Turbulent stabilisation: Turkey’s economy under Şimşek’s supervision

In June, two years passed since Mehmet Şimşek assumed office as Minister of Treasury and Finance, under whose leadership the Turkish economy has been gradually emerging from a prolonged crisis marked by depreciation of the lira, high inflation, and dependence on external financing. This progress is the result of a return to strict monetary and fiscal policies, coordinated with the governors of the Central Bank of Turkey (TCMB), increased oversight of public spending, and the curbing of credit support for Turkish businesses. These measures have improved economic stability and boosted foreign investor confidence in the country.

Turkey’s economic stabilisation programme remains vulnerable to political factors. The arrest of Istanbul Mayor Ekrem İmamoğlu in March this year triggered severe market turmoil and served as a reminder of the primacy of domestic political objectives over economic governance, which guides President Recep Tayyip Erdoğan. Further stabilisation will depend on the consistent continuation of Şimşek’s current course and the intensity of domestic political conflicts.

The end of ‘Erdoğanomics’

Following the presidential and parliamentary elections in May 2023, Turkey experienced a shift in its monetary and fiscal policy. This change was implemented by Mehmet Şimşek – a politician well regarded by international markets, previously serving as Minister of State for the Economy and Deputy Prime Minister in Justice and Development Party (AKP) governments – alongside Hafize Gaye Erkan, who was appointed Governor of the TCMB in June 2023. The Şimşek–Erkan duo brought an end to the era of unorthodox economic policy known as ‘Erdoğanomics’, which, from 2018 to 2023, fuelled Turkey’s financial crisis by controversially lowering interest rates despite high inflation (see Charts 1 and 2). This approach was justified by the aim of generating short-term economic growth through low-interest loans intended to stimulate consumption and investment. However, this policy led to surging inflation, further depreciation of the lira, and destabilisation of the country’s finances.

Between 2018 and 2023, attempts were also made to contain the crisis, but they were short-lived, costly, and failed to produce lasting improvement. Temporary stabilisation was achieved when the TCMB raised interest rates (to 24% in 2019 and, after a previous cut, to 19% in 2021) and conducted foreign exchange interventions to defend the value of the lira. The positive effects of these actions were supported by global trends, such as lower commodity prices and the expansionary monetary policy of the United States, which facilitated easier access to international lending and a capital influx to emerging markets. An increase in exports, driven by the depreciation of the lira, improved Turkey’s trade balance, and inflation declined from 25.2% in October 2018 to 8.6% a year later. At the end of 2021, fears in the private sector of continued depreciation of the lira triggered market panic, causing the currency’s value to plummet – from 10 lira to the US dollar in November to 17 in December – and pushing inflation from 21.3% to 36% in just one month. The second stabilisation attempt occurred in the run-up to the May 2023 elections, when inflation fell from 85.5% in October 2022 to 43.7% in April 2023. This was the result of large-scale TCMB foreign exchange interventions which kept the lira’s exchange rate at 17–18 to the US dollar. However, excessive use of currency reserves nearly depleted them (by May 2023, they had fallen to just $2.33 billion), heightening the risk of insufficient funds to finance the current account deficit and repay foreign debt.

A U-turn

The Şimşek–Erkan duo introduced six fundamental changes to Turkey’s financial policy between 2023 and 2024. First, the TCMB abandoned the controversial policy of lowering interest rates, gradually raising the reference rate from 8.5% in May 2023 to 50% in March 2024. Second, in response to the depletion of foreign currency reserves, it significantly scaled back its support for the lira’s value, resulting in a more realistic exchange rate against foreign currencies. This led to a substantial depreciation of the Turkish lira against the US dollar – from 18 lira in May 2023 to around 32 lira in March 2024.

Third, more stringent regulations were introduced to monitor banks’ financial liquidity and capital flows in order to rebuild the TCMB’s foreign currency reserves, which by September 2024 had increased to $39.7 billion net. Fourth, Şimşek tightened fiscal policy – reducing the budget deficit to 4.7% of GDP in 2024 by raising taxes and cutting public spending, promoted structural reforms, and curtailed credit support for Turkish businesses.

Fifth, the minister made a significant effort to restore the confidence of foreign investors, including by organising numerous meetings with them in London, New York, and the Gulf states. Consequently, demand for Turkish sovereign bonds increased, accompanied by a drop in their yields from 26% in 2023 to 15% in 2024, as well as a rise in equities, with the main index of the Turkish stock exchange, BIST 100, gaining 20% in 2024. There was also an influx of foreign investment, which rose from $10.6 billion in 2023 to $12–14 billion in 2024, supported by entities from the Gulf region and China, primarily engaged in the technology and automotive sectors. Consequently, in 2024, the Fitch rating agency upgraded Turkey’s credit rating twice – first from B to B+ in March, and then to BB– in September – changing the outlook to stable. Sixth, Şimşek and Erkan also sought to gradually phase out the exchange rate-protected deposit programme introduced in December 2021, which had generated enormous costs for the state.

Erkan resigned from her position as Governor of the TCMB in February 2024, citing personal reasons. She was succeeded by Fatih Karahan, a member of the TCMB’s Monetary Policy Committee, who gained the approval of the finance minister partly due to his support for strict monetary policy. By continuing Erkan’s approach, Karahan reinforced confidence in the durability of Şimşek’s reforms. This suggested that the Turkish economy was on a path towards stable recovery from the crisis.

Another bout of turbulence

The arrest of Istanbul Mayor Ekrem İmamoğlu on 19 March 2025 on corruption charges had a negative impact on the country’s economic situation. Markets perceived the move as a politically motivated action by President Erdoğan against his main rival ahead of the 2028 presidential election. Consequently, the Turkish currency plummeted, reaching 42 lira to the dollar on 19 March 2025 – a drop of approximately 10% within a matter of hours.

The TCMB responded with measures reminiscent of the pre-Şimşek era – namely, large-scale currency interventions. In the first month following the mayor’s arrest, it sold over $40 billion, reducing net reserves to below $20 billion. Simultaneously, to counter inflationary pressure caused by the lira’s depreciation, the bank halted the interest rate-cutting cycle that had begun earlier in the year and raised the reference rate from 42.5% to 46% in April. This decision helped to maintain the downward trend in inflation.

The sharp depreciation of the lira and the large-scale use of foreign currency reserves once again undermined foreign investor confidence, raising concerns about the durability of the economic stabilisation efforts led by Şimşek. The authorities appeared surprised by the intensity of the market’s reaction to İmamoğlu’s arrest, which highlighted the continued vulnerability of the Turkish economy to domestic political shocks. Speculation arose over a possible resignation by the minister, but Şimşek denied such reports, reaffirming his commitment to continuing the reform programme.

Outlook

Despite the challenges following İmamoğlu’s arrest, Turkey’s economic stabilisation process has not stalled. Forecasts for 2025 indicate continued GDP growth of approximately 3% (compared with 3.2% in 2024), driven by private consumption and services, particularly tourism, which generated $61.1 billion in revenue in 2024. Inflation, reduced to 35.4% in May 2025, is on a downward trajectory. The TCMB projects further declines: to 24% by the end of 2025, 12% in 2026, and 8% in 2027. The weakening of the US dollar, which offsets the depreciation of the lira, has supported the replenishment of foreign currency reserves held by the central bank, which rose to around $30 billion net in mid-June (up from approximately $13.8 billion in May 2025). Additionally, the decision to raise interest rates after the Istanbul mayor’s arrest (from 44% to 46% in April) – despite easing inflationary pressure – signals a continued commitment to reform and a deliberate avoidance of a return to ‘Erdoğanomics’, at least until the parliamentary and presidential elections in 2028.

The turbulence triggered by İmamoğlu’s arrest clearly illustrates the prioritisation of domestic political interests over economic stability, which heightens investor doubts about the durability of Şimşek’s reforms. Furthermore, tensions between the authorities and the opposition (for example, over challenges to the legality of the leadership election within the Republican People’s Party or threats to impose a government-appointed trustee on the party) increase the risk of destabilisation (see ‘Turkey: consolidation within the opposition party amid anti-government protests’). For the continued recovery of the economy, it will therefore be crucial to pursue a consistent and rational fiscal and monetary policy, while avoiding major political crises in the country.

At the same time, despite positive trends, the Turkish economy will continue to face serious challenges. Inflation, although reduced to 35.4% in May 2025, still limits citizens’ purchasing power, and the depreciation of the local currency (with the dollar costing around 39 lira in June) increases the cost of imports, particularly energy carriers. Registered unemployment remains high at 8.6% (April data), while the labour force participation rate is low – 53.4% overall (71.8% for men, 35.9% for women), suggesting a significant level of undeclared work in the informal (untaxed) economy. Additionally, the risk of a full-scale war in the Middle East, triggered by Israeli attacks on Iran, along with rising reconstruction costs in southeastern Turkey following the 2023 earthquake (which have so far amounted to at least $75 billion), may negatively affect public finances and delay a full recovery from the crisis.

Chart 1. Inflation in Turkey, 2018–2025

Source: Central Bank of Turkey, tcmb.gov.tr.

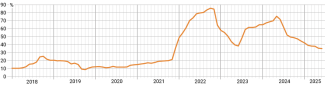

Chart 2. Reference interest rate in Turkey, 2018–2025

Source: Central Bank of Turkey, tcmb.gov.tr.