Germany: sixth extension of state control over Rosneft assets

On 8 September, the Federal Ministry for Economic Affairs and Energy announced a further — sixth — extension of trusteeship over Rosneft Deutschland and RN Refining & Marketing. The measure will remain in force until 10 March 2026. Berlin first assumed control of the Russian oil company’s assets in Germany in September 2022 (see: Germany: the state takes control over Rosneft's assets). Under German law, a trusteeship can initially be imposed for six months, but may subsequently be extended multiple times for the same period if required to safeguard national energy security. During this time, the legal owner loses the right to manage the assets, and authority is transferred to a government-appointed body — in this case, the German regulator, the Federal Network Agency (Bundesnetzagentur).

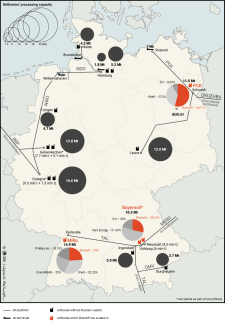

The justification for the decision, published in the Federal Gazette, stated that continued state control over Rosneft’s assets was necessary to guarantee the uninterrupted operation of the three German refineries in which the Russian company holds stakes (see map). It noted that business partners — including oil suppliers, financial institutions and insurers — refuse to cooperate with facilities managed by Russian entities. Many contracts include clauses allowing partners to unilaterally terminate cooperation should Rosneft regain control of the companies. Such a scenario would paralyse operations at refineries that are vital to Germany‘s fuel security.

The document also referenced a fourth agreement between the German government and Rosneft, under which the company has committed to selling its German assets. Under the latest arrangement, the deadline for the sale has been set for 28 February 2026.

Commentary

- It is becoming increasingly evident that Rosneft has no intention of voluntarily selling its German assets and is merely playing for time by simulating negotiations. In 2024 the media still reported — with indirect confirmation from both the Russian and German sides — ongoing talks with potential buyers, including the Qatari sovereign fund, the Qatar Investment Authority, and the Kazakh state-owned company KazMunayGas, but no progress has been reported this year. In fact, the Qataris are believed to have withdrawn from the negotiations altogether.

- The latest extension of the trusteeship merely entrenches the existing status quo. From Germany’s perspective, a voluntary sale of the shares by the Russian side remains the most convenient outcome, since it is neither possible to put the assets back under Rosneft’s control nor politically feasible to pursue expropriation — an option explicitly permitted by law if national energy security requires it. Berlin fears Russian retaliation, which would likely target the German companies still operating in Russia. It could also involve halting, under some pretext, the supply of Kazakh oil to the PCK refinery in Schwedt. Germany’s strained fiscal situation adds another layer of complexity, as expropriation could potentially result in multi-billion-euro compensation claims for nationalised assets. Reluctance to move forward with expropriation may also stem from broader international considerations, including efforts by the US administration to engage Moscow in talks on the war in Ukraine. According to statements made by the Federal Minister for Economic Affairs and Energy Katharina Reiche during a Bundestag committee session, the government is currently seeking a ‘legally secure’ long-term solution to the ownership of the disputed shares. Opposition parties, including the Greens and The Left, have openly called for expropriation and permanent state ownership of the assets.

- Due to limited crude oil supplies, the PCK refinery in Schwedt — which also supplies part of western Poland — is operating at just over 80% of its processing capacity. As a result, it is operating on the edge of profitability or, according to the plant’s council, incurring losses. The increase in output compared to last year (just under 70%) was made possible by higher oil deliveries from Kazakhstan, which are expected to total 2 million tonnes this year (up from 1.5 million tonnes in 2024). The refinery’s main source of supply remains the port of Rostock, which handles between 6 and 7 million tonnes annually. The remainder is delivered via the Polish oil terminal in Gdańsk.

Map. Oil transmission infrastructure and refineries in Germany

Source: German Petroleum Industry Association (MWV, since 2021 – En2X).