Derogation of Rosneft’s German assets from US sanctions

On 29 October, the United States temporarily (until 29 April 2026) exempted the Germany-registered Rosneft Deutschland (RND) and RN Refining & Marketing (RNRM) from sanctions imposed a week earlier on Russia’s largest oil companies (for more, see: ‘Trump’s first sanctions, the EU’s 19th sanctions package: the West increases the pressure on Russia’). Since September 2022, Rosneft’s German assets have remained under the control of the Federal Republic of Germany through a trusteeship administered by the Federal Network Agency (BNetzA). This arrangement is renewed every six months, with the current mandate in force until 10 March 2026 (for more, see: ‘Germany: sixth extension of state control over Rosneft assets’).

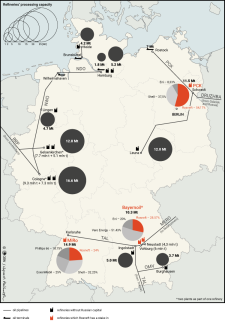

RND and RNRM are responsible for the import, processing, and sale of crude oil and petroleum products within Germany. Through these entities, Rosneft previously co-managed three German refineries – a role now undertaken by BNetzA. The company holds a 54.17% stake in PCK Schwedt (37.5% via RND and 16.67% via RNRM), 24% in MiRo in Karlsruhe, and 28.57% in Bayernoil in Vohburg/Neustadt. By virtue of these holdings, Rosneft is Germany’s third-largest oil company by refining capacity, with a 12% market share, behind Shell and BP. It also holds stakes in several German oil pipelines, including an 11% share in the TAL pipeline, which plays a key role in supplying refineries in southern Germany.

Commentary

- In recent days, Germany has been vigorously lobbying for a derogation, as the US sanctions threatened to seriously disrupt the operations of the refineries in which RND and RNRM hold stakes. In response to the US measures, many partners of these facilities, primarily banks, reportedly informed their operators that they would have to suspend cooperation from 21 November – the date the sanctions are set to take effect – due to concerns over so-called secondary sanctions from the United States. The company operating the PCK refinery in Schwedt would have found itself in the most precarious position, potentially facing insolvency under such circumstances. Moreover, a shutdown of these facilities would have disrupted fuel supplies in parts of the country, triggering price increases.

- Germany’s control over Rosneft’s assets in the country is a temporary measure introduced to stabilise the operations of the refineries with Russian ownership stakes until the disputed shares can be transferred to new owners. In February 2024, Berlin was reportedly considering expropriating Rosneft – a step for which legal grounds had been established in 2022, with energy security among the possible justifications. Ultimately, however, the German government reached an agreement with the Russian company, which committed itself to selling its German assets voluntarily. Last year, discussions on this matter were reportedly held with the Qatar Investment Authority and Kazakhstan’s KazMunayGas. For nearly a year, however, no information has emerged concerning any ongoing negotiations (the Qatari fund is believed to have withdrawn from the talks altogether), despite Russian assurances to Berlin that discussions have continued. It is becoming increasingly evident that Rosneft has merely been playing for time and feigning negotiations.

- The temporary nature of the derogation potentially introduces a new dynamic into the issue of transferring ownership of the disputed shares. The looming threat of US sanctions may prompt the parties concerned to break the deadlock. Three scenarios are possible. In the first, Rosneft voluntarily sells its assets to a chosen buyer – a solution Germany has long preferred as the simplest option, both politically and legally. In the second, due to the lack of any realistic prospect of concluding such a transaction, Germany opts for expropriation. In this case, Russia is likely to respond with retaliatory measures, including the possible suspension of crude oil supplies to the Schwedt refinery from Kazakhstan transiting Russian territory; these shipments currently account for about 15% of the refinery’s throughput. Following expropriation, the shares could be sold to one or more new owners or possibly retained by the federal treasury. From Germany’s perspective, ensuring alternative crude supplies to Schwedt via Poland would be of critical importance in this scenario. Under the third option, Rosneft continues to stall, hoping for a breakthrough in US-Russia negotiations over the war in Ukraine that could lead to the lifting of sanctions, or seeking another extension of the derogation. Early indications from Berlin following the imposition of the US sanctions suggest that preparations for expropriation have resumed. However, these actions may be intended as a form of pressure on the Russian side to persuade it to divest its German holdings voluntarily.

Map. Oil transmission infrastructure and refineries in Germany

Source: German Petroleum Industry Association (MWV, since 2021 – En2X).