Russia: the government’s ineffectiveness in the face of Ukrainian attacks on refineries

On 30 September, the Russian government decided to extend restrictions on fuel exports. Until the end of 2025, Russian entities will be completely forbidden from exporting petrol and there will be a partial limitation on the sale of other goods, including diesel oil. On the same day, the Council of the Eurasian Economic Commission (the executive body of the Eurasian Economic Union) temporarily abolished tariffs on fuels imported into the common market from 10 October. According to media reports, at the end of September Deputy Prime Minister Aleksandr Novak submitted a proposal to Prime Minister Mikhail Mishustin to adopt other measures to regulate the fuel market, including allowing an increase in fuel production at the cost of environmental standards. The Russian parliament will also consider legislation expanding subsidies for the sector.

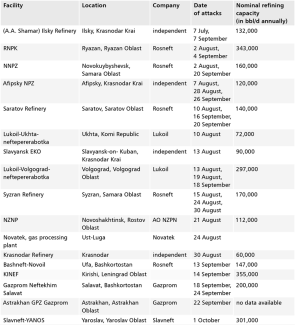

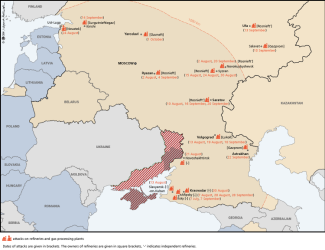

The regulations introduced by the Kremlin are a response to fuel shortages caused by the wave of Ukrainian attacks on fuel infrastructure facilities which began in July (see ‘Russia: record petrol prices following a wave of Ukrainian drone strikes’). Over the past three months, Ukraine has attacked at least 16 separate refinery facilities, carrying out more than 30 drone strikes. The need for state intervention testifies to their high effectiveness. Despite the usual decline in fuel demand after the summer season, tensions on the domestic market persist, as indicated by regional petrol shortages and the government measures.

Commentary

- The effectiveness of the regulations remains doubtful should Ukrainian attacks continue to succeed. Each of the measures introduced or proposed by the government offers only a short-term remedy and increases the costs borne by the government to ensure an adequate domestic supply. Given the expanding scope of Ukrainian strikes – now also targeting distribution stations and export terminals – it may be assumed that Kyiv’s Western partners are not opposed to the ongoing campaign (as they had been in 2024). If the frequency and effectiveness of the attacks are maintained, part of Russia’s refining capacity will remain out of operation, forcing decision-makers to bear the costs linked to an insufficient fuel supply.

- The actual scale of refinery capacity outages is impossible to estimate. At the end of September, industry sources assessed that they amounted to between 15% and 30% of total processing capacity, i.e. up to 2 million bbl/d. Media estimates suggesting damage to as much as 40% of total capacity cannot be verified. Firstly, refinery shutdowns caused by the attacks vary in severity, and a strike on installations of a given throughput does not necessarily equate to the complete loss of nominal refining capacity. Secondly, intensive repair work is under way at the damaged facilities. According to industry reports, some installations attacked in August were expected to resume operations by the end of September. Moreover, Russia had not been using its refinery capacity to its full extent – hence the possibility of shortages being mitigated by increasing refining intensity at undamaged facilities. All this is further compounded by the government’s information censorship, which makes it difficult to assess the extent of the damage.

- As a result of the Ukrainian attacks, Russia has been forced to increase its exports of crude oil. According to calculations by Reuters, in September Russia’s western ports exported 2.5 million bbl/d of crude oil – approximately 25% (500,000 bbl/d) more than in August. Taking into account total crude exports, volumes reached their highest levels since May 2024. This increase is most likely driven largely by the lack of refining capacity. The forced rise in crude exports is unfavourable for the Kremlin, as it leads to a fall in global prices, which form the basis for the Russian government’s taxation of oil extraction. Moreover, the need to import foreign fuel to meet domestic demand also generates costs. Decision-makers will most likely seek to ‘hide’ the real cost of fuel from consumers by covering the difference between international and domestic prices.

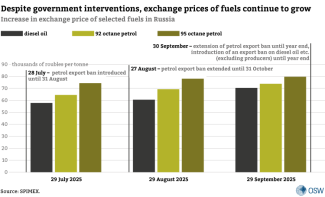

- The seriousness of the problem is reflected in the continuing price dynamics within Russia, confirmed by high wholesale fuel prices. Notably, September saw an increase in diesel oil prices, both on the exchange and at the retail level. This indicates a growing scale of refinery shutdowns, which now affect not only petrol production but are also translating into higher costs for individual consumers. According to Rosstat figures, between December 2024 and the end of September 2025, retail petrol prices rose by 9.2%, while diesel oil prices increased by 3.7%; however, the rise in diesel oil prices saw a marked acceleration in the second half of September (the overall increase in consumer prices measured by the agency during this period amounted to 4.3%). The inflationary impact of the reduced fuel supply presents a dilemma for the Russian government, as rising prices reduce the likelihood of lowering high interest rates, thereby stifling economic activity. Furthermore, the Kremlin’s determination to control retail fuel prices is generating mounting costs for the state budget.

Table. Ukrainian attacks on refineries in Russia between 1 July – 1 October 2025

Map. Attacks on Russian refineries between 1 July – 1 October 2025

Source: author’s own analysis.