Russia: Arctic LNG 2’s capacity is reduced due to sanctions

According to a report from Reuters at the beginning of April, the Russian LNG giant Novatek intends to reduce the target production capacity of the Arctic LNG 2 facility. This project, which was expected to be Russia’s biggest liquefaction plant, was intended to include three production lines with a total capacity enabling the production of 19.8 mn tonnes of LNG annually. According to media reports, the facility’s infrastructure will ultimately be limited to two lines, which will reduce its capacity to 13.2 mn tonnes annually.

The reasons for this modification include US restrictions which have prevented the LNG produced from being transported from this facility. In November 2023, the US authorities put the company which manages the installation on the sanctions list (see ‘The effect of the sanctions: the Russian LNG sector’s problems’); this ran the risk that any company involved in cooperation with this facility could be covered by secondary sanctions. In February 2024, the restrictions were also expanded to cover the Russian shipowner Sovkomflot, which owns the gas carriers which should transport the LNG produced by Arctic LNG 2. Although work on this project was launched in December 2023, the facility has not as yet exported a single tonne of LNG.

Commentary

- The decision to reduce Arctic LNG 2’s capacity to two production lines is an attempt to adapt to the restrictions resulting from the US sanctions. According to media reports, a third line intended for this facility, which at present is being built at the Centre for the Construction of Large Offshore Facilities located in Murmansk oblast, will be installed at another of Novatek’s projects, the Murmansk LNG. The location of this facility and the transfer there of a portion of the production capacity were motivated by geographical factors. Locating the liquefaction plant in the vicinity of a warm-water port in Murmansk means there will be fewer problems regarding the export logistics, that is, it will not be necessary to lease a large number of ice-class ships. The limited availability of gas carriers, in particular those which are capable of breaking the ice cap, has prevented Russia from implementing its plans to increase its LNG exports under sanctions. For most of the year, only icebreakers can sail to the Arctic LNG 2.

- According to Novatek’s declarations, it needs one Arc 7-class gas carrier (which is able to break the ice cap) per one million tonnes of the facility’s annual capacity to transport the whole volume of the Arctic LNG 2’s production. This means that it will be necessary to lease around 13 ships of this type to ensure the stable operation of two production lines, something which Russia cannot do at present. The US sanctions have prevented the transfer of six Arc 7-class gas carriers which were built at the Hanwha shipbuilding facility in South Korea; three of these were intended for Sovkomflot, and the other three for Japan’s Mitsui O.S.K. Lines, but all of them were intended to handle the transport of LNG produced by Novatek’s facility. Fearing secondary sanctions, the shipbuilding plant has also suspended work on another 10 ships intended for the Arctic LNG 2. These gas carriers will most likely be used as FSUs/FSRUs on other markets.

- The ships built at the Russian Zvezda shipbuilding facility could become involved in transporting some of the LNG produced by the first line of the Arctic LNG 2. According to available information, three out of the five Arc 7-class gas carriers which are being built there will be ready to operate by the end of this year. Their utilisation, alongside the standard gas carriers which operate in summer, could enable the facility to start exporting its LNG. However, in this scenario it is doubtful whether the facility could use its full nominal capacity in the situation of a limited number of ships to transport its LNG. Moreover, the failure to lease other gas carriers has reduced the prospects for boosting the facility’s production by launching the second installation, which was initially expected to become operational at the end of 2024.

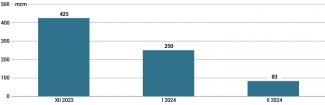

- In line with the intentions of Novatek’s executives, the Arctic LNG 2 was expected to contribute to a significant increase in the company’s production as early as the beginning of this year. The US restrictions and the resulting problems with gas transport have thwarted these plans and forced the company to slow down the pace of its gas liquefaction activities, even though the first production line was launched in December 2023. According to Russian media reports, production was gradually reduced since that time, and finally most likely halted in March. This negative trend is impacting Novatek’s production as a whole, and a decline in its growth rate has been recorded. According to official figures, in Q1 2024 the facility produced 21.12 bcm of LNG, which indicates a minor increase of 1.2% y/y.

Chart. Arctic LNG 2’s monthly LNG production between December 2023 and February 2024

Source: Vedomosti.