) and provoke questions as to whether the EU’s policy of diversifying gas supply sources is fit for purpose. The problems EU-based gas companies have been encountering incline them to adopt more precautionary strategies and to search for ways of stimulating EU gas demand, for example through co-operation with traditional suppliers, including the world’s largest gas exporter, Russia.

Russia vs. LNG on the European gas market

Russia’s Gazprom will remain the EU’s most important external supplier of natural gas: in 2015 it exported around 132 bcm to the EU [21]. The share of Russian gas in the EU’s gas imports visibly increased from 28% in 2009 to over 32% in 2014. In the context of stagnating and even falling demand, this did not result in a significant growth in Gazprom’s exports. A diversification of sources of gas supplies to the EU on a greater scale would thus put the share of Russian gas in the EU market at stake. The current situation on the EU’s gas market, intensifying competition from LNG and the policy of gas supplies diversification adopted by the EU and its member states are among key challenges Gazprom faces in Europe. Additionally Gazprom faces the lack of available alternative large markets for Russian gas in the short to medium term (the projects envisaging exports to China will be implemented in the longer term). All of that are the key factors triggering a probable modification of Gazprom’s European gas exports strategy. It seems particularly likely that the Russian gas price defence strategy will be replaced with the strategy of defending its share in the European market – for example, through improving the flexibility its operation on this market and by competing with alternative suppliers on price.

There are several ways in which Gazprom could, and already is improving its flexibility. It could intensify its engagement in short-term transactions on the gas market (by holding further gas auctions, more frequent sales via hubs and at spot prices and other). It could increase its share in the EU’s gas infrastructure (as it already does for example in case of storage facilities in Germany and Austria, and gas pipelines e.g. Gascade). And it could continue to diversify the export routes to the EU (for example by promoting projects such as Nord Stream 2, and, in the longer run, increasing its share in the LNG market).

It is difficult to predict at present whether, and to what extent, Gazprom is in fact prepared for a ‘price war’[22], i.e. deliberately playing to reduce the gas prices at European hubs to a level that would undermine the profitability of LNG imports[23]. Doubtless, it is capable of taking action of this kind (low marginal costs of production, assets owned on the European market, etc.), and the present gas prices in its long-term contracts are already exceptionally low and will continue to fall[24]. Gazprom also seems to be quite strongly motivated to fight for its share in the EU market, given the dwindling sales in the CIS area[25], the distant perspective of exporting gas via pipelines to Asia and the challenges on the domestic market[26].

Conclusions

The availability of LNG to European customers will visibly grow in 2016-2018 – this will above all be from gas originating from Australia, Qatar and the USA. Given the oversupply on the gas markets and the continuing slump in oil prices, this gas will be relatively cheap.

The inflow of LNG to the EU poses a challenge to Gazprom, which also faces a number of other challenges, such as competition on the Russian domestic market, the EU’s diversification policy and falling exports to the CIS. This may stimulate changes in the company’s European export strategy, and potentially also even lead to a ‘price war’ in order to protect the share of Russian gas in the EU market.

As a consequence of LNG inflow and the likely changes in the rules of Russian gas sales, European customers may expect more favourable conditions of supplies and a development of the EU’s market – growth in its flexibility and number of short-term transactions. This also offers a chance to Central and Eastern European countries seeking diversification, better conditions of supplies and increased competition.

Intensified competition between Russian gas and LNG may adversely affect the shares of other suppliers in the EU market (Norway) and make European recipients less inclined to sign long-term contracts for LNG supplies. This, in turn, may make it difficult to assure a sustained increased role for LNG on the European market should the likely change of the situation on global gas markets come to bear.

Appendix

Rise in LNG export capacities in 2016-2020 (bcm)

Data from: www.globallnginfo.org, IEA, Mid-Term Gas Market Report 2015

Map

[1] IEA, Mid-Term Gas Market Report, 2015.

[2] The owners and the operators of LNG terminals in the USA are usually different entities than the producers and potential exporters of gas; hence the possible delay in gas exports due to the slump in gas prices. The delay is not certain, though, given the changing market conditions, the need to compensate for the minimal expenses, etc..

[3] Cf. e.g.: R. Huber, LNG pricing – the enemy within (and the one at the door), 25 January 2016; http://www.lng.guru/the-enemy-within/

[4] e.g. Bloomberg Business, M. Sergie, ‘Biggest No Longer Means Best in Qatar's Strategy for LNG Wealth’, 6 January 2016, http://www.bloomberg.com/news/articles/2016-01-06/biggest-no-longer-means-best-in-qatar-s-strategy-for-lng-wealth

[5] Business Today, ‘Qatar to halve gas price for India as global rates slump’, 1 January 2016; http://www.businesstoday.in/current/corporate/petronet-to-buy-lng-from-qatar-at-almost-half-original-cost/story/227630.html

[6] Pipeline Oil & Gas magazine, ‘Qatar signs LNG supply deal with Pakistan’, 11 February 2016; https://www.pipelineme.com/news/regional-news/2016/02/qatar-signs-lng-supply-deal-with-pakistan/#.Vrw2CeDYejI.twitter

[7] Natural Gas Europe, S. Sakmar, ‘Cheniere LNG: What Carl Icahn Got Right’, 16 December 2015; http://www.naturalgaseurope.com/cheniere-lng-what-carl-icahn-got-right-27182

[8] European Commission, Communication on an EU strategy for liquefied natural gas and gas storage, 16 February 2016; https://ec.europa.eu/energy/sites/ener/files/documents/1_EN_ACT_part1_v10-1.pdf

[9] Gas Infrastructure Europe, ‘Abstract LNG Map & Investment Database 2015: The European LNG terminal infrastructure 2015 - Status and Outlook’, 17 June 2015; http://www.gie.eu/index.php/publications/cat_view/3-gle-publications

[10] The first LNG cargo from the Sabine Pass terminal was supplied to Brazil, and the first from Gorgon LNG to Japan.

[11] Cf. International Group of Liquefied Natural Gas Importers, The LNG Industry. GIIGNL Annual Report 2016 Edition, 2016 http://www.giignl.org/sites/default/files/PUBLIC_AREA/Publications/giignl_2016_annual_report.pdf. This growth has been achieved partly owing to a decrease (by 31%) of the EU’s LNG re-export.

[12] Cf. IEA, Mid-Term Gas Market Report, 2015, page 95.

[13] With the option to be increased by 2.5 or even 5 bcm.

[14] Reuters, Norway to surpass Russia as Lithuania's top gas supplier in 2016, 8 February 2016; http://www.reuters.com/article/lithuania-gas-idUSL8N15N1UF

[15] Joanna Hyndle-Hussein, ‘Russia – Lithuania: towards a normalisation of gas relations?’, OSW Analyses, 4 June 2014; http://www.osw.waw.pl/en/publikacje/analyses/2014-06-04/russia-lithuania-towards-a-normalisation-gas-relations

[16] Joanna Hyndle-Hussein, ‘Pierwsza aukcja rosyjskiego gazu dla państw bałtyckich’, OSW Analyses, 23 March 2016; http://www.osw.waw.pl/pl/publikacje/analizy/2016-03-23/pierwsza-aukcja-rosyjskiego-gazu-dla-panstw-baltyckich

[17] Eurogas, ‘New Eurogas data confirms dynamic EU gas market’, 25 March 2015; http://www.eurogas.org/uploads/media/Eurogas_Press_Release_-_New_Eurogas_data_confirms_dynamic_EU_gas_market.pdf

|

[18] Cf. IEA, World Energy Outlook 2015 and European Commission, Fact Sheet – Security of gas supply regulation, 16 February 2016; http://europa.eu/rapid/press-release_MEMO-16-308_en.htm |

[19] Cf. IEA, Mid-Term…, op. cit.

[20] YCharts, ‘European Union Natural Gas Import Price: 4.90 USD/MMBtu for Feb 2016’, 3 March 2016;

[21] Initial data from Gazprom Export and the media.

[22] Reuters, U.S. and Russian gas exporters square up over Europe, 17 November 2015; http://www.cnbc.com/2015/11/17/reuters-america-us-and-russian-gas-exporters-square-up-over-europe.html

[23] H. Rogers, D. Stokes, O. Spinks, ‘Russia’s strategic response to an oversupplied gas market’, Timera Energy, 23 November 2015; http://www.timera-energy.com/russias-strategic-response-to-an-oversupplied-gas-market/

[24] J. Henderson, ‘Time to contemplate a change of Gazprom marketing strategy in Europe?’, Gastech News, 17 February 2016; http://www.gastechnews.com/lng/time-to-contemplate-a-change-of-gazprom-marketing-strategy-in-europe/

[25] Mainly due to the rapid decrease in exports to Ukraine by around 58% in 2015: Naftogaz, ‘У 2015 році Україна забезпечила 63% потреб в імпортованому газі поставками з Європи’, 29 January 2016;

http://www.naftogaz.com/www/3/nakweb.nsf/0/DDF058F6412F06C8C2257F4900584C01?OpenDocument

[26] Including the falling demand and Gazprom’s losing share in the domestic market to Rosneft and Novatek.