Trump’s One Big Beautiful Bill Act: lower taxes and greater focus on border protection and confrontation with China

On 4 July, President Donald Trump signed a reconciliation bill, concluding months of negotiations in the US Congress over its final form. The legislation enables adjustments to the budget for the ongoing fiscal year and represents a key pillar of the current administration’s political agenda on tax cuts, immigration, and defence – particularly in preparing for confrontation with China. It also introduces changes to the US healthcare and welfare systems and raises the debt ceiling. Passing the reconciliation bill in Congress was a significant achievement for the president, who once again managed to overcome divisions within the Republican Party. Given its scope and importance to the legacy of his second term, Trump referred to it as the ‘One Big Beautiful Bill Act’ – a name that has also become its official title. Its adoption marks a victory for both the president and Republican congressional leaders, although the drafting process also exposed deep internal rifts within the party. The bill’s social and fiscal costs could affect Republican polling figures over the longer term.

Trump’s last major victory in Congress?

The idea of passing President Trump’s key campaign pledges through one or two reconciliation bills – to be drafted by Congress within the first year of his current term – emerged shortly after the 2024 presidential election, in December. The need to bundle together such disparate issues as tax policy, defence spending, and the debt ceiling stemmed from the Republicans’ weak position in Congress. In the Senate, they do not hold the 60 votes required for procedural votes, effectively preventing them from passing legislation through standard channels. The exception is reconciliation bills, which require only a simple majority. However, these come with significant restrictions: they may be used a maximum of three times per fiscal year, their provisions must relate to budgetary matters, and their impact on the federal deficit cannot extend beyond a 10-year timeframe. In modern US politics, reconciliation has become one of the primary tools for implementing major reforms (for more, see ‘The US budget battle: a crucial test for Republicans’).

Although the process surrounding the One Big Beautiful Bill Act ultimately resulted in its adoption, it also exposed the Republican Party’s fragility in Congress. The Senate vote ended in a 50:50 tie after three Republican senators opposed the bill. The deciding vote was cast by Vice President J.D. Vance, as permitted in the case of a deadlock. In the House of Representatives, the bill’s passage required prolonged negotiations and direct pressure from the president. The final version, incorporating Senate amendments, was approved by a narrow 218:214 margin (the House had passed the original version by just a single vote). The struggle to secure votes demonstrated that Trump still possesses significant influence within the Republican Party, particularly through his ability to threaten the electoral prospects of dissenting members ahead of the 2026 midterms.

The bill also gave rise to a direct conflict between President Trump and billionaire Elon Musk, who until recently headed the Department of Government Efficiency (DOGE). As a result of the dispute, Musk decided to launch his own political party – the American Party. Although its chances of posing a serious threat to the Republicans are slim, the combination of Musk’s financial resources and his vast social media reach could negatively affect the electoral prospects of individual Republican politicians.

Lower taxes, social spending cuts and a larger deficit

Despite its populist turn and growing popularity among lower-income voters, the Republican Party continues to advocate a governance model characterised by low taxes and reduced social spending. The new law makes permanent the tax cuts introduced during Trump’s first administration, which were otherwise set to expire at the end of this year. It expands the ability to deduct state and local taxes from federal income tax, and introduces a tax exemption for income from tips and overtime. The legislation also includes pro-family measures such as increased child tax credits, as well as additional provisions such as tax relief for senior citizens.

However, the bill also introduces several changes that negatively affect the living conditions of less affluent Americans, reflecting the Republicans’ efforts to find savings. According to estimates from the Congressional Budget Office (CBO), the tax changes could reduce federal revenues by over $4 trillion by 2034. To partially offset this fiscal burden, the administration has introduced stricter conditions for access to public healthcare, including the requirement to be in employment to participate in Medicaid. These measures are expected to save more than $1 trillion over the same period, although the number of uninsured Americans is projected to rise by up to 12 million. A similar work requirement has been applied to the Supplemental Nutrition Assistance Program (SNAP), which is expected to generate around $285 billion in savings by the end of 2034. These are among the bill’s most controversial provisions, as they disproportionately affect groups considered part of the Republican core electorate – potentially undermining the party’s long-term support.

The reconciliation bill contributes to fulfilling a key element of President Trump’s election platform: securing the border and launching a large-scale deportation campaign targeting undocumented migrants in the United States. Without the funding provisions included in the bill, particularly for deportation efforts, such operations would soon have to be suspended due to a lack of infrastructure and personnel. The legislation allocates funds for the continued construction of the border wall and additional barriers along the Rio Grande, the construction of detention centres for migrants awaiting deportation, the recruitment and training of new border security personnel, and operational activities related to intercepting and detaining individuals attempting to cross the border illegally.

Republicans also succeeded in raising the federal debt ceiling by $5 trillion – a move opposed by fiscal conservatives within the party. Without this increase, the United States would have faced insolvency in the second half of the year. Attempting to pass a separate bill to raise the debt ceiling would not only have required negotiations with the Democrats, but would also likely have triggered internal conflict within Republican ranks. As of now, the US national debt stands at over $36.6 trillion.

Defence: increased focus on the Indo-Pacific

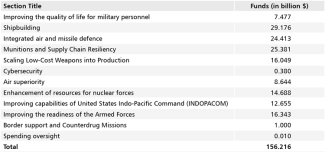

The reconciliation bill also includes an additional $156.2 billion in funding for the US Department of Defence (whose fiscal year 2025 budget totals approximately $850 billion). The vast majority of this allocation is aimed at building and expanding US capabilities in the Indo-Pacific region, with a focus on preparing for confrontation with China. These funds will not expire at the end of the current fiscal year and will remain available through 2029.

The largest sums are earmarked for the acquisition of additional naval vessels – including guided missile destroyers, attack submarines, and amphibious assault ships – as well as for expanding the US shipbuilding base. The second priority is munitions, with significant investment in PrSM ballistic missiles, JASSM cruise missiles, and AIM-120 and AIM-9X air-to-air missiles, alongside a substantial boost in production capacity. The third major area is the expansion of integrated air and missile defence systems for Army units, involving systems such as THAAD, Patriot, M-SHORAD, and IFPC. The bill also provides initial research and development funding for a space-based missile defence initiative known as the Golden Dome project. Nearly all additional funds for the Army and Marine Corps will go towards three areas: rocket artillery, air defence, and barracks renovation. The Air Force will receive new weapons systems and expanded production of F-15EX air superiority fighters, which are intended to be stationed in both the United States and Japan.

An important aspect of the reconciliation bill is the additional funding allocated to strengthen US nuclear capabilities. These funds are intended to accelerate the deployment of the B-21 Raider strategic bomber, support the development of submarine-launched cruise missiles armed with tactical nuclear warheads, and expand the industrial base responsible for the production and maintenance of nuclear weapons.

The only Combatant Command to receive dedicated funding under the reconciliation bill is the United States Indo-Pacific Command (INDOPACOM). The allocated resources will be used to intensify large-scale military exercises in the region, expand infrastructure such as airfields and prepositioned stocks, and deepen cooperation with regional allies and partners.

The bill’s defence funding allows Republicans to claim that the Pentagon’s budget will exceed $1 trillion in the 2026 fiscal year, fulfilling a key pledge made by President Trump. However, as the funds are spread over several years, the Department of Defence’s 2026 budget may ultimately be slightly lower than in 2025. There is also a risk that financing certain arms programmes through the reconciliation bill could lead to future reductions in their funding under regular budget legislation. One example is the proposed 2026 US Navy budget, which includes the purchase of fewer ships than previously planned, as some of these vessels are now expected to be funded through reconciliation.

Table. Military spending under the reconciliation bill: breakdown by section