Low oil prices are forcing Russia to revise its 2025 budget

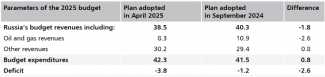

On 30 April, the Russian government approved a draft law to revise the 2025 budget parameters. The government’s new macroeconomic projection assumes, among other things, an average annual oil export price of $56 per barrel (down from the $69.7 projected in autumn 2024) and an inflation rate of 7.5% (compared to the previously forecasted 4.5%). Despite this, GDP growth for 2025 is still projected at 2.5%. As a result of these adjustments, budget revenues from the oil and gas sector will fall by over 2.6 trillion roubles, increasing the deficit to almost 3.8 trillion roubles (i.e. 1.7% of GDP, see Tables 1 and 2 for details). The parliament is expected to approve the government bill by the end of June. Due to the evolving economic situation, the government plans another budget revision in the autumn.

The revision of Russia’s 2025 budget parameters was prompted by a sharp drop in the price of Russian oil exports since the beginning of the year. Despite declining revenues, the Kremlin is unwilling to cut budget spending. Instead, it has pledged to increase it by relying on non-oil and gas revenues, which the government expects to rise. However, due to high inflation, the real value of total spending in 2025 will still be almost 1% of GDP lower than in 2024.

Commentary

- The situation on the global oil market is increasing pressure on Russia’s public finances. Due to a planned further rise in oil production by some OPEC+ countries starting in June and a deteriorating global economic outlook, the export price of Russian oil fell below $50 per barrel in early May (compared to an average of $54.8 in April and $59 in March). Simultaneously, due to the strong rouble, the value of sold oil, calculated in Russian currency, was already nearly 40% lower than the figure projected in the 2025 budget. So far, despite the significant drop in oil prices, Russia’s revenues in the first four months of the year were just 10% lower than the previous year, partly due to high inflows from the excess profits tax paid by oil companies for 2024. According to the revised budget assumptions, in 2025 as a whole total revenue from the oil and gas sector is expected to decline by 25% year-on-year.

- To compensate for shortfalls in oil and gas revenues, the Russian government will be forced to draw significantly from the assets accumulated in the National Welfare Fund (NWF). As of 1 April 2025, the fund’s liquid reserves stood at 3.3 trillion roubles (approximately $39 billion). In accordance with the fiscal rule, the central bank has been selling off yuan and gold from the NWF on behalf of the government since April, which has further contributed to the strengthening of the rouble (for more see ‘Rosyjski budżet pod presją niskich cen ropy’).

- Russia’s deteriorating economic performance threatens the realisation of projected high revenues from non-oil and gas sectors. In Q1 2025, the growth rate of these revenues was 10% year-on-year, significantly below the 18% target set in the budget. Additionally, early-year indicators showed signs of slowing economic growth. Industrial production in Q1 was only 1% higher than a year earlier (compared to 5.4% growth in 2023), with the extraction sector declining by 3.7%. Government projections for 2025 GDP growth (2.5%) are notably more optimistic than those from the Russian central bank (1–2%) and local analysts (1.6%).

- The Kremlin will likely be able to finance its planned 2025 expenditures, thanks in part to high inflation, bond issuance, and a strengthened rouble. Additionally, the government has already announced more than a 10% increase in utility, electricity, and gas prices, exceeding the official inflation rate. However, due to low reserve levels, public spending cuts will likely be necessary in the following years. In April, the Ministry of Finance proposed lowering the baseline oil price in the budget (currently set at $60 per barrel), which would effectively reduce budget expenditures and help replenish reserves. The government may only use oil and gas revenues based on the baseline price for current spending; any surplus from higher actual oil prices must be saved in the NWF.

Table 1. Revision of budgetary assumptions for 2025

Source: government of the Russian Federation.

Table 2. Changes in parameters of the Russian Federation’s 2025 budget (in trillions of roubles)

Source: government of the Russian Federation.