Seven lean years? Romania’s struggle with record high debt

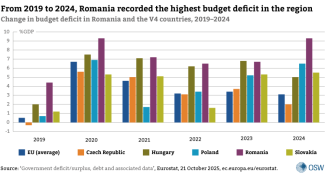

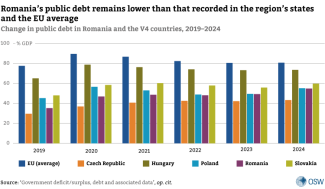

Romania has been grappling with exceptionally high public debt since 2020. It was then that the budget deficit reached 9.3% of GDP, prompting the European Union to place the country under the Excessive Deficit Procedure (EDP). Despite this, in subsequent years the deficit remained well above the EU threshold of 3%, amounting to 7.2% in 2021, 6.5% in 2022, and 6.7% in 2023. In 2024, it once again rose to 9.3%, the highest level recorded in the European Union during this period. Consequently, Bucharest has faced a tangible risk of losing part of its EU funding. The persistently high deficits of recent years have also translated into a sharp increase in public debt: whereas in 2019 it stood at just 35% of GDP, by 2024 it had reached 55%.

Despite the public finance crisis that has been intensifying for several years, the Romanian authorities only decided to undertake concrete corrective measures in the second half of 2025, under pressure from EU institutions. The reforms being implemented are, however, highly unpopular, and their short-term, socially painful effects (including significant budget cuts and increases in certain taxes) will be felt for some time to come, as the fiscal consolidation plan is scheduled to span seven years. Already, these measures are generating tensions within the fragile, internally divided, and ideologically heterogeneous governing coalition, which brings together centre-left and centre-right parties. They are also fuelling the growing strength of radical and anti-establishment parties, led by the Alliance for the Union of Romanians (AUR).

Mounting debt: the causes…

Until 2020, Romania was able to keep its public debt at a stable and relatively low level, particularly in comparison with other EU member states,[1] fluctuating between 29% and 39% of GDP from 2010 to 2019. Moreover, towards the end of the second decade of the twenty-first century, this indicator displayed a downward trend: while it stood at 37.8% of GDP in 2016, it declined to 35.3% in 2017 and to 34.6% in 2018. This trend was supported by the rapid economic growth recorded by the country during that period. In 2017 and 2018 alone, Romania’s GDP expanded by 8.2% and 6.1% respectively. At the same time, the budget deficit remained relatively low, averaging around 3% of GDP between 2016 and 2019.

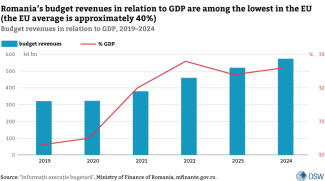

This favourable financial position encouraged the government in Bucharest to relax its previous fiscal discipline and to implement a series of reforms reducing the tax burden on both individuals and enterprises. For example, in 2016–2017 the standard VAT rate was lowered from 24% to 20% and subsequently to 19%, while in 2018 the personal income tax was also reduced, with the flat rate cut from 16% to 10%. Alongside this, a special tax regime was introduced for micro-enterprises, defined as businesses with an annual turnover not exceeding €1 million. From 2016 onwards, rather than paying the flat 16% corporate income tax, such entities were allowed to opt for a turnover tax of 1% or 3% levied on declared revenues.[2] In the same year, the dividend tax was also reduced from 16% to 5%.

In 2020, public debt rose sharply. The budget deficit reached 9.3%, while public debt rose by nearly 11 percentage points to 46.9% of GDP, up from 35.2% in 2019. This was driven by the COVID-19 pandemic, which forced a significant share of Romanian enterprises to scale back their operations, adversely affecting state revenues. Consequently, in 2020 revenues were almost identical to those recorded in 2019, increasing by only 0.5%, whereas in the years preceding the pandemic they had grown very dynamically – largely owing to rapid economic growth – rising by 12.5% in 2017, 17.2% in 2018, and 8.7% in 2019, despite cuts in tax rates. At the same time, budgetary expenditure increased year on year by 14.8%, driven in part by government support programmes introduced to assist the private sector. The sharp rise in the deficit and public debt in 2020 also reflected the so-called denominator effect. Romania’s previously fast-growing GDP – the denominator against which debt is measured – contracted by 3.7% in 2020, further inflating the debt ratio.

In the following years, public debt remained elevated as a result of continued accommodative fiscal policy, which by then encompassed not only reduced revenues but also a circumstantially driven increase in public expenditure. In 2022–2023, Romania recorded high inflation reaching 12–13%, driven – among other factors – by a sharp surge in energy prices. In the second half of 2022, electricity tariffs for households were more than 158% higher than those applied at the onset of the COVID-19 pandemic.[3] This prompted the authorities to introduce substantial indexation-driven pay increases in the public sector[4] and in the pension system, and also forced the government to launch costly, budget-burdening subsidy programmes for electricity and gas bills, covering both households and businesses. According to government statements, compensation measures implemented between 2022 and early 2024 cost the state budget up to approximately €4.5 billion, equivalent to around 4% of total budgetary expenditure in 2023.[5] At the same time, the Romanian economy, which had recorded a strong rebound one year after the outbreak of the pandemic (with growth of 5.5% in 2021), began to slow once again. GDP growth reached 4% in 2022, declined to 2.4% in 2023, and fell to just 0.8% in 2024. The rising cost of debt servicing has also increasingly contributed to debt accumulation, amounting to 2% of GDP in 2024.[6] Consequently, in that year the budget deficit reached 9.3% of GDP – matching the level recorded in the ‘pandemic’ year of 2020 – while public debt increased to 55% of GDP.

The accumulation of debt has also been facilitated by long-standing structural weaknesses in Romania’s tax system. Romania records the largest VAT gap in the European Union, defined as the difference between the amount of value-added tax revenues that should, in principle, be collected and the amount actually received by the state. This is due primarily to the inefficiency of institutions such as the National Agency of Fiscal Administration (Agenția Națională de Administrare Fiscală, ANAF) and, consequently, to the state’s limited capacity to combat tax fraud effectively (including VAT carousel schemes) and corporate tax avoidance. Between 2014 and 2018, Romania’s VAT gap fluctuated at around 35–40%; it stood at 34.8% in 2021 and declined to 30% in 2023. For comparison, in neighbouring Bulgaria and Hungary the corresponding figures in 2023 amounted to 8.6% and 7.4% respectively, while the EU average stood at 9.5%.[7] Romania’s low level of tax collection and – more broadly – its relatively low tax rates (i.e. lower than in most other EU member states) are also reflected in the ratio of total tax revenues to GDP. From 2016 to 2022, this indicator averaged only 27.1%, which was 13 percentage points below the EU-wide average of 41%.[8]

…and the consequences

The Romanian authorities were aware of the deteriorating state of public finances and the resulting need to implement difficult fiscal reforms and improve the effectiveness of tax administration institutions. For a long time, however, they postponed large-scale corrective action. Nor did they face particularly strong external pressure. Although in April 2020 the EU Council, acting on a proposal from the European Commission, placed Romania under the Excessive Deficit Procedure[9] and recommended that the deficit be corrected by 2022, this deadline was postponed a year later – to 2024 – in view of the ongoing pandemic.[10] From the start of 2024, the political situation and the onset of the electoral campaign were also not conducive to the implementation of the necessary reforms. The year 2024 was a so-called ‘super election year’, meaning that all possible elections were held: local and European Parliament elections in June, followed by a presidential election in November and December, and a parliamentary election in December. Ultimately, owing to the annulment of the presidential election by the Constitutional Court and the need to rerun it, the uninterrupted electoral campaign that had begun at the start of 2024 effectively ended only on 18 May 2025, with the election of Nicușor Dan as head of state. Full political stabilisation, however, occurred more than a month later, with the formation of a governing coalition led by Prime Minister Ilie Bolojan. Consequently, between 2020 and mid-2025 the Romanian authorities largely refrained from taking substantive action to address the problem of rising debt.

The absence of measures to curb the budget deficit increasingly alarmed both credit rating agencies and EU institutions. In December 2024, Fitch revised Romania’s long-term rating outlook from ‘stable’ to ‘negative’. As the country remains rated at BBB–, the lowest level within the investment-grade category, this move created a tangible risk of a downgrade to ‘junk’ status.[11] In effect, this would have meant classifying Romania as an unreliable borrower and increasing the risk associated with purchasing its bonds. The European Commission issued its first critical reports on the matter as early as June and July 2024. At the beginning of 2025, the EU Council recommended that, by 30 April 2025, Bucharest take concrete steps towards exiting the Excessive Deficit Procedure by 2030 and establish corresponding limits on the growth of public expenditure. Finally, due to Romania’s failure to meet these recommendations, the Commission issued a further recommendation to the EU Council in June, opening up the possibility of suspending Romania’s access to EU funds.

The implemented reforms and the blocked ones

Immediately after taking office, the Bolojan cabinet – facing the risk of Romania’s access to EU funds being curtailed and taking advantage of the end of the electoral cycle – set about preparing comprehensive reforms aimed at bringing the public finances under control. The first fiscal package, adopted in July 2025, was designed to reduce public expenditure as rapidly as possible and generate additional revenue. As part of the package, the standard VAT rate was raised from 19% to 21%, while the reduced rate was increased from 5–9% to 11%. In addition, excise duties were increased by around 10% (from August 2025), and a requirement was introduced to pay a 10% health insurance contribution on pensions exceeding 3,000 lei (approximately €590). The government also decided to raise the dividend tax from 5% to 16% (from 1 January 2026) and to introduce a 4% turnover tax on banks (from 1 July 2025). Levies and fees for companies operating in the gambling sector were also increased, as were motorway tolls. According to government estimates, these measures are expected to boost budget revenues by 9.5 billion lei (approximately 0.5% of GDP) in 2025 and by a further 35 billion lei (1.71% of GDP) in 2026.

As early as September, the government decided to push through a so-called second fiscal package which, according to official expectations, should generate an additional 18.8 billion lei (approximately €3.7 billion) in 2026. This set of reforms includes a reduction in the level of judges’ pensions,[12] as well as raising judges’ retirement age (aligning it with the standard threshold), introducing changes to the functioning of state-owned enterprises (including the level and rules for awarding salary top-ups for management board members and limiting their number), and improving the cost-efficiency of healthcare by reducing ‘unnecessary hospitalisations’.[13] However, it has not yet been fully implemented, as the Constitutional Court rejected the amendment concerning judges’ pensions on 20 October 2025.[14] Moreover, the attempt to implement this reform triggered a nationwide strike within Romania’s judiciary. At the end of August 2025 – when the draft amendment on judges’ pensions began to be processed – some judges (including all courts of appeal) and certain prosecutors announced that, in protest, they would suspend the examination of cases under their responsibility. The only exceptions were to be urgent proceedings or cases of a special nature.[15] The failure to introduce changes to pension benefits for judges (also referred to as ‘special pensions’) not only prevents a reduction in budgetary expenditure but, more importantly, has halted the disbursement of a portion of EU funds (€231 million) under Romania’s National Recovery and Resilience Plan. Implementing this reform is, in fact, one of the conditions set out under the so-called milestones.[16]

Political fuel for the radicals

The fiscal reform currently under way – one of the largest in scale and most painful for average citizens in contemporary Romania – has been unfolding amid deep public disillusionment with the ruling elites and growing support for radical and anti-establishment forces, led by AUR under George Simion (Nicușor Dan’s rival in the recent presidential election). The unpopularity of the measures being pushed through, combined with the fact that the same political parties now in government are responsible for the state of public finances, provides AUR with potent propaganda material and strengthens its polling position. According to opinion polls, AUR, which secured 18% of the vote in the December 2024 parliamentary election, could now count on the support of 38–40%.

It appears certain that society will experience the effects of the reforms currently being implemented in a negative manner for at least the next several months. The increases in VAT and excise duties have contributed to a marked rise in inflation, as they have led to higher fuel prices and, in turn, to a spike in the prices of goods and services. In October 2025, Romania’s inflation rate reached 8.2%, the highest in the European Union, while the EU average in the same period was more than three times lower, at 2.5%.[17] Public dissatisfaction with the fiscal reforms is also evident in opinion polling. According to a survey conducted in September 2025, as many as 83% of respondents stated that the programme of spending cuts and tax increases being implemented by the Bolojan government affects them to a large or very large extent, while 75% declared that the country is heading in the wrong direction. The reforms have already triggered strikes among some professional groups: in addition to judges, teachers also protested after their number of working hours was increased as part of cost-optimisation measures, while pay remained unchanged.[18]

Outlook

The measures undertaken by the Romanian authorities since July 2025 have been met with a positive response from the EU and the credit rating agencies. In August 2025, Fitch revised Romania’s rating outlook to ‘stable’, while signals from the European Commission suggest that it has taken note of Bucharest’s efforts – most likely to be reflected in its forthcoming reports and recommendations. Consequently, the risk of a partial suspension of EU funds for Romania appears to be receding.[19]

The Romanian authorities state that, as a result of the reforms being introduced, the budget deficit in 2025 should not exceed 8.4% of GDP (down from 9.3% in 2024), and that in the current year it will fall to 6% of GDP. According to the seven-year medium-term fiscal and structural consolidation plan adopted in 2024, the deficit is expected to fall below the 3% threshold required to exit the Excessive Deficit Procedure only in 2031. This does not, however, necessarily mean that Romania will be released from the procedure at that point, since the plan foresees that public debt will exceed 60% of GDP in around 2027 and remain above that level until 2031 inclusive.[20] Assuming that the reform agenda is maintained, the pace of debt reduction declared by the authorities appears plausible. The government’s key challenge will be to improve tax collection (including through more effective action by ANAF). An example of the government’s efforts in this context is Operation ‘Jupiter’ – in essence, a large-scale crackdown targeting primarily entities that evade payment obligations or otherwise harm the state financially.[21]

The local government reform announced by Prime Minister Bolojan – an element of the cost-cutting agenda – will also prove highly challenging. According to the prime minister’s declarations, he and his party (the centre-right National Liberal Party, PNL) aim to eliminate approximately 13,000 administrative posts, equivalent to roughly 10% of total employment in local authorities and local institutions.[22] The proposal has, however, been criticised by the Social Democratic Party (PSD), a coalition partner that is nonetheless an ideological rival of the PNL. The success of efforts to curb public debt will also depend on the pace of Romania’s economic growth, which remains uncertain, not least owing to the restrictive fiscal policy that is dampening economic momentum. According to World Bank estimates from October, Romania’s GDP is expected to increase by a mere 0.4% in 2025 (a forecast 0.5 percentage points lower than that published in June 2025), and by only 1.3% and 1.9% in 2026 and 2027 respectively.[23] This, in turn, casts doubt on Romania’s ability to sustain effective convergence with wealthier EU member states. The country’s current fiscal situation is also delaying plans to introduce the euro. According to official declarations, Bucharest would like to adopt the common European currency in around 2029; in practice, however, this appears unrealistic. Meanwhile, Bulgaria – which joined the EU at the same time as Romania – entered the eurozone on 1 January 2026.

[1] The EU average in that period was up to three times higher, amounting to between 77.5% and 87%.

[2] The 1% rate applied to micro-enterprises employing at least one worker, while the 3% tax was levied on businesses that formally employed no staff (i.e. sole proprietorships).

[3] ‘Electricity prices for household consumers – bi-annual data’, Eurostat, 21 November 2025, ec.europa.eu/eurostat.

[4] V. Ionescu, ‘Salariile bugetarilor vor fi majorate de la 1 iulie’, Curs de guvernare, 31 May 2022, cursdeguvernare.ro; A. Mirea, ‘Public sector salaries increase by 10% from January 1, 2023 (draft)’, 29 November 2022, stiripesurse.ro.

[5] L. Ilie, ‘Romanian government lowers regulated energy prices in support scheme’, Reuters, 28 March 2024, reuters.com.

[6] C. Grosu, ‘Cristian Grosu / Planul fiscal: Bizarerie și extaz. Pentru antreprenori și manageri’, Curs de guvernare, 17 October 2024, cursdeguvernare.ro.

[7] ‘EU VAT Gap Report’, European Commission, 11 December 2025, taxation-customs.ec.europa.eu.

[8] ‘Main national accounts tax aggregates’, Eurostat, 31 October 2025, ec.europa.eu/eurostat.

[9] The EU’s Excessive Deficit Procedure (EDP) is triggered when a country’s budget deficit exceeds 3% of GDP or when general government gross debt surpasses 60% of GDP.

[10] ‘Excessive deficit procedure: Council adopts recommendation for Romania’, EU Council, 18 June 2021, consilium.europa.eu.

[11] ‘Fitch Affirms Romania at 'BBB-'; Outlook Negative’, Fitch Ratings, 15 August 2025, fitchratings.com.

[12] Under the assumptions of the draft, pensions are to amount to 70% of the final net salary. At present, members of this profession may receive retirement benefits equivalent to 80% of their final gross salary.

[13] S. Cârlugea, ‘Toate modificările din Pachetul II. Cum te afectează cele cinci legi pentru care Guvernul și-a asumat răspunderea în Parlament’, Europa Liberă România, 2 September 2025, romania.europalibera.org.

[14] ‘Judecătorii CCR au decis că reforma pensiilor magistraților nu respectă Constituția. Surse: votul ar fi fost 5-4’, Euronews, 20 October 2025, euronews.ro.

[15] S. Saghin, ‘A început protestul magistraților față de reforma pensiilor speciale. Și-au suspendat activitatea, dosarele sunt blocate’, Pro TV, 27 August 2025, stirileprotv.ro.

[16] A. Cicovschi, ‘România pierde 231 milioane de euro dacă nu face reforma pensiilor speciale. Mesajul Comisiei Europene către București’, Adevărul, 22 October 2025, adevarul.ro.

[17] ‘Annual inflation down to 2.1% in the euro area’, Eurostat, 19 November 2025, ec.europa.eu/eurostat.

[18] A. Stere, C. Nițoi, ‘Profesorii vor continua protestele, după ce au boicotat prima zi de școală. „Greva generală nu este exclusă”’, Pro TV, 9 September 2025, stirileprotv.ro.

[19] T. Moller-Nielsen, ‘Brussels urges Romania to ‘stay the course’ on deficit-slashing measures’, Euractiv, 28 October 2025, euractiv.com.

[20] ‘Note on the Medium-Term Fiscal-Structural Plan (MTP)’, Fiscal Council of Romania, 24 March 2025, fiscalcouncil.ro.

[21] ‘Operaţiunea Jupiter 4 continuă: 88 de percheziții, în mai multe județe, au loc în cea de-a cincea zi a acțiunii’, Digi24, 7 November 2025, digi24.ro.

[22] ‘Ilie Bolojan: “Trebuie concediaţi cel puţin 13.000 de funcţionari publici”’, Bursa, 3 September 2025, bursa.ro.

[23] A. Cristea, ‘World Bank cuts Romania’s 2025 GDP growth forecast to 0.4%’, SeeNews, 8 October 2025, seenews.com.