Germany: amendment to the special LNG law

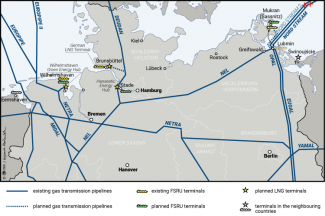

On 7 July 2023, the Bundestag and the Bundesrat amended the special law on the construction of LNG import infrastructure in Germany (LNG-Beschleunigungsgesetz), which will enable it to speed up the implementation of the specific projects listed in the document. The most important modification involves the list of investments, that is, the beneficiaries of the amended law. The construction of an LNG terminal at the port of Mukran on Rügen, alongside an interconnector linking the facility with the gas transmission network near Lubmin, has been added to the list. The initial plans regarding the location of so-called floating terminals (FSRU) in Rostock and Hamburg were dropped in summer 2022 following the relevant analyses, and have now been removed from the list. In its current wording the law refers to the three FSRUs inaugurated at the beginning of this year in Wilhelmshaven (I), Brunsbüttel and Lubmin, as well as another three planned units: in Wilhelmshaven (II), Stade and Rügen, plus three onshore gas ports which are currently being considered (see map).

Another modification resulting from this amendment involves the adoption of a more precise wording of the regulations, on the basis of which the onshore gas ports will be switched from LNG to emission-neutral energy carriers (the law envisages such a switch in the future). The investors were already obliged to present plans for the future modernisation of their facilities during the permit issuance process.

The LNG terminal on Rügen is expected to serve two FSRU units: the one which has been leased by Deutsche ReGas and is currently operating in Lubmin (Neptune), and one of the five units leased by the German government (Transgas Power). Both units will be operated by Deutsche ReGas. According to a press release published by this company, their total regasification capacity will be 13.5 bcm annually. Plans have been made to connect the terminal on Rügen with the gas transmission network near Lubmin via an undersea gas pipeline around 50 km in length; this will be constructed using the remaining pipes which have been left unused since the construction of the Nord Stream 2 gas pipeline. The facility will be inaugurated at the turn of 2024.

In its initial wording, the special law was enacted in May 2022 in response to the energy crisis triggered by Russia’s invasion of Ukraine, mainly in order to ensure that the FSRUs were launched efficiently (for more see ‘An abundance of gas ports. The emergency diversification of gas supplies in Germany’). It considerably accelerated the procedures related to the issuance of construction permits and to the study of the environmental impact of the investments, shortened the period for submitting comments on projects, and limited the consideration of possible complaints to the courts of first instance. In the explanatory memorandum to the law, it was stated that the ‘immediate’ implementation of projects involving the construction of LNG terminals is of ‘particular public interest’ and serves Germany’s public safety. Alongside this, in the context of Berlin’s climate policy, which envisages that Germany will achieve carbon neutrality by 2045, the law had set a deadline for the end of LNG imports using the newly-built infrastructure of 31 December 2043. After this date, the gas ports will only be used to import emission-neutral energy carriers (that is, hydrogen and its derivatives such as ammonia, methanol and synthetic fuels).

Commentary

- The inclusion in the special law of the planned LNG terminal on Rügen is necessary for it to be put into operation on time. Due to shortened and simplified procedures, the period for obtaining the relevant permits and the construction work should last a mere couple of months, just as was the case for the FSRUs already operating in Wilhelmshaven, Brunsbüttel and Lubmin. According to German government representatives and the Federal Network Agency officials, the inauguration of the remaining three planned FSRUs in line with the schedule (that is, ahead of the next winter) will significantly boost the security of gas supplies to Germany in the peak consumption period at the height of the heating season. Forecasts indicate that in the absence of gas supplies from Russia, a potentially long and cold winter could result in the quick consumption of the gas stored in storage facilities, which in turn would create the risk of a gas shortage at the beginning of 2024. The location of at least two FSRUs in the Baltic Sea (near Lubmin) is favourable because they are capable of pumping gas into the transmission network which (until 2022) had been used to distribute Russian gas which was then sent to Germany’s eastern and southern federal states, as well as to the Czech Republic, Austria and other countries. These countries have expressed their interest in importing LNG via the German terminals. The split of LNG imports into facilities located in the North and Baltic Seas (see map) is expected to result in a more balanced utilisation of the transmission network and avoid bottlenecks in the system.

- The concept for building an LNG hub on Rügen, which was unveiled in February 2023, has sparked major controversy in the region and has become a topic of nationwide debate. Numerous protests have finally forced the federal government to modify its initial plans in terms of both the terminal’s location and its technical parameters (for more on the initial project see ‘Germany: plans for a new LNG hub near Rügen’). The initiative’s opponents have mainly criticised its alleged negative impact on tourism, the driving force of the region’s economy, and on the environment. Other observers (including some experts) have also called into question Germany’s demand for additional LNG import infrastructure, especially in the context of its ambition to meet its climate policy goals. The concept’s most fervent opponents, which mainly include environmental organisations, have announced their intention to continue their attempts to hamper the terminal’s construction, including in court.

- The government’s activities have demonstrated that the federal authorities are determined to implement this project. Despite major public resistance recorded in the region (which has been criticised in the nationwide public debate), recent weeks have seen consistent steps being taken to carry out the investment. Before the enactment of the amended special law, the pipes which will be used to construct the pipeline had been procured, an agreement with the Deutsche ReGas company regarding the terminal’s utilisation had been signed, and the preparatory work had been launched. In this context, it is worth noting that it is mainly Germany’s Vice-Chancellor Robert Habeck from the Greens who is politically responsible for these activities. His activity in this field has sparked controversy both among his party’s members and among their diehard electorate and support base (of which environmental organisations form an important part).

- The more precise wording of the regulations regarding the future switch of onshore gas ports to the import of emission-neutral energy carriers is intended to force the investors to take the future modernisation of their facilities into consideration when planning the investment. This modification was mainly supported by the Greens because to some degree it reduces the political cost of decisions regarding the expansion of the LNG import infrastructure which will be unpopular with the party’s supporters. The Greens’ leadership has presented this infrastructure as a guarantee that the nature of these activities will be transitional, and that efforts will be made to include these facilities in the energy transition and climate policy goals. From the investors’ perspective though, the amendment may pose a certain problem because it extends the duration of the planning process yet further. It remains unclear which of the ‘green’ energy carriers will be selected by specific companies. The current state of the debate suggests that ammonia may be the most promising energy carrier because, compared to the other carriers under consideration, it can be easily transported, does not require any new infrastructure or transport vessels, and can be used directly in the industrial sector (for example, in the chemical industry) or processed to obtain hydrogen and then pumped into the planned hydrogen transmission network. The investors of the gas ports in Brunsbüttel and Stade, as well as the importers who have booked regasification capacity in these terminals, plan to import ammonia in the future. As regards Wilhelmshaven, plans have been made to switch this facility to synthetic methane in the future.

Map. Location of the existing and planned LNG terminals in Germany

Source: Federal Ministry for Economic Affairs and Climate Action.