Russia: record petrol prices following wave of Ukrainian drone strikes

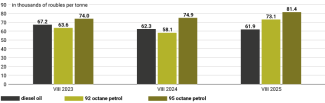

On 21 August, wholesale prices for two types of petrol in Russia – 92- and 95-octane – reached record highs of 73,100 and 81,400 roubles per tonne, respectively. These figures surpassed the previous peak from autumn 2023, when a temporary reduction in government subsidies led to localised fuel shortages at petrol stations (see ‘Fanning the flames: crisis on the Russian fuel market’). Since the beginning of this year, petrol prices have risen by approximately 50%, with the steepest increases occurring during the summer. In response, a temporary export ban was imposed on all companies in the sector from 28 July until the end of August (the regulation does not apply to sales to member states of the Eurasian Economic Union). Despite government intervention, the surge in prices has not been halted. Since mid-August, petrol shortages have been reported in several regions of Russia, including occupied Crimea, Zabaykalsky Krai, and Primorsky Krai.

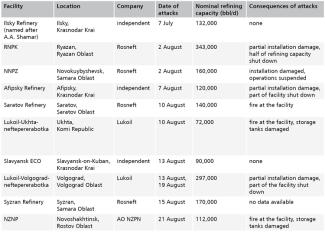

The spike in petrol prices is a direct result of Ukrainian strikes on Russia’s oil and fuel sector. Over the summer, drones targeted at least ten refineries across the country, damaging infrastructure and forcing many to halt production. It is estimated that the current wave of attacks – which has affected some of Russia’s largest refineries, including those in Ryazan and Volgograd that primarily supply the domestic market – has disabled more than 10% of national refining capacity. Resuming operations will require repairs, but these are hampered by sanctions that restrict the import of spare parts. It should be noted, however, that most vehicles in Russia run on diesel, which mitigates the broader economic impact of reduced petrol output.

Commentary

- Ukrainian strikes are effectively disrupting Russia’s fuel market, and their impact has intensified. Although Ukraine has targeted refineries and fuel infrastructure since the outset of the full-scale invasion (see ‘Budanov's sanctions. The consequences of Ukrainian attacks on Russian refineries’), the recent escalation has had the most severe consequences to date. Compared with earlier attacks, those carried out in August were more concentrated, whereas previous strikes were more dispersed over time. The fact that these successful attacks occurred during the summer – a period of heightened fuel demand – further exacerbates their impact on the sector.

- The crisis is also compounded by internal factors, including government policy. Summer fuel price increases in Russia are cyclical, largely due to higher demand during the tourist season and harvest period, as well as the need to build reserves ahead of autumn maintenance shutdowns at refineries. In pre-war conditions, the sector was able to meet this seasonal rise in demand without difficulty, owing to significant spare production capacity. According to estimates by the Argus agency, annual petrol consumption in Russia stands at 35–36 million tonnes, while refinery capacity significantly exceeds this figure (in 2023, nearly 44 million tonnes of petrol were produced). However, in 2024, the government classified data on petroleum product output, making it more difficult for the industry to operate. In particular, it has become impossible to forecast supply trends based on official statistics. According to media reports, parts of the sector chose not to build reserves in the spring, believing that demand for petrol would remain low and citing high interest rates, which rendered financing purchases less viable.

- The difficult situation in the fuel market carries negative implications for the Russian government, compelling it to intervene. The Kremlin views both the inflationary impact of rising fuel prices and the emergence of local supply shortages as potential sources of social tension. Moreover, the shutdown of part of the country’s refining capacity necessitates the rerouting of petroleum product volumes from other facilities, which strains the rail network and creates logistical bottlenecks. The inability to process crude oil domestically has also led to an increase in raw exports, which adds downward pressure on global prices and, in turn, reduces federal budget revenues from taxes on the sector.

- The situation is further aggravated by the government’s reluctance to implement structural improvements to the market. Liberalising the sector – that is, lifting controls on retail fuel prices – would place a sudden and heavy burden on consumers. At the same time, increasing subsidies for producers is problematic given the growing budget deficit. Moscow is attempting to mitigate the crisis through external support, including the possibility of increasing imports from Belarus – a step already taken in 2024 during the first wave of Ukrainian strikes. However, this represents only a short-term remedy and merely postpones the adoption of a systemic solution.

APPENDIX

Table. Ukrainian attacks on refineries in Russia from 1 July to 23 August 2025

Source: author’s own estimates.

Chart. Exchange price of selected fuels 30 August 2023, 22 August 2024 and 21 August 2025

Source: SPIMEX.